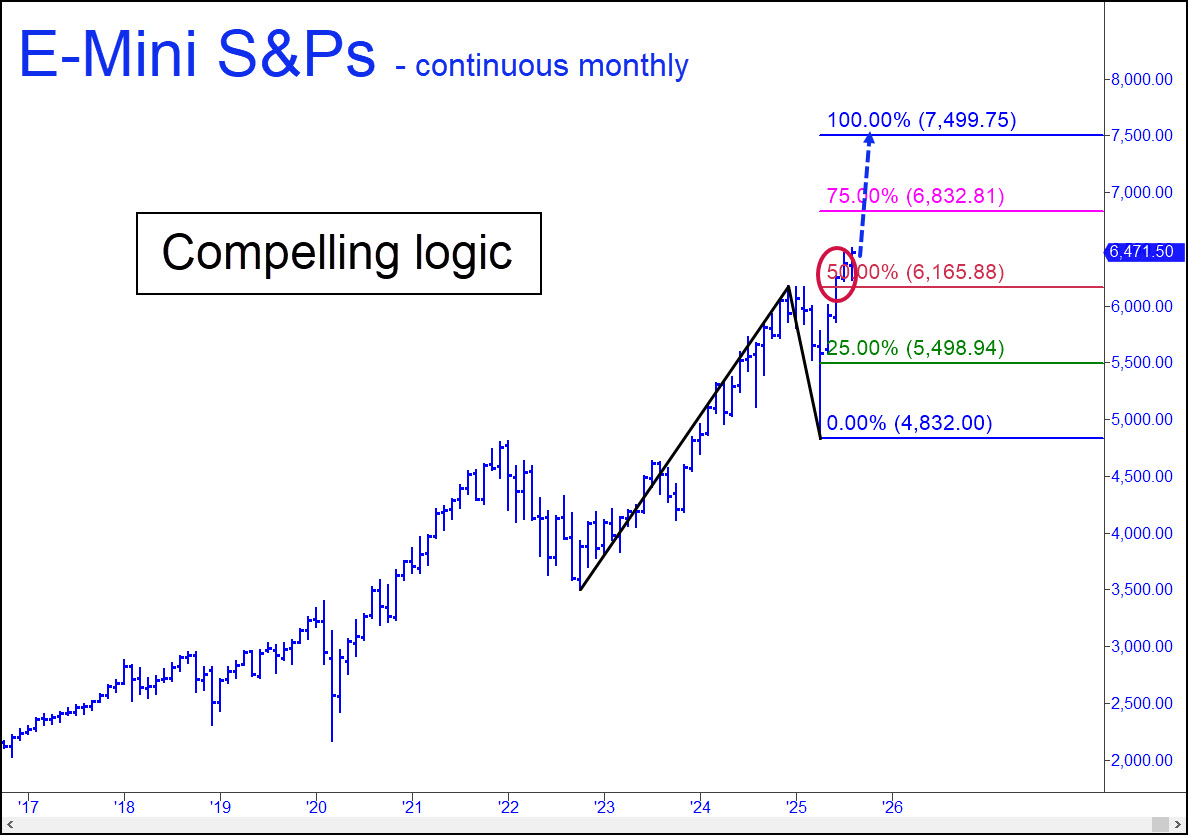

As a hard-core permabear, I find this chart painful to contemplate. It says a thousand-point rally is coming in the S&Ps and that nothing, not even an October surprise, can derail it. This conclusion is related to the way in which buyers penetrated the midpoint Hidden Pivot support at 6165.88. Not only did they slice through it on the first try, they then closed above it for three consecutive bars and never looked back. The pattern itself is too obvious to yield a penny-precise top to short, but there is no mistaking the power that made such short work of p=6165.88. As many subscribers will already know, price action at the midpoint pivot is a reliable telltale even when the underlying pattern is less-than-appealing, never mind perfect. In this instance, there is also the prospect of a back-up-the-truck bottom-fishing opportunity if the futures relapse to the green line (x=5498.94). Although the implied plunge of nearly a thousand points would be widely viewed as the start of a bear market, it would be an exceptional opportunity to reload, as far as we’re concerned.

As a hard-core permabear, I find this chart painful to contemplate. It says a thousand-point rally is coming in the S&Ps and that nothing, not even an October surprise, can derail it. This conclusion is related to the way in which buyers penetrated the midpoint Hidden Pivot support at 6165.88. Not only did they slice through it on the first try, they then closed above it for three consecutive bars and never looked back. The pattern itself is too obvious to yield a penny-precise top to short, but there is no mistaking the power that made such short work of p=6165.88. As many subscribers will already know, price action at the midpoint pivot is a reliable telltale even when the underlying pattern is less-than-appealing, never mind perfect. In this instance, there is also the prospect of a back-up-the-truck bottom-fishing opportunity if the futures relapse to the green line (x=5498.94). Although the implied plunge of nearly a thousand points would be widely viewed as the start of a bear market, it would be an exceptional opportunity to reload, as far as we’re concerned.

ESU25 – Sep E-Mini S&Ps (Last:6471.50)

Posted on August 17, 2025, 5:00 pm EDT

Last Updated August 17, 2025, 8:32 pm EDT

Posted on August 17, 2025, 5:00 pm EDT

Last Updated August 17, 2025, 8:32 pm EDT