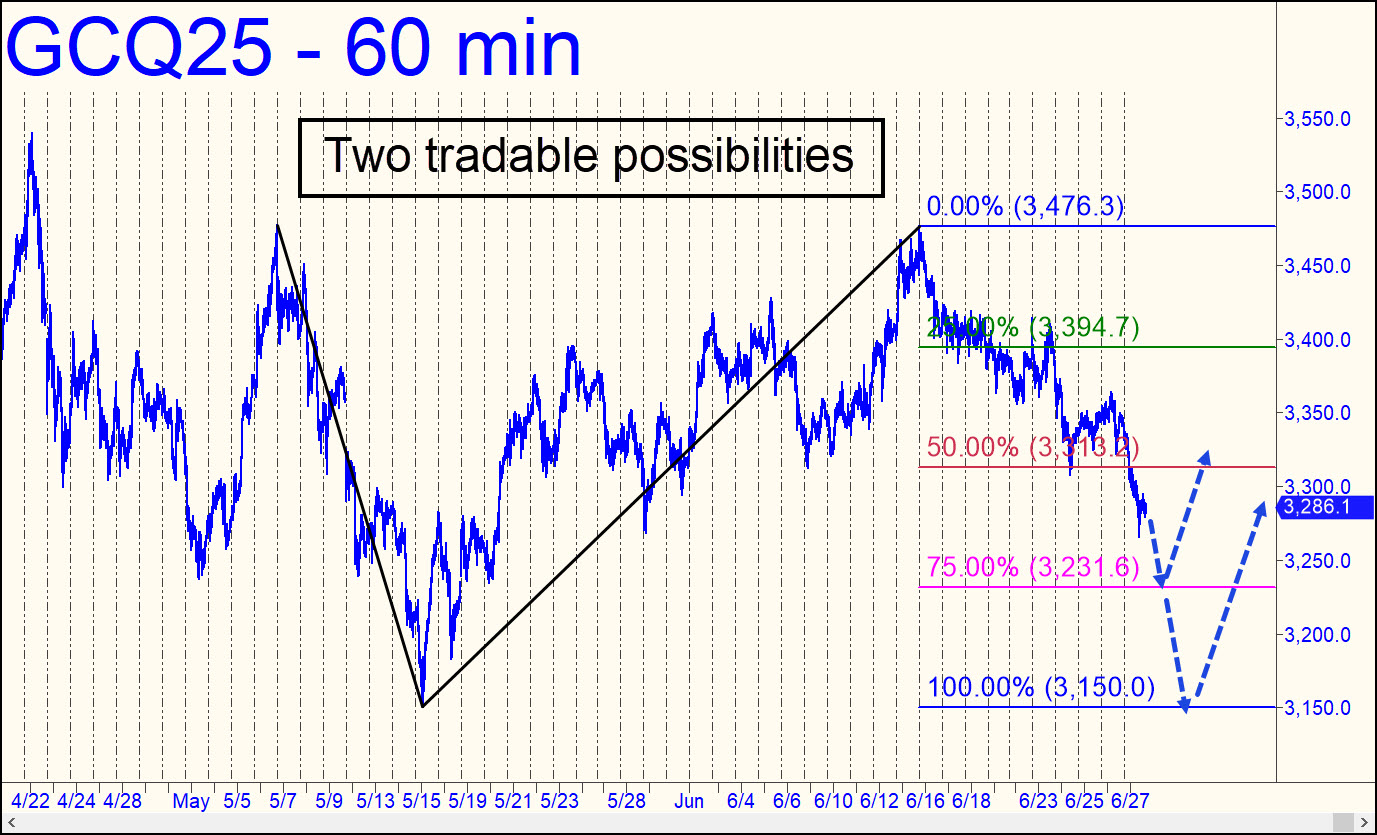

Sellers savaged the 3313.20 midpoint support with such ease last week that the futures are likely to continue down to at least p2=3231.60. And if they fail to get a strong bounce from that Hidden Pivot, expect the correction to hit D=3150.00. An additional possibility is that the turn will come from near the middle of the gap between p and p2, or between p2 and D. Unfortunately, the only way one can trade that scenario with risk tightly controlled is to watch for the turn on a chart of every small (i.e., one- or two-minute) bar chart. And here’s one more possible bottom-fishing opportunity for Pivoteers who know how to craft a low-risk trigger: 3253.30, a voodoo number. ________ UPDATE (Jul 2, 1:19 a.m.) The futures opened on a gap down to 3250.50 on Sunday afternoon, triggering a long entry at 3257.60. (The ‘reverse’ used to fashion the trigger can be found on the 30-min chart, where a=3266.50 on 6/27 at 9:00 a.m.) The pattern, the only one available, could not have produced a losing trade, but it triggered at a time of day when relatively few would have been watching. I have not established a tracking position because no one reported getting long.

Sellers savaged the 3313.20 midpoint support with such ease last week that the futures are likely to continue down to at least p2=3231.60. And if they fail to get a strong bounce from that Hidden Pivot, expect the correction to hit D=3150.00. An additional possibility is that the turn will come from near the middle of the gap between p and p2, or between p2 and D. Unfortunately, the only way one can trade that scenario with risk tightly controlled is to watch for the turn on a chart of every small (i.e., one- or two-minute) bar chart. And here’s one more possible bottom-fishing opportunity for Pivoteers who know how to craft a low-risk trigger: 3253.30, a voodoo number. ________ UPDATE (Jul 2, 1:19 a.m.) The futures opened on a gap down to 3250.50 on Sunday afternoon, triggering a long entry at 3257.60. (The ‘reverse’ used to fashion the trigger can be found on the 30-min chart, where a=3266.50 on 6/27 at 9:00 a.m.) The pattern, the only one available, could not have produced a losing trade, but it triggered at a time of day when relatively few would have been watching. I have not established a tracking position because no one reported getting long.

GCQ25 – August Gold (Last:3351.40)

Posted on June 29, 2025, 5:15 pm EDT

Last Updated July 2, 2025, 1:20 am EDT

Posted on June 29, 2025, 5:15 pm EDT

Last Updated July 2, 2025, 1:20 am EDT