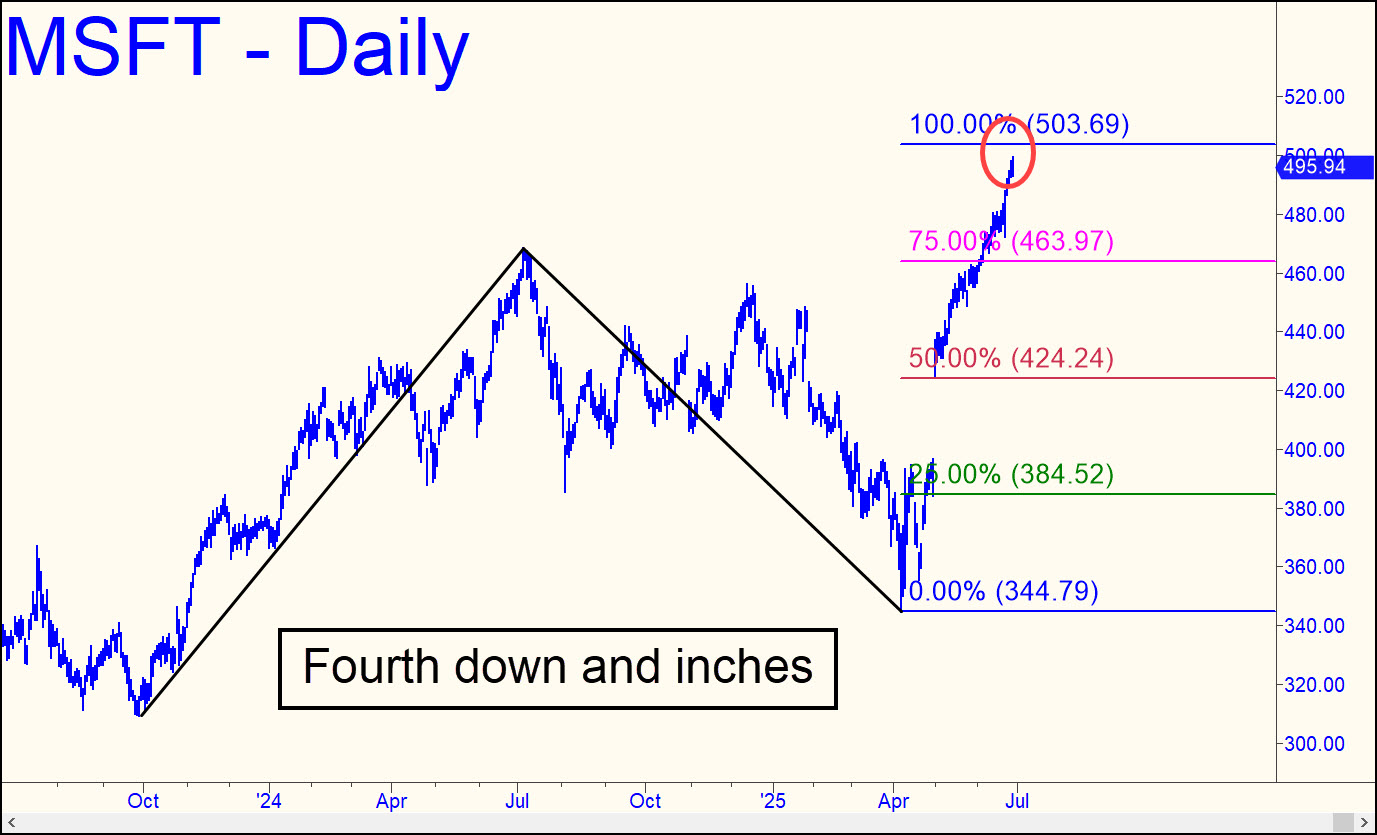

The grandaddy of all short squeezes (in dollar terms) stopped an inch shy of the 503.69 target we’ve been using. It looks like ‘our’ target got front-run on the intraday charts, but the view shown, of the daily chart, ‘feels’ like the target will be achieved. In any case, we should be ready to get short there, especially subscribers who have made money on the way up using my crazy-bullish targets. This should be done with a tight stop-loss, preferably tied to a small-pattern (‘camouflage’) trigger, since we’ve become used to seeing this stock vaporize Hidden Pivots made from inch-thick titanium. I consider this unlikely, but the pattern itself is probably too obvious to give us our top precisely where we want it. ______ UPDATE (Jul 4, 12:55 p.m. EDT): Some subscribers were able to get long just ahead of the stock’s engineered, lunatic leap this morning using a Hidden Pivot correction target I’d disseminated earlier. Visit the chat room for details. ______ UPDATE (Jul 4): Technical signs remain persuasive that the stock will make a potentially important top at or near 503.69, a Hidden Pivot resistance nine months in the making. This warrants laying out shorts at or near the target — either via purchasing puts when MSFT gets there; or, preferably, naked-shorting soon-to-expire, at-the-money calls with a tight stop-loss. ________ UPDATE July 9, 6:41 p.m. EDT): The Great Microsoft Waft drilled a .50 caliber hole in my Hidden Pivot target before pulling back unconvincingly. The stock is on its way to at least 516.95 over the near-term. It should be bought ‘mechanically’ on a retracement to x=495.76, stop 488.69, (60m, A=472.51 on 6/23).

The grandaddy of all short squeezes (in dollar terms) stopped an inch shy of the 503.69 target we’ve been using. It looks like ‘our’ target got front-run on the intraday charts, but the view shown, of the daily chart, ‘feels’ like the target will be achieved. In any case, we should be ready to get short there, especially subscribers who have made money on the way up using my crazy-bullish targets. This should be done with a tight stop-loss, preferably tied to a small-pattern (‘camouflage’) trigger, since we’ve become used to seeing this stock vaporize Hidden Pivots made from inch-thick titanium. I consider this unlikely, but the pattern itself is probably too obvious to give us our top precisely where we want it. ______ UPDATE (Jul 4, 12:55 p.m. EDT): Some subscribers were able to get long just ahead of the stock’s engineered, lunatic leap this morning using a Hidden Pivot correction target I’d disseminated earlier. Visit the chat room for details. ______ UPDATE (Jul 4): Technical signs remain persuasive that the stock will make a potentially important top at or near 503.69, a Hidden Pivot resistance nine months in the making. This warrants laying out shorts at or near the target — either via purchasing puts when MSFT gets there; or, preferably, naked-shorting soon-to-expire, at-the-money calls with a tight stop-loss. ________ UPDATE July 9, 6:41 p.m. EDT): The Great Microsoft Waft drilled a .50 caliber hole in my Hidden Pivot target before pulling back unconvincingly. The stock is on its way to at least 516.95 over the near-term. It should be bought ‘mechanically’ on a retracement to x=495.76, stop 488.69, (60m, A=472.51 on 6/23).

MSFT – Microsoft (Last:503.48)

Posted on June 29, 2025, 5:17 pm EDT

Last Updated July 9, 2025, 6:41 pm EDT

Posted on June 29, 2025, 5:17 pm EDT

Last Updated July 9, 2025, 6:41 pm EDT