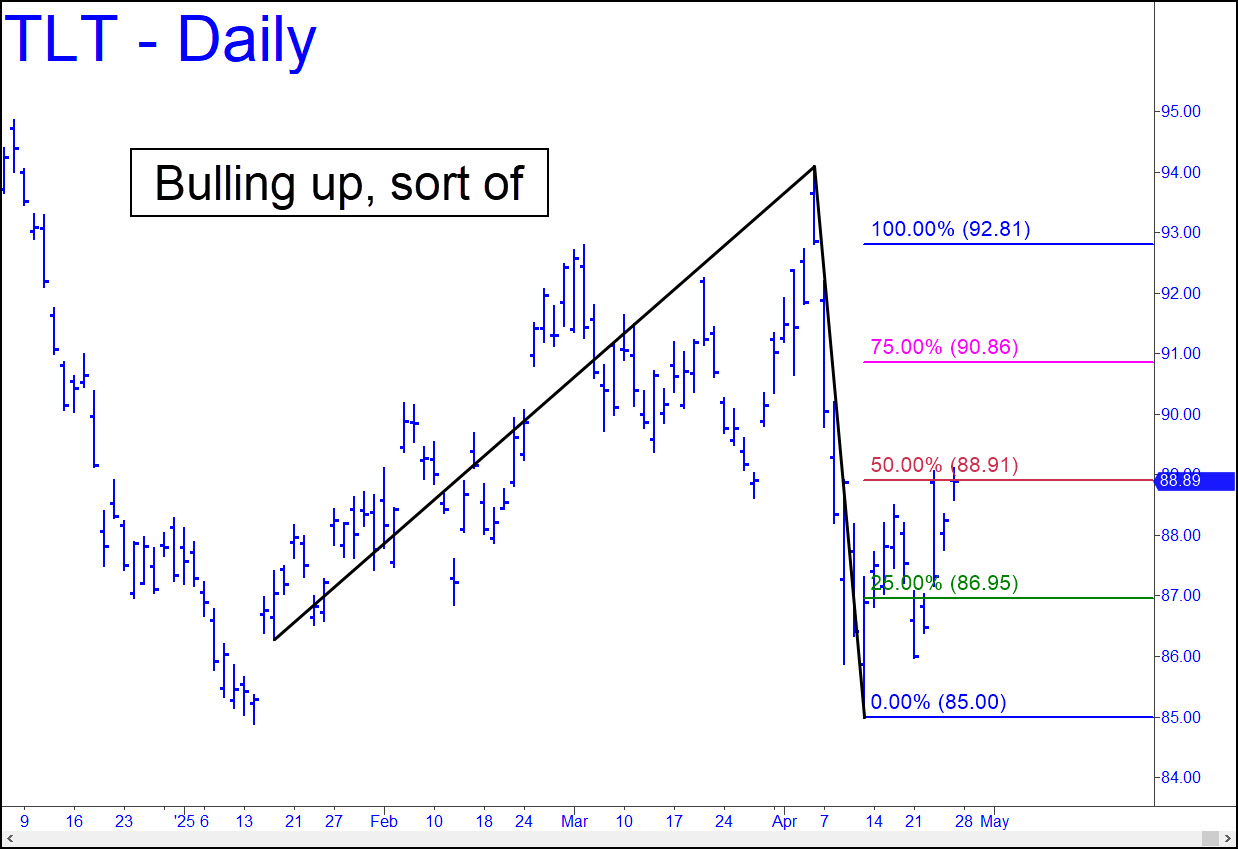

The short-term picture has turned mildly bullish with TLT’s so-far timid poke above the Hidden Pivot midpoint resistance, p=88.91. It’s not too late for a decisive blast through it, but we’ll reserve judgment on the strength and durability of the rally until we’ve seen more. A conventional ‘buy’ signal has been in effect since TLT first touched the green line (x=86.95) two weeks ago. I’d rather buy on a pullback to the green line from our ‘sweet spot’ above p, however, and we should plan on doing so if the opportunity arises. _______ UPDATE (May 3): TLT did precisely what we needed, vaulting to the ‘sweet spot‘ before receding toward the green line. The move has created a price we can bid ‘mechanically’ with confidence. The trade should be good for at least a one-level move, from x=86.96 to p=88.91, with a stop-loss at 84.99.

The short-term picture has turned mildly bullish with TLT’s so-far timid poke above the Hidden Pivot midpoint resistance, p=88.91. It’s not too late for a decisive blast through it, but we’ll reserve judgment on the strength and durability of the rally until we’ve seen more. A conventional ‘buy’ signal has been in effect since TLT first touched the green line (x=86.95) two weeks ago. I’d rather buy on a pullback to the green line from our ‘sweet spot’ above p, however, and we should plan on doing so if the opportunity arises. _______ UPDATE (May 3): TLT did precisely what we needed, vaulting to the ‘sweet spot‘ before receding toward the green line. The move has created a price we can bid ‘mechanically’ with confidence. The trade should be good for at least a one-level move, from x=86.96 to p=88.91, with a stop-loss at 84.99.

TLT – Lehman Bond ETF (Last:87.72)

Posted on April 27, 2025, 5:10 pm EDT

Last Updated May 3, 2025, 12:03 pm EDT

Posted on April 27, 2025, 5:10 pm EDT

Last Updated May 3, 2025, 12:03 pm EDT