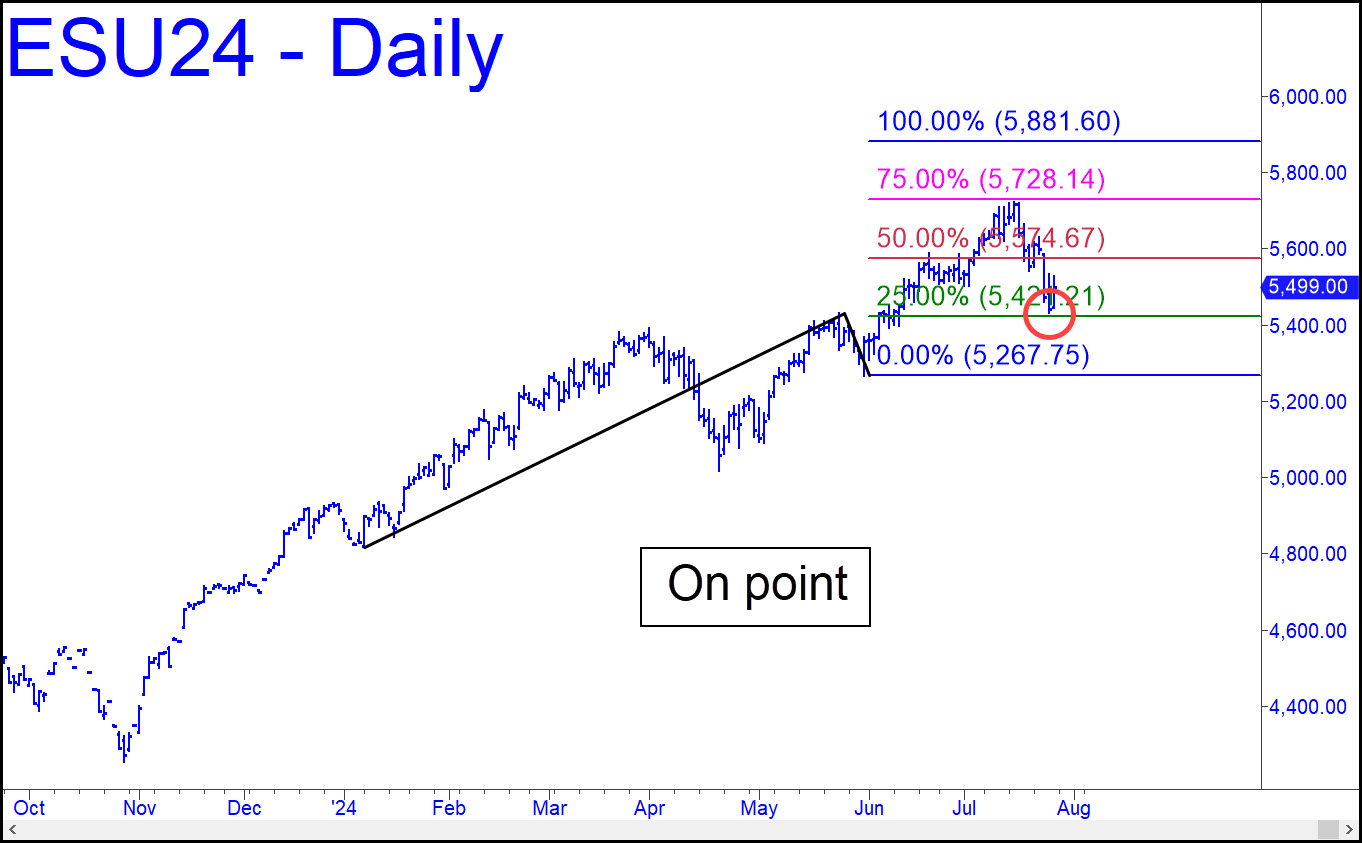

The futures bounced last Thursday from within a hair of the green line (x=5421.21), triggering a textbook ‘mechanical’ buy within a very un-textbook ABCD pattern. It’s a credible signal, however, given the initial hesitation at the red line on the way up, and the stall precisely at p2=5728.14. Even so, I am wary of the possibility that this so-far moderate bounce will fail to achieve the D target at 5881.60, effectively ending the bull market begun in 2009. The September contract is a lead-pipe cinch to reach p, though, so we’ll put further speculation aside and focus on trading the remaining 75 points of ‘ceertain’ upside.

The futures bounced last Thursday from within a hair of the green line (x=5421.21), triggering a textbook ‘mechanical’ buy within a very un-textbook ABCD pattern. It’s a credible signal, however, given the initial hesitation at the red line on the way up, and the stall precisely at p2=5728.14. Even so, I am wary of the possibility that this so-far moderate bounce will fail to achieve the D target at 5881.60, effectively ending the bull market begun in 2009. The September contract is a lead-pipe cinch to reach p, though, so we’ll put further speculation aside and focus on trading the remaining 75 points of ‘ceertain’ upside.

ESU24 – Sep E-Mini S&P (Last:5499.25)

Posted on July 28, 2024, 5:20 pm EDT

Last Updated July 28, 2024, 12:31 am EDT

Posted on July 28, 2024, 5:20 pm EDT

Last Updated July 28, 2024, 12:31 am EDT