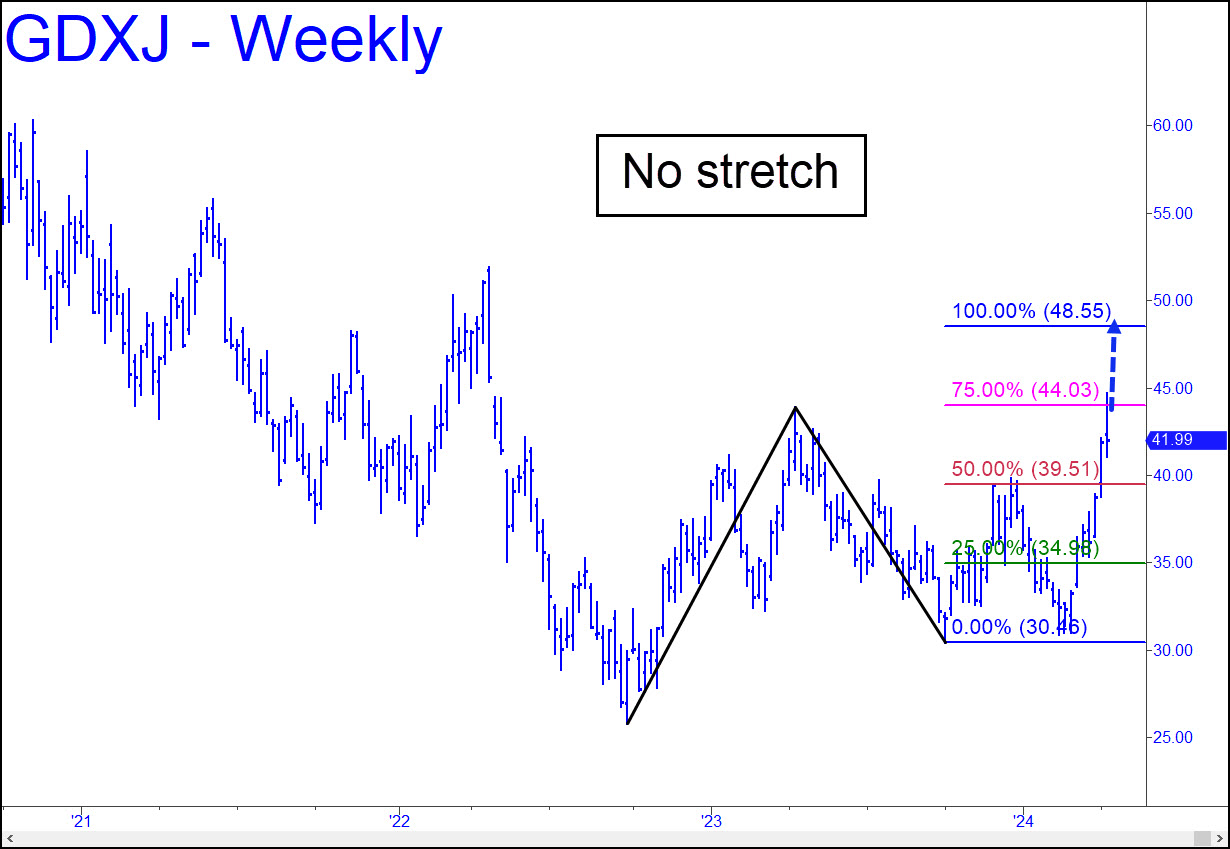

If the beating that gold and silver futures took in the last half of Friday’s session was unnerving, we should still be reassured by the robust look of GDXJ’s weekly chart. There are a few reasons to expect the bull cycle begun in September 2022 to achieve the 48.55 target. For one, the impulse leg, although balky at times, ultimately exceeded a key external peak at 42.19 recorded in June 2022. Also, even though the C-D leg stalled at p=39.51 for more than a month, the running start it got after pulling back nearly to ‘C’ spring-loaded a powerful blast that impaled both p and p2 while also exceeding the pattern’s ‘B’ high. Taken together, these factors should leave no doubt concerning whether 48.55 will be reached. Plan accordingly, and don’t get spooked by a hard pullback if it comes. That would be a buying opportunity, and the pattern itself provides ample means to do so with risk under tight control.

If the beating that gold and silver futures took in the last half of Friday’s session was unnerving, we should still be reassured by the robust look of GDXJ’s weekly chart. There are a few reasons to expect the bull cycle begun in September 2022 to achieve the 48.55 target. For one, the impulse leg, although balky at times, ultimately exceeded a key external peak at 42.19 recorded in June 2022. Also, even though the C-D leg stalled at p=39.51 for more than a month, the running start it got after pulling back nearly to ‘C’ spring-loaded a powerful blast that impaled both p and p2 while also exceeding the pattern’s ‘B’ high. Taken together, these factors should leave no doubt concerning whether 48.55 will be reached. Plan accordingly, and don’t get spooked by a hard pullback if it comes. That would be a buying opportunity, and the pattern itself provides ample means to do so with risk under tight control.

GDXJ – Junior Gold Miner ETF (Last:41.99)

Posted on April 14, 2024, 5:13 pm EDT

Last Updated April 13, 2024, 9:11 pm EDT

Posted on April 14, 2024, 5:13 pm EDT

Last Updated April 13, 2024, 9:11 pm EDT