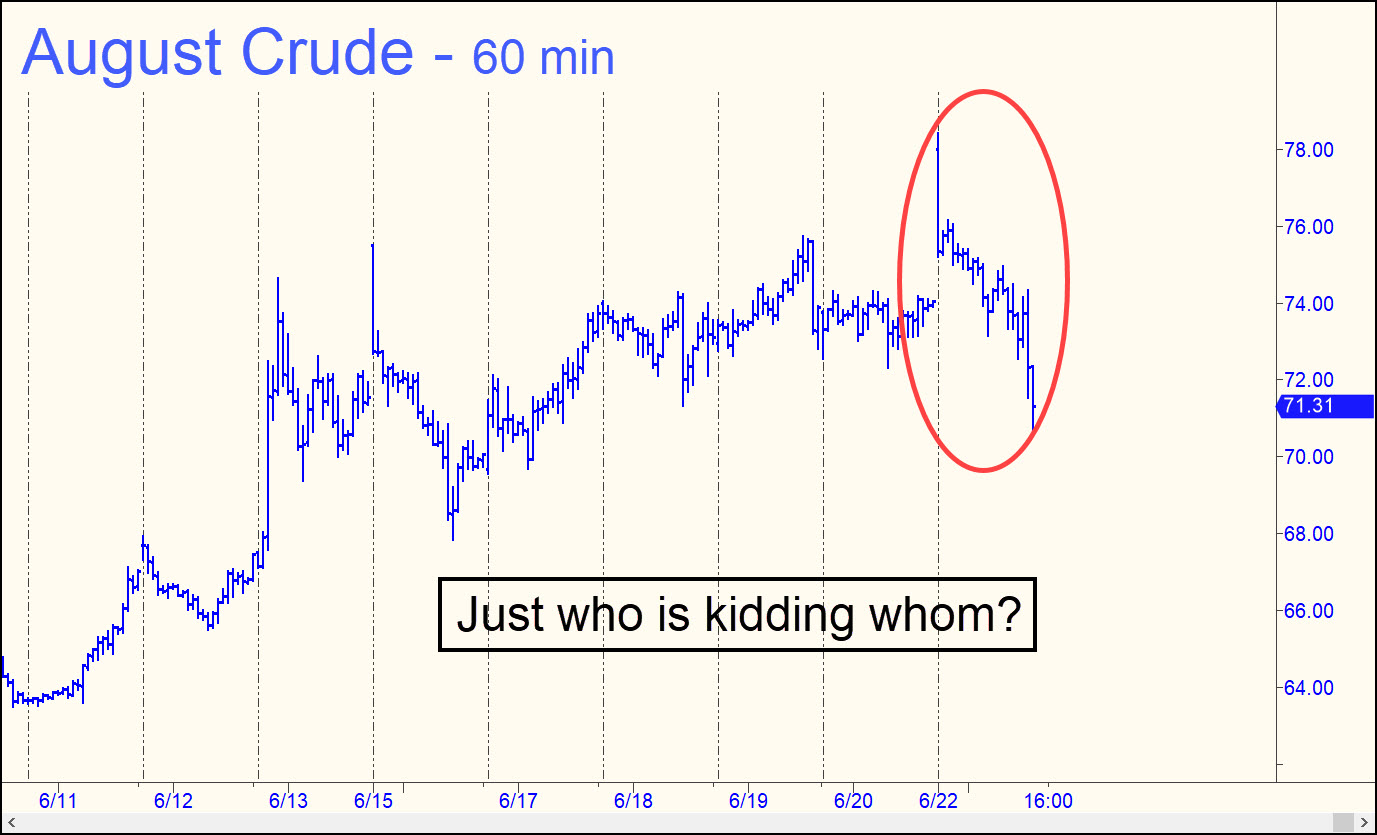

Right on cue, Bloomberg.com splashed an article on its front page over the weekend explaining why the price of crude has been so subdued in the face of potentially severe supply disruptions in the Middle East. Turns out the world is awash in oil, the article explained — not just because of the success of U.S. fracking, but also because the Saudis have been pumping oil like crazy to stabilize their market share. The article was almost surely planted by Bloomberg’s masters in Washington to calm the herd. Energy markets are very heavily manipulated, and PR is frequently used to nudge quotes one way or the other, ostensibly “in the national interest.” Capping prices would appear to be a high priority at the moment, superseding the $100-a-barrel needs of traders and speculators who thrive on volatility. But who is kidding whom? Just beneath the veneer of eerie, artificial calm lurks enough pent-up panic to push quotes from a current $72 to $100 literally overnight. That’s why I’m sticking with a forecast from a week ago that August Crude will hit a minimum $86. In the meantime, don’t be lulled by the way bulls were rebuked this morning with a so-far $8 reversal from 78. Too many things could go wrong for oil prices to be this docile, and for stocks to be hovering so close to record highs. Only fools are buyers of shares at these levels. _______ ADDENDUM (1:25 p.m. EDT): Sunday evening’s fleeting spike, noted above, came within three cents (0.03) of the 78.37 rally target I had flagged in the earlier tout as a good bet. If you took that bet and then got short at the target with a stop-loss as tight as a nickel, you could have caught an up-and-down ride worth as much as $4,000 per contract. ________ UPDATE (Jun 23, 11:29 p.m. EDT): The selling is just a tad overdone, doncha think? It’s not as though a ceasefire will meaningfully boost oil output that just days ago yielded a more or less stable price in the low to mid-$70s. Nevertheless, the August contract, currently trading for around 66.61, is on its way down to at least 62.10. But if it crashes that Hidden Pivot support, the next lies at 58.76; then, worst case, at 56.11. Each of these ‘hidden supports’ can be bottom-fished with a small-degree trigger pattern (i.e., ‘camouflage’)

Right on cue, Bloomberg.com splashed an article on its front page over the weekend explaining why the price of crude has been so subdued in the face of potentially severe supply disruptions in the Middle East. Turns out the world is awash in oil, the article explained — not just because of the success of U.S. fracking, but also because the Saudis have been pumping oil like crazy to stabilize their market share. The article was almost surely planted by Bloomberg’s masters in Washington to calm the herd. Energy markets are very heavily manipulated, and PR is frequently used to nudge quotes one way or the other, ostensibly “in the national interest.” Capping prices would appear to be a high priority at the moment, superseding the $100-a-barrel needs of traders and speculators who thrive on volatility. But who is kidding whom? Just beneath the veneer of eerie, artificial calm lurks enough pent-up panic to push quotes from a current $72 to $100 literally overnight. That’s why I’m sticking with a forecast from a week ago that August Crude will hit a minimum $86. In the meantime, don’t be lulled by the way bulls were rebuked this morning with a so-far $8 reversal from 78. Too many things could go wrong for oil prices to be this docile, and for stocks to be hovering so close to record highs. Only fools are buyers of shares at these levels. _______ ADDENDUM (1:25 p.m. EDT): Sunday evening’s fleeting spike, noted above, came within three cents (0.03) of the 78.37 rally target I had flagged in the earlier tout as a good bet. If you took that bet and then got short at the target with a stop-loss as tight as a nickel, you could have caught an up-and-down ride worth as much as $4,000 per contract. ________ UPDATE (Jun 23, 11:29 p.m. EDT): The selling is just a tad overdone, doncha think? It’s not as though a ceasefire will meaningfully boost oil output that just days ago yielded a more or less stable price in the low to mid-$70s. Nevertheless, the August contract, currently trading for around 66.61, is on its way down to at least 62.10. But if it crashes that Hidden Pivot support, the next lies at 58.76; then, worst case, at 56.11. Each of these ‘hidden supports’ can be bottom-fished with a small-degree trigger pattern (i.e., ‘camouflage’)

CLQ25 – August Crude (Last:66.71)

Posted on June 23, 2025, 1:24 pm EDT

Last Updated June 23, 2025, 11:28 pm EDT

Posted on June 23, 2025, 1:24 pm EDT

Last Updated June 23, 2025, 11:28 pm EDT