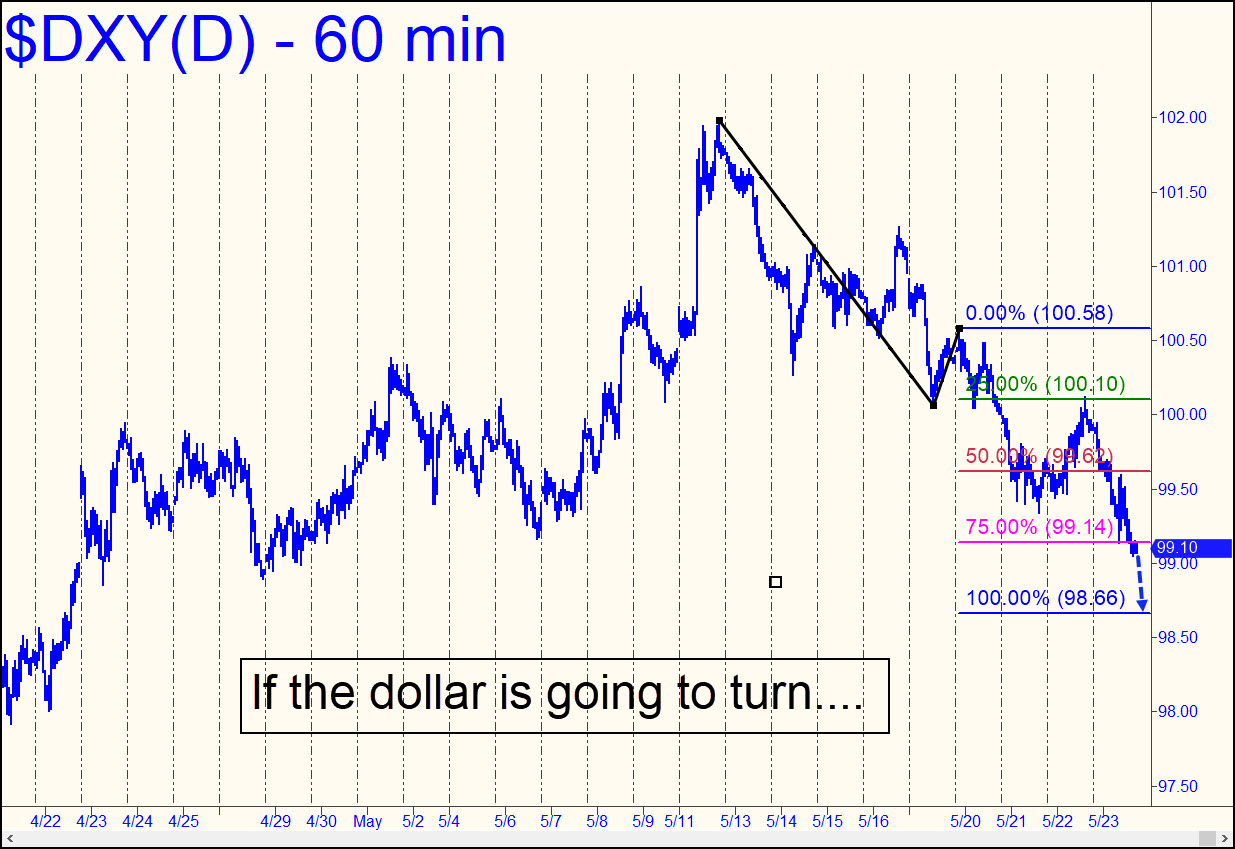

If DXY is going to resume the uptrend begun in April from 98.01, the 98.66 Hidden Pivot support shown would be a logical place for this to occur. The pattern is a conventional one, but because the ‘B’ low is not obvious, its gnarliness should work for us, delivering a tradable bottom precisely where expected. We don’t typically trade this vehicle, but a reversal from the target could yield opportunity in currency pairs or futures. ______ UPDATE (May 30): Easy come, easy go. What started out as a promising week ended with a steep, one-day reversal that left the dollar little changed from the previous week’s lows. Still worse is that the apex of the rally failed to generate an impulse leg on the hourly chart by surpassing an external’ peak at 110.58 recorded May 19 on the way down.

If DXY is going to resume the uptrend begun in April from 98.01, the 98.66 Hidden Pivot support shown would be a logical place for this to occur. The pattern is a conventional one, but because the ‘B’ low is not obvious, its gnarliness should work for us, delivering a tradable bottom precisely where expected. We don’t typically trade this vehicle, but a reversal from the target could yield opportunity in currency pairs or futures. ______ UPDATE (May 30): Easy come, easy go. What started out as a promising week ended with a steep, one-day reversal that left the dollar little changed from the previous week’s lows. Still worse is that the apex of the rally failed to generate an impulse leg on the hourly chart by surpassing an external’ peak at 110.58 recorded May 19 on the way down.

DXY – NYBOT Dollar Index (Last:99.44)

Posted on May 25, 2025, 5:07 pm EDT

Last Updated May 30, 2025, 11:15 pm EDT

Posted on May 25, 2025, 5:07 pm EDT

Last Updated May 30, 2025, 11:15 pm EDT