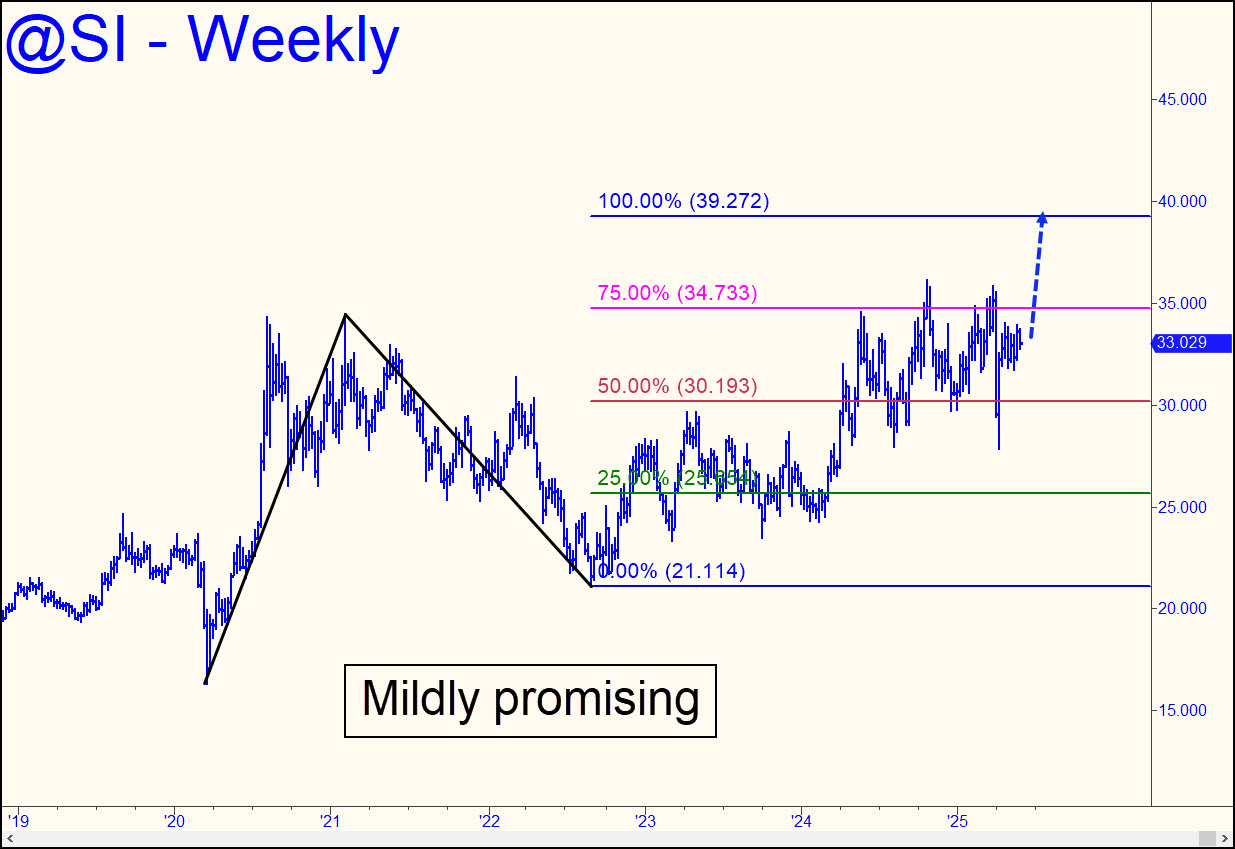

Silver’s long-term chart has been promising a run-up to at least 39.272 for years, but don’t hold your breath. It’s been stuck in an $8 range for more than a year, but bulls show little inclination to leave the comfort zone any time soon. Moreover, you can see that even a $7 drop to the pattern’s green line wouldn’t have much impact on the big picture, even if investors would likely be feeling pretty disappointed by then. The most promising opportunity I can discern for bottom-fishing or augmenting a long-term position would come on a pullback to 30.033, the midpoint Hidden Pivot support of a corrective pattern projecting to as low as 26.058. The trade would be invalidated, however, by an upthrust exceeding 34.008. _______ UPDATE (Jun 3, 1:04 a.m. EDT): I’m just a tad skeptical about today’s big rally, which fell six cents shy of the 34.995 ‘d’ target of the super-gnarly reverse pattern shown. Let’s stipulate that the futures close for two consecutive days above it, or trade above 35.800 intraday, before we assume they’re headed significantly higher.

Silver’s long-term chart has been promising a run-up to at least 39.272 for years, but don’t hold your breath. It’s been stuck in an $8 range for more than a year, but bulls show little inclination to leave the comfort zone any time soon. Moreover, you can see that even a $7 drop to the pattern’s green line wouldn’t have much impact on the big picture, even if investors would likely be feeling pretty disappointed by then. The most promising opportunity I can discern for bottom-fishing or augmenting a long-term position would come on a pullback to 30.033, the midpoint Hidden Pivot support of a corrective pattern projecting to as low as 26.058. The trade would be invalidated, however, by an upthrust exceeding 34.008. _______ UPDATE (Jun 3, 1:04 a.m. EDT): I’m just a tad skeptical about today’s big rally, which fell six cents shy of the 34.995 ‘d’ target of the super-gnarly reverse pattern shown. Let’s stipulate that the futures close for two consecutive days above it, or trade above 35.800 intraday, before we assume they’re headed significantly higher.

SIN25 – July Silver (Last:34.365)

Posted on June 1, 2025, 5:14 pm EDT

Last Updated June 3, 2025, 2:03 am EDT

Posted on June 1, 2025, 5:14 pm EDT

Last Updated June 3, 2025, 2:03 am EDT