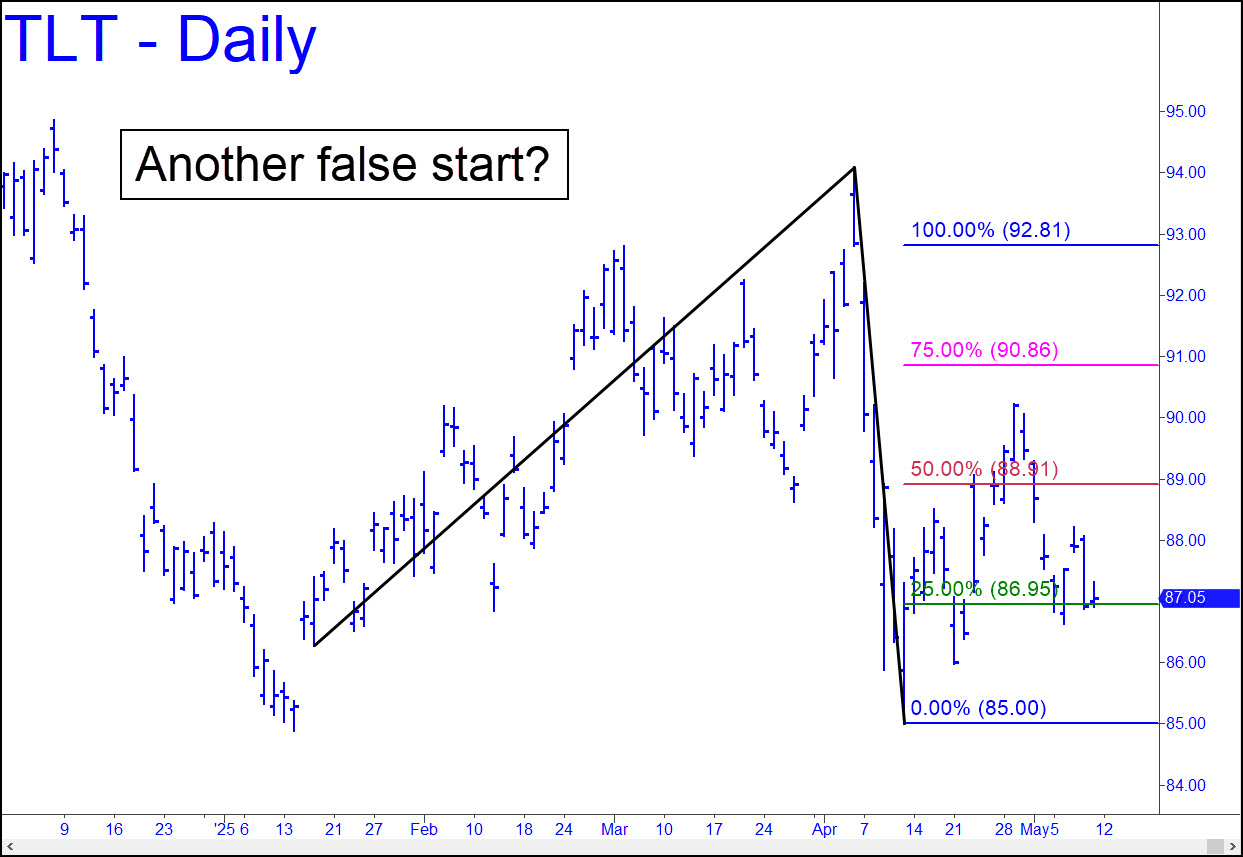

We should know soon whether Silver’s mini-explosion upward, the second in three months, is just another false start. From a Hidden Pivot perspective, the selloff of the last two weeks is not as bearish as it seems. It triggered an attractive ‘mechanical’ buy on Monday when it touched the green line (x=86.95). This implies that a bounce will reach p=89.91, at least, before it can stop out bulls with a dip beneath c=85.00. Whether it can muster a finishing stroke to d=92.81 depends on how easily buyers penetrate p on the next rally. _______ UPDATE (May 18, 12:50 a.m.): Bulls held on by a hair when TLT dipped last week to a bottom just 20 cents from the 85.00 point ‘c’ low of the ostensibly bullish pattern detailed above. _______ UPDATE (May 25): TLT popped a wheelie at an 83.66 voodoo support, but don’t expect the bounce to get legs. The low occurred just inches shy of a chasm beneath the watershed low recorded in October 2023 at 82.42. It is too obvious a place for a good bottom to form, nor do T-Bonds much respect ‘technical’ tops and bottoms. For now, all we can do is watch.

We should know soon whether Silver’s mini-explosion upward, the second in three months, is just another false start. From a Hidden Pivot perspective, the selloff of the last two weeks is not as bearish as it seems. It triggered an attractive ‘mechanical’ buy on Monday when it touched the green line (x=86.95). This implies that a bounce will reach p=89.91, at least, before it can stop out bulls with a dip beneath c=85.00. Whether it can muster a finishing stroke to d=92.81 depends on how easily buyers penetrate p on the next rally. _______ UPDATE (May 18, 12:50 a.m.): Bulls held on by a hair when TLT dipped last week to a bottom just 20 cents from the 85.00 point ‘c’ low of the ostensibly bullish pattern detailed above. _______ UPDATE (May 25): TLT popped a wheelie at an 83.66 voodoo support, but don’t expect the bounce to get legs. The low occurred just inches shy of a chasm beneath the watershed low recorded in October 2023 at 82.42. It is too obvious a place for a good bottom to form, nor do T-Bonds much respect ‘technical’ tops and bottoms. For now, all we can do is watch.

TLT – Lehman Bond ETF (Last:84.55)

Posted on May 11, 2025, 5:05 pm EDT

Last Updated May 25, 2025, 8:23 pm EDT

Posted on May 11, 2025, 5:05 pm EDT

Last Updated May 25, 2025, 8:23 pm EDT