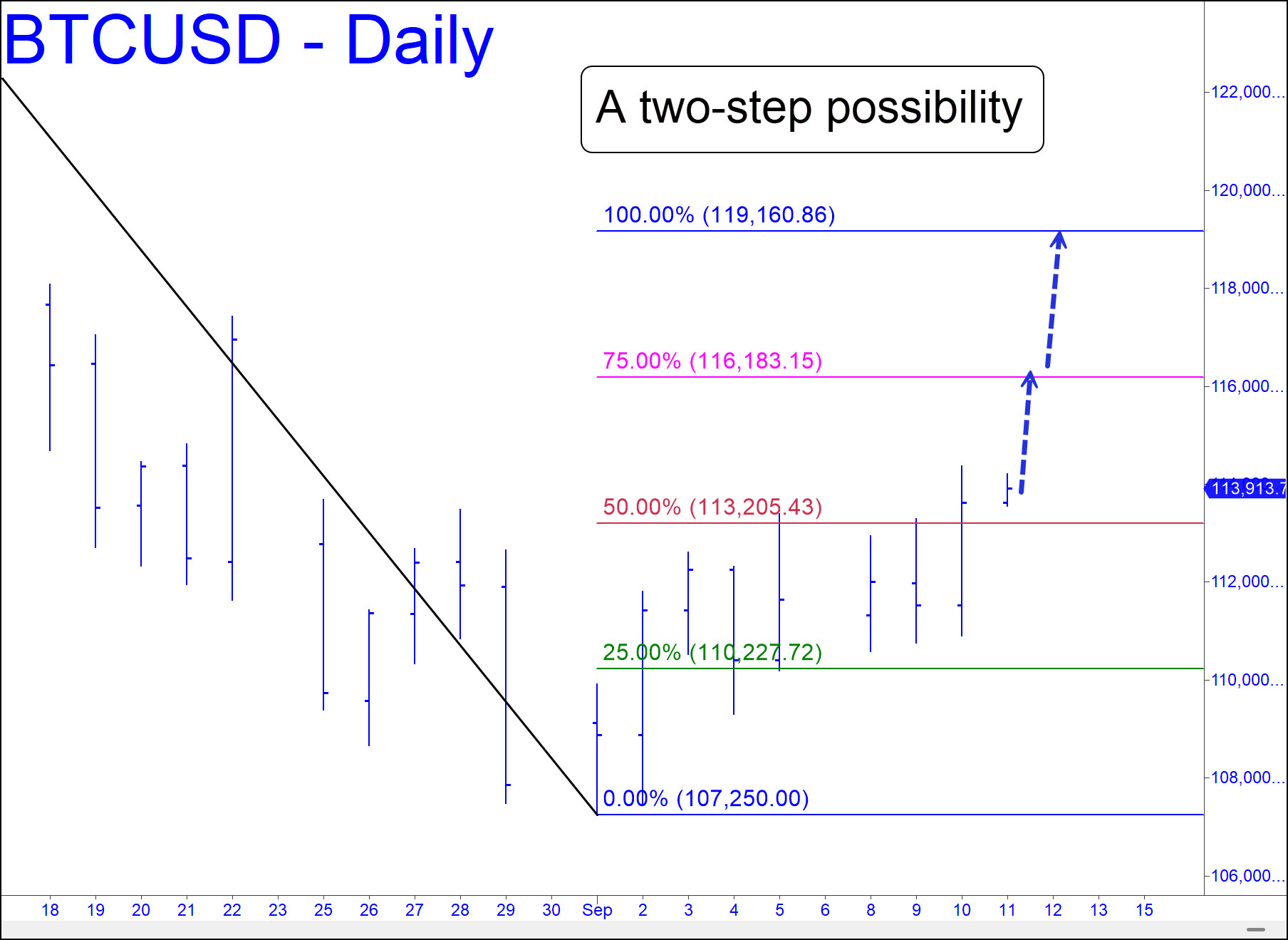

Bitcoin’s bounce two weeks ago from within a hair of a correction target at 107,064 has gotten legs and now promises more upside over the near term to as high as 119,160. Bulls have all but clinched a move to at least 116,183, the ‘secondary’ Hidden Pivot resistance (p2) of the pattern shown. However, a follow-through to D=119,160 is not a done deal yet and would be predicated on a decisive penetration of 116,183 on first contact. Meanwhile, a relapse to 110,272 (x, the green line) can be bought with a 107,249 stop-loss. ______ UPDATE (Sep 12, 2:01 p.m. EDT): Bulls have popped this gas-bag to 116,365 this morning. That’s 0.15 percent higher than my minimum target, but not quite enough to guarantee that D=119,160 will be achieved. I expect this to happen, but the yellow flag is out anyway just to be extra cautious. _______ UPDATE (Sep 20): No change, although I’ll suggest shorting the 119,160 target with tight risk-control., since I strongly doubt BTC will take it out without a see-saw battle. If it does, it would be signaling more upside to at least 126,622, or 132,996 if any higher. _______ UPDATE (Sep 22): Bitcoin’s meaningless histrionics have not altered my rally target, although I will: with a small upward adjustment to 119,740. Meanwhile, the current correction looks bound for at least 110,435, but a breach of that Hidden Pivot support could send bulls down to as low as 107,894 in search of traction. ________ UPDATE Oct 2, 2:41 a.m.): The little hoax rallied to within 0.2% of my target, close enough for us to consider it precisely fulfilled. Anyone care to know exactly where it is going next? I saw a ZeroHedge article about a supposed double-top in this vehicle, but I’m guessing it was written by a Starbucks barista moonlighting as a chartist.

Bitcoin’s bounce two weeks ago from within a hair of a correction target at 107,064 has gotten legs and now promises more upside over the near term to as high as 119,160. Bulls have all but clinched a move to at least 116,183, the ‘secondary’ Hidden Pivot resistance (p2) of the pattern shown. However, a follow-through to D=119,160 is not a done deal yet and would be predicated on a decisive penetration of 116,183 on first contact. Meanwhile, a relapse to 110,272 (x, the green line) can be bought with a 107,249 stop-loss. ______ UPDATE (Sep 12, 2:01 p.m. EDT): Bulls have popped this gas-bag to 116,365 this morning. That’s 0.15 percent higher than my minimum target, but not quite enough to guarantee that D=119,160 will be achieved. I expect this to happen, but the yellow flag is out anyway just to be extra cautious. _______ UPDATE (Sep 20): No change, although I’ll suggest shorting the 119,160 target with tight risk-control., since I strongly doubt BTC will take it out without a see-saw battle. If it does, it would be signaling more upside to at least 126,622, or 132,996 if any higher. _______ UPDATE (Sep 22): Bitcoin’s meaningless histrionics have not altered my rally target, although I will: with a small upward adjustment to 119,740. Meanwhile, the current correction looks bound for at least 110,435, but a breach of that Hidden Pivot support could send bulls down to as low as 107,894 in search of traction. ________ UPDATE Oct 2, 2:41 a.m.): The little hoax rallied to within 0.2% of my target, close enough for us to consider it precisely fulfilled. Anyone care to know exactly where it is going next? I saw a ZeroHedge article about a supposed double-top in this vehicle, but I’m guessing it was written by a Starbucks barista moonlighting as a chartist.

BTCUSD – Bitcoin (Last:118,702)

Posted on September 10, 2025, 9:50 pm EDT

Last Updated October 2, 2025, 2:48 am EDT

Posted on September 10, 2025, 9:50 pm EDT

Last Updated October 2, 2025, 2:48 am EDT