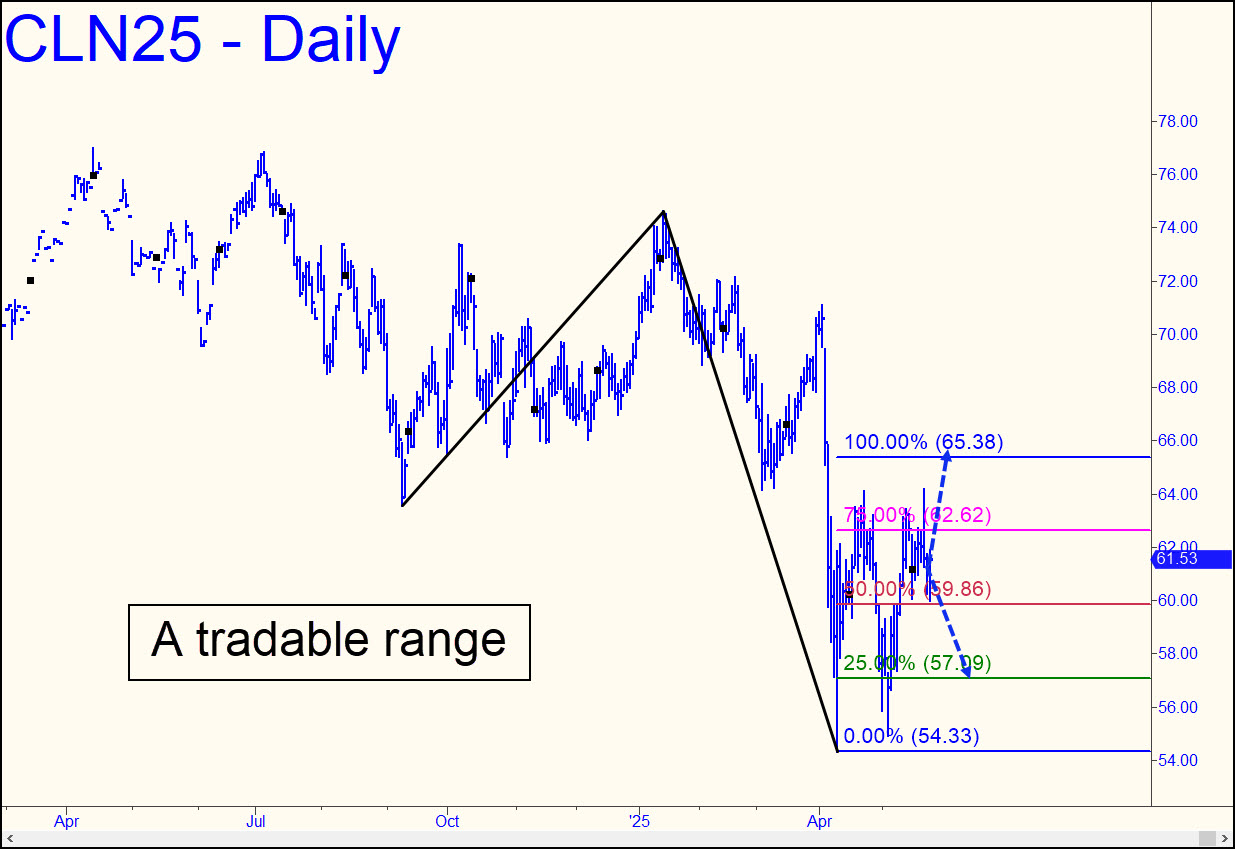

Crude looks primed to screw the pooch, but the daily chart suggests two trade possibilities nonetheless. One would call for getting short on a pop to d=65.38. A stop-loss as tight as 15 cents can be used, although it would be preferable to set up a ‘camo’ trigger pattern on a chart of a lesser degree. The second trade calls for bidding ‘mechanically at the green line (x=57.0). The textbook stop-loss would be just below c=54.33, so tighter risk management is called for by entering the trade with a trigger pattern of small degree. _______ UPDATE (Jun 11): Today’s unusually powerful spasm suggests war may be coming, perhaps in the form of the long-anticipated strike on Iran’s nuclear bomb facilities by Israel. There are many other imaginable catalysts, however, and they should all be taken seriously if this spike gets past two tough obstacles: 1) a Hidden Pivot at 68.98; and 2) the distinctive peak at 71.10 recorded on April 2.

Crude looks primed to screw the pooch, but the daily chart suggests two trade possibilities nonetheless. One would call for getting short on a pop to d=65.38. A stop-loss as tight as 15 cents can be used, although it would be preferable to set up a ‘camo’ trigger pattern on a chart of a lesser degree. The second trade calls for bidding ‘mechanically at the green line (x=57.0). The textbook stop-loss would be just below c=54.33, so tighter risk management is called for by entering the trade with a trigger pattern of small degree. _______ UPDATE (Jun 11): Today’s unusually powerful spasm suggests war may be coming, perhaps in the form of the long-anticipated strike on Iran’s nuclear bomb facilities by Israel. There are many other imaginable catalysts, however, and they should all be taken seriously if this spike gets past two tough obstacles: 1) a Hidden Pivot at 68.98; and 2) the distinctive peak at 71.10 recorded on April 2.

CLN25 – July Crude (Last:68.17)

Posted on May 25, 2025, 5:08 pm EDT

Last Updated June 13, 2025, 1:03 pm EDT

Posted on May 25, 2025, 5:08 pm EDT

Last Updated June 13, 2025, 1:03 pm EDT