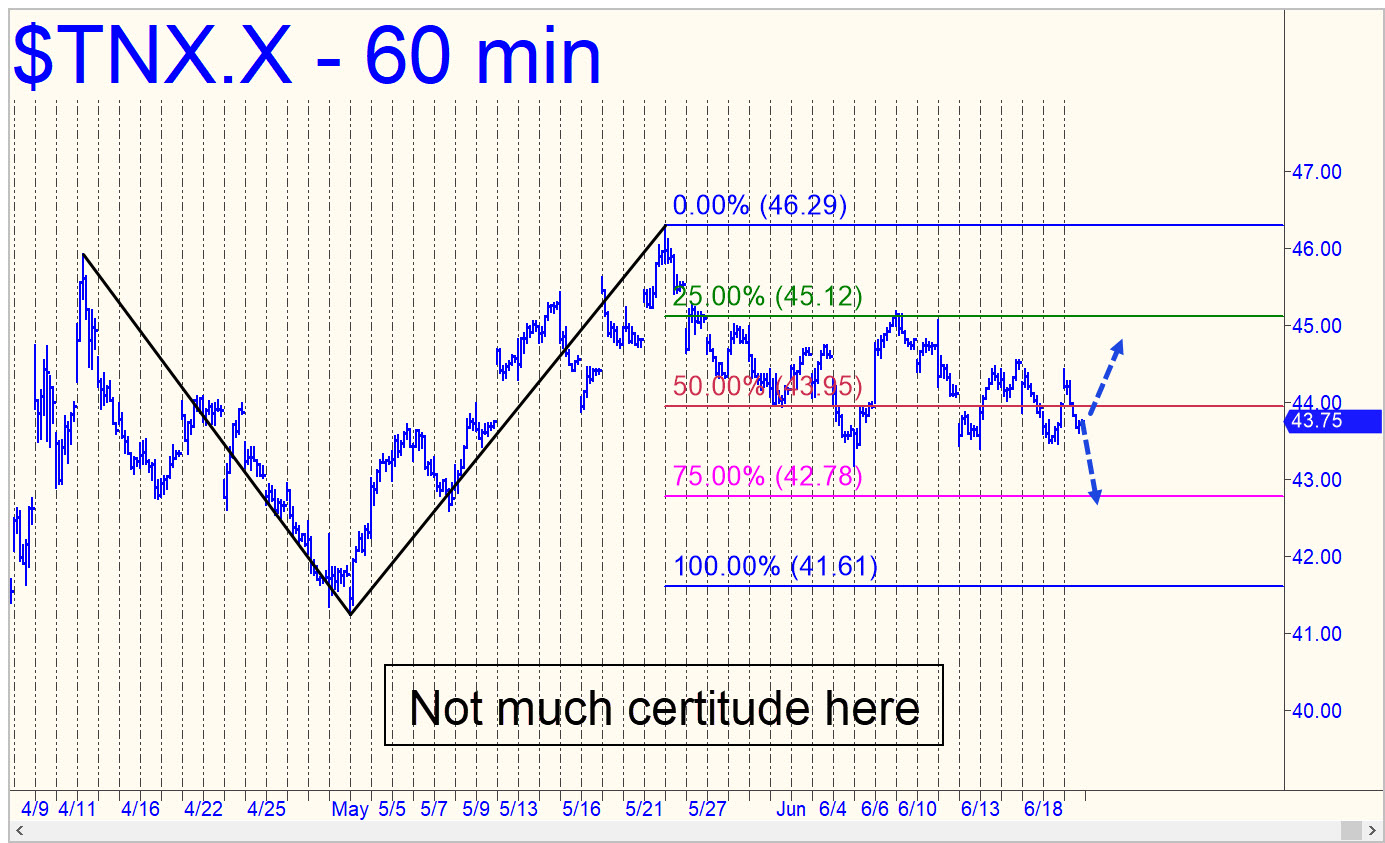

This symbol has tracked my forecast for the last couple of weeks, but what now? Up or down in the week ahead looks like a coin-toss at the moment, but if rates break lower, expect them to fall to at least 4.278% (p2, the secondary Hidden Pivot), and to take a tradable bounce from that number. Best case (for borrowers, that is) would be for further slippage to d=4.161%, which presumably would be signaled by a decisive breach of p2=4.278%. Alternatively, if rates move higher, signaled by a two-day close above 4.439%, look for a move to 4.559%.

This symbol has tracked my forecast for the last couple of weeks, but what now? Up or down in the week ahead looks like a coin-toss at the moment, but if rates break lower, expect them to fall to at least 4.278% (p2, the secondary Hidden Pivot), and to take a tradable bounce from that number. Best case (for borrowers, that is) would be for further slippage to d=4.161%, which presumably would be signaled by a decisive breach of p2=4.278%. Alternatively, if rates move higher, signaled by a two-day close above 4.439%, look for a move to 4.559%.

TNX.X – Ten-Year Note Rate (Last:4.375%)

Posted on June 22, 2025, 5:16 pm EDT

Last Updated June 28, 2025, 1:25 am EDT

Posted on June 22, 2025, 5:16 pm EDT

Last Updated June 28, 2025, 1:25 am EDT