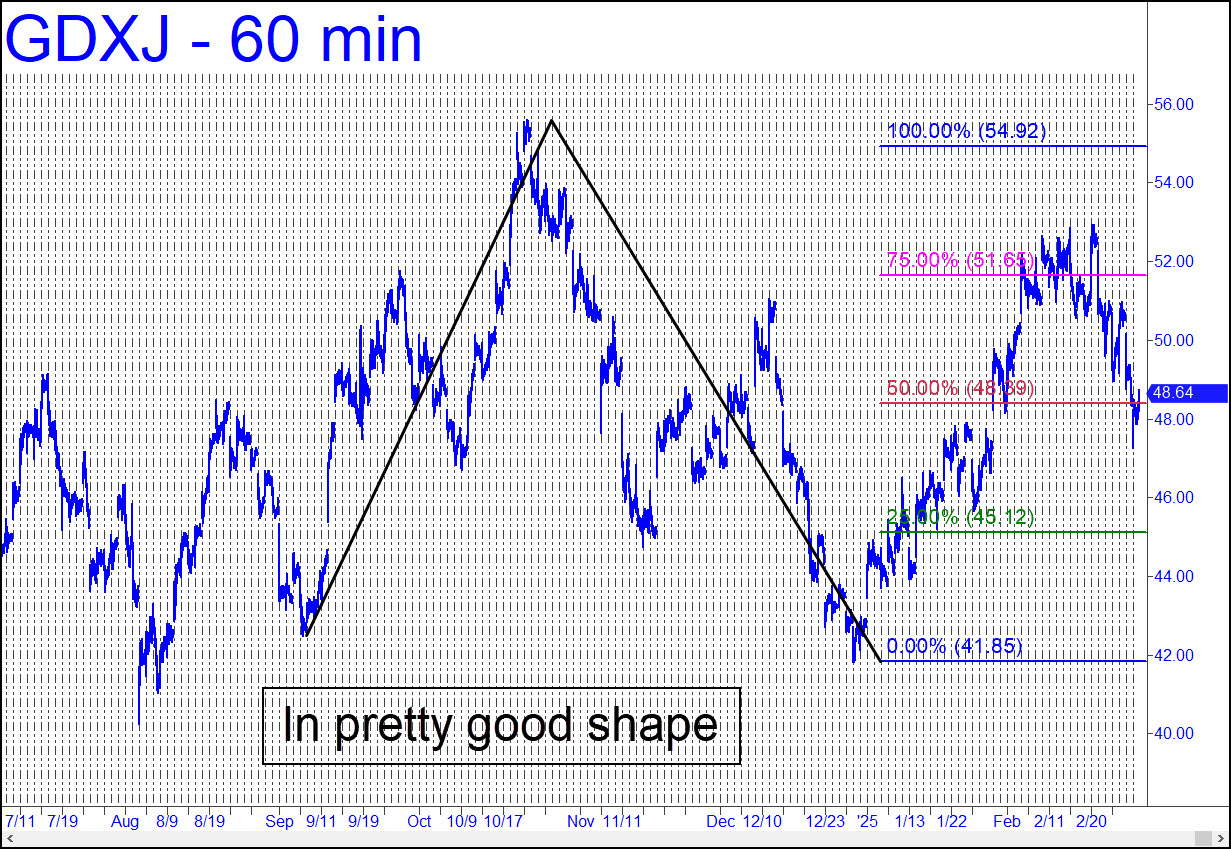

GDXJ’s chart is in good shape — good enough, actually, to hint that the upcoming test of support in gold and silver futures will favor bulls. The likelihood of this will increase if this vehicle hits the green line just as its Comex-contract cousins are touching their respective ‘D’ correction targets. Regardless, if GDXJ falls to x=45.12, shown in that inset chart as a green line, that would signal a ‘mechanical’ buy, stop 41.84. Presumably, it would be good for an easy ride back up to at least p = 48.39.

GDXJ’s chart is in good shape — good enough, actually, to hint that the upcoming test of support in gold and silver futures will favor bulls. The likelihood of this will increase if this vehicle hits the green line just as its Comex-contract cousins are touching their respective ‘D’ correction targets. Regardless, if GDXJ falls to x=45.12, shown in that inset chart as a green line, that would signal a ‘mechanical’ buy, stop 41.84. Presumably, it would be good for an easy ride back up to at least p = 48.39.

GDXJ – Junior Gold Miner ETF (Last:48.66)

Posted on March 2, 2025, 5:13 pm EST

Last Updated March 1, 2025, 2:50 pm EST

Posted on March 2, 2025, 5:13 pm EST

Last Updated March 1, 2025, 2:50 pm EST