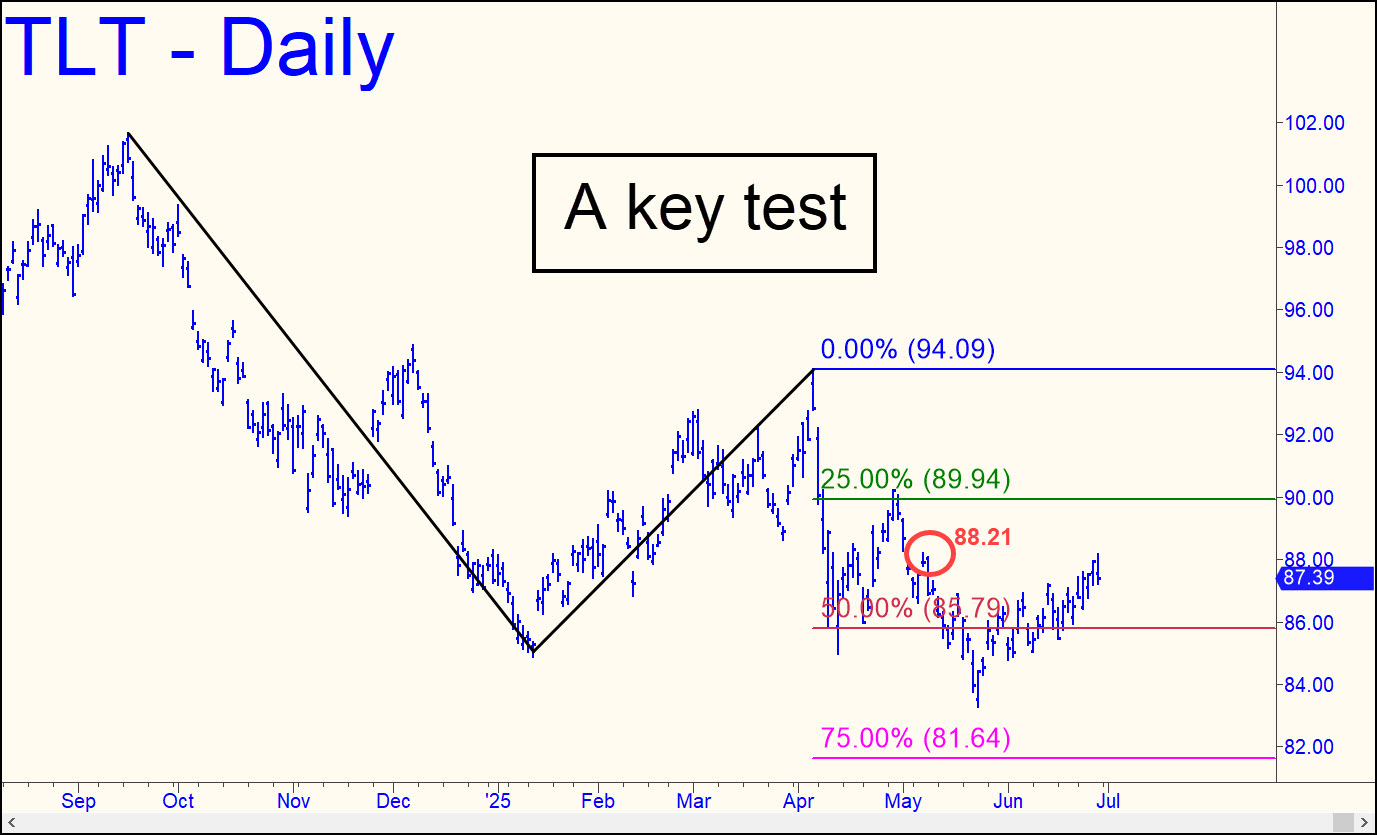

Is this rally for real? We’ll probably have our answer this week, since this vehicle will either vault above the ‘external’ peak at 88.21 (see inset), or it will chicken out and pull back to form a distinctive low before taking a running start. The first scenario would be more bullish, but the second would be no disqualifier. In either case, we’ll monitor minor ABCD retracements, since they should not reach ‘D’ if the rally is going to continue. Correspondingly, ABCD rallies of minor degree should easily surpass p midpoints, and even D targets, for the bull to remain healthy. These rules should hold true even for patterns that play out in an hour or less on the one-minute chart. FYI, the most immediate target for a tradable pullback low is 86.42 (assuming 88.16 is not exceeded first; that would shift the target higher). _______ UPDATE (Jul 2, 1:38 a.m. EDT): Buyers easily surpassed the external peak at 88.21, creating a fresh impulse leg and clearing the way for a new leg up to 88.86. This ETF proxy for long-term Treasurys is rising because foreign money has been flowing copiously into the U.S. Trump has put America into ascendance, and the trend is just getting rolling. It helps that Europe is a basket case.

Is this rally for real? We’ll probably have our answer this week, since this vehicle will either vault above the ‘external’ peak at 88.21 (see inset), or it will chicken out and pull back to form a distinctive low before taking a running start. The first scenario would be more bullish, but the second would be no disqualifier. In either case, we’ll monitor minor ABCD retracements, since they should not reach ‘D’ if the rally is going to continue. Correspondingly, ABCD rallies of minor degree should easily surpass p midpoints, and even D targets, for the bull to remain healthy. These rules should hold true even for patterns that play out in an hour or less on the one-minute chart. FYI, the most immediate target for a tradable pullback low is 86.42 (assuming 88.16 is not exceeded first; that would shift the target higher). _______ UPDATE (Jul 2, 1:38 a.m. EDT): Buyers easily surpassed the external peak at 88.21, creating a fresh impulse leg and clearing the way for a new leg up to 88.86. This ETF proxy for long-term Treasurys is rising because foreign money has been flowing copiously into the U.S. Trump has put America into ascendance, and the trend is just getting rolling. It helps that Europe is a basket case.

TLT – Lehman Bond ETF (Last:88.13)

Posted on June 29, 2025, 5:12 pm EDT

Last Updated July 2, 2025, 1:39 am EDT

Posted on June 29, 2025, 5:12 pm EDT

Last Updated July 2, 2025, 1:39 am EDT