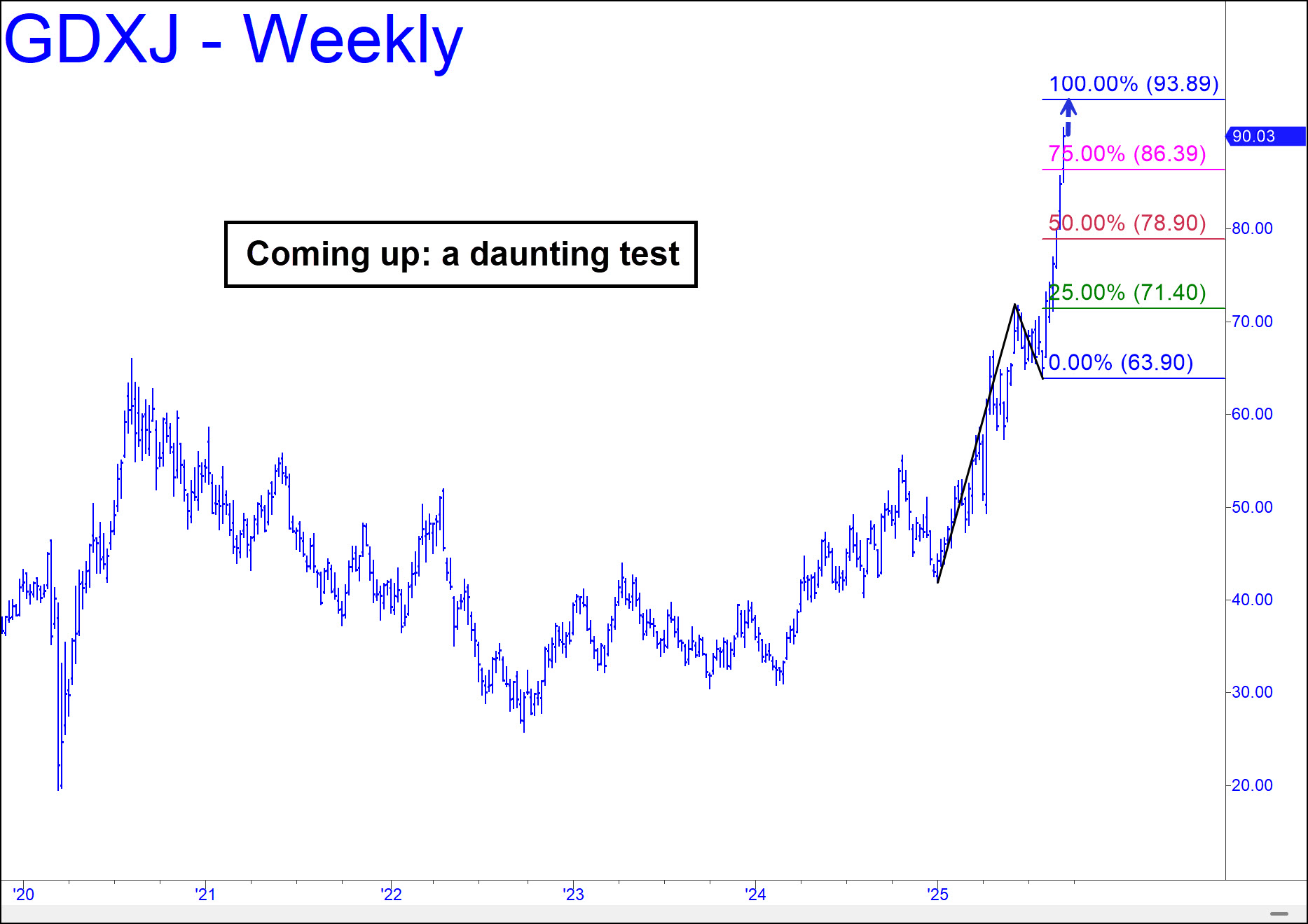

GDXJ has shredded its way past all lesser targets, leaving just one more, major, Hidden Pivot resistance at 93.89 that comes from the weekly chart and beckons a test. Judging from the ease with which buyers penetrated the midpoint resistance at 78.90, the target is all but certain to be reached. It is nearly as likely to produce a precise reaction, meaning you should consider covered writes if you hold a long-term position. I advised doing so at a lesser target not far below, but there was relatively little resistance. This time it is likely to be different, but if GDXJ melts through the resistance anyway, I’ll need to rummage through my bag of technical tricks to come up with a new target, since the one at 93.89 is the highest I can produce with conventional tools. In most cases, this entails extrapolating an ‘extension’ target from the intraday charts. This tactic will yield Hidden Pivots that should be expected to show shortable stopping power, but it is not a reliable means for predicting a major top. _______ UPDATE (Sep 25, 2:14 p.m.): Bulls vaporized the 93.89 target on first contact, ensuring that the nearly vertical rally will continue to at least 104.85. This Hidden Pivot target does NOT come from the lesser charts, which reveal nothing of interest at the moment, but from weekly bars. The pattern is unorthodox, but our rule is that the midpoint Hidden Pivot of all patterns, however odd, will unfailingly yield an accurate assessment of trend strength. Since p=84.38 got impaled the first time it was touched, that means the move must reach D, even if this ‘hidden’ resistance does not mark the ultimate top. Here’s the chart.

GDXJ has shredded its way past all lesser targets, leaving just one more, major, Hidden Pivot resistance at 93.89 that comes from the weekly chart and beckons a test. Judging from the ease with which buyers penetrated the midpoint resistance at 78.90, the target is all but certain to be reached. It is nearly as likely to produce a precise reaction, meaning you should consider covered writes if you hold a long-term position. I advised doing so at a lesser target not far below, but there was relatively little resistance. This time it is likely to be different, but if GDXJ melts through the resistance anyway, I’ll need to rummage through my bag of technical tricks to come up with a new target, since the one at 93.89 is the highest I can produce with conventional tools. In most cases, this entails extrapolating an ‘extension’ target from the intraday charts. This tactic will yield Hidden Pivots that should be expected to show shortable stopping power, but it is not a reliable means for predicting a major top. _______ UPDATE (Sep 25, 2:14 p.m.): Bulls vaporized the 93.89 target on first contact, ensuring that the nearly vertical rally will continue to at least 104.85. This Hidden Pivot target does NOT come from the lesser charts, which reveal nothing of interest at the moment, but from weekly bars. The pattern is unorthodox, but our rule is that the midpoint Hidden Pivot of all patterns, however odd, will unfailingly yield an accurate assessment of trend strength. Since p=84.38 got impaled the first time it was touched, that means the move must reach D, even if this ‘hidden’ resistance does not mark the ultimate top. Here’s the chart.

GDXJ – Junior Gold Miner ETF (Last:92.98)

Posted on September 12, 2025, 8:11 pm EDT

Last Updated September 25, 2025, 3:15 pm EDT

Posted on September 12, 2025, 8:11 pm EDT

Last Updated September 25, 2025, 3:15 pm EDT