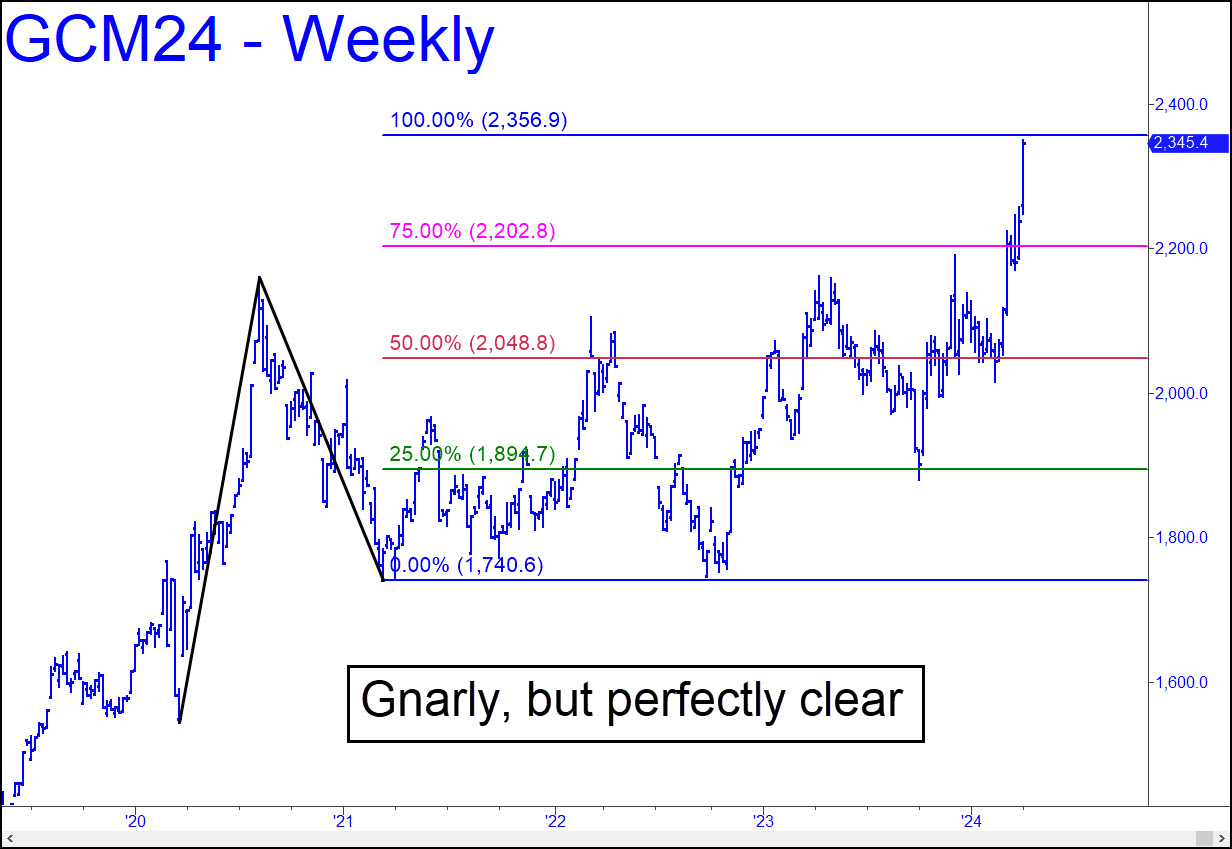

Although prayer can’t hurt, I doubt that it can push June Gold past the 2356.90 target shown any time soon. With the futures peaking just $7 from this daunting Hidden Pivot on Friday, a correction is due soon. We should be prepared for a nasty one, too, since it has taken the June contract more than four years to get there. Even so, we should open our minds to the satisfying possibility that buyers will blow past D with ease. If that happens, accompanied by voracious, insatiable buying, our focus could shift hopefully toward $3000, gold bugs’ next dream number. In the meantime, we can use this reverse pattern, with a tentative, worst-case pullback target at 1991.10, to exploit the trend confidently. We’ll adjust everything upward if a new high occurs. _______ UPDATE (Apr 8, 12:54 a.m. EDT): Although the June futures have receded from this morning’s 2372.50 peak, the $18 overshoot of so clear a target is significant and at least mildly bullish. When a big-pattern target has been exceeded, we usually look at the target of a smaller ‘extension’ pattern as an alternative. In this case, the lesser pattern’s D target at 2367.50 has also been hit — and somewhat exceeded — implying gold should correct for perhaps 2-3 days. Here’s the chart. And if it doesn’t? Ordinarily, I would say June Gold’s overshoot of $2372 is quite bullish. But I am all-too-conscious of the fact that subscribers are counting on me to avoid getting crushed if and when the pond scum that Spartacus refers to as ‘Mr Slammy’ makes his all-but-inevitable appearance. Greatly complicating things is Mr Market’s propensity to fuck as many of us as possible, as often as He can. That could mean He continues to push the precious metals complex higher without rest, so that even die-hard bulls are too scared to augment their positions. Another nasty side-effect is that making money becomes nerve wracking. A workaround is to take partial profits and/or do covered writes on the way up. _______ UPDATE (Apr 8, 4:08 p.m.): At session’s end, the futures appeared bound for the 2400.00 target shown in this chart. Because of the gnarliness of the pattern and the subtlety of the one-off ‘A’ low, this ABCD seems likely to deliver a precisely tradeable top. _______ UPDATE (Apr 8, 9:57 p.m.): Gold’s easy push past a major Hidden Pivot target took me by surprise, since it hasn’t happened in more than four years. It is happening now, though, and it will be a trick for us to keep from getting skittish as the ascent exceeds our too-often-crushed hopes. My bull-market target is now 2514.60 (give or take a little, since this number comes from a composite chart). _______ UPDATE (4:59 p.m.): Posted in the chat room: Don’t be surprised if Mr. Market takes advantage of round-number fears at 2400 and blows past it with ease that will catch skeptics with their pants down.

Although prayer can’t hurt, I doubt that it can push June Gold past the 2356.90 target shown any time soon. With the futures peaking just $7 from this daunting Hidden Pivot on Friday, a correction is due soon. We should be prepared for a nasty one, too, since it has taken the June contract more than four years to get there. Even so, we should open our minds to the satisfying possibility that buyers will blow past D with ease. If that happens, accompanied by voracious, insatiable buying, our focus could shift hopefully toward $3000, gold bugs’ next dream number. In the meantime, we can use this reverse pattern, with a tentative, worst-case pullback target at 1991.10, to exploit the trend confidently. We’ll adjust everything upward if a new high occurs. _______ UPDATE (Apr 8, 12:54 a.m. EDT): Although the June futures have receded from this morning’s 2372.50 peak, the $18 overshoot of so clear a target is significant and at least mildly bullish. When a big-pattern target has been exceeded, we usually look at the target of a smaller ‘extension’ pattern as an alternative. In this case, the lesser pattern’s D target at 2367.50 has also been hit — and somewhat exceeded — implying gold should correct for perhaps 2-3 days. Here’s the chart. And if it doesn’t? Ordinarily, I would say June Gold’s overshoot of $2372 is quite bullish. But I am all-too-conscious of the fact that subscribers are counting on me to avoid getting crushed if and when the pond scum that Spartacus refers to as ‘Mr Slammy’ makes his all-but-inevitable appearance. Greatly complicating things is Mr Market’s propensity to fuck as many of us as possible, as often as He can. That could mean He continues to push the precious metals complex higher without rest, so that even die-hard bulls are too scared to augment their positions. Another nasty side-effect is that making money becomes nerve wracking. A workaround is to take partial profits and/or do covered writes on the way up. _______ UPDATE (Apr 8, 4:08 p.m.): At session’s end, the futures appeared bound for the 2400.00 target shown in this chart. Because of the gnarliness of the pattern and the subtlety of the one-off ‘A’ low, this ABCD seems likely to deliver a precisely tradeable top. _______ UPDATE (Apr 8, 9:57 p.m.): Gold’s easy push past a major Hidden Pivot target took me by surprise, since it hasn’t happened in more than four years. It is happening now, though, and it will be a trick for us to keep from getting skittish as the ascent exceeds our too-often-crushed hopes. My bull-market target is now 2514.60 (give or take a little, since this number comes from a composite chart). _______ UPDATE (4:59 p.m.): Posted in the chat room: Don’t be surprised if Mr. Market takes advantage of round-number fears at 2400 and blows past it with ease that will catch skeptics with their pants down.

GCM24 – June Gold (Last:2390.80)

Posted on April 7, 2024, 5:15 pm EDT

Last Updated April 11, 2024, 11:42 pm EDT

Posted on April 7, 2024, 5:15 pm EDT

Last Updated April 11, 2024, 11:42 pm EDT