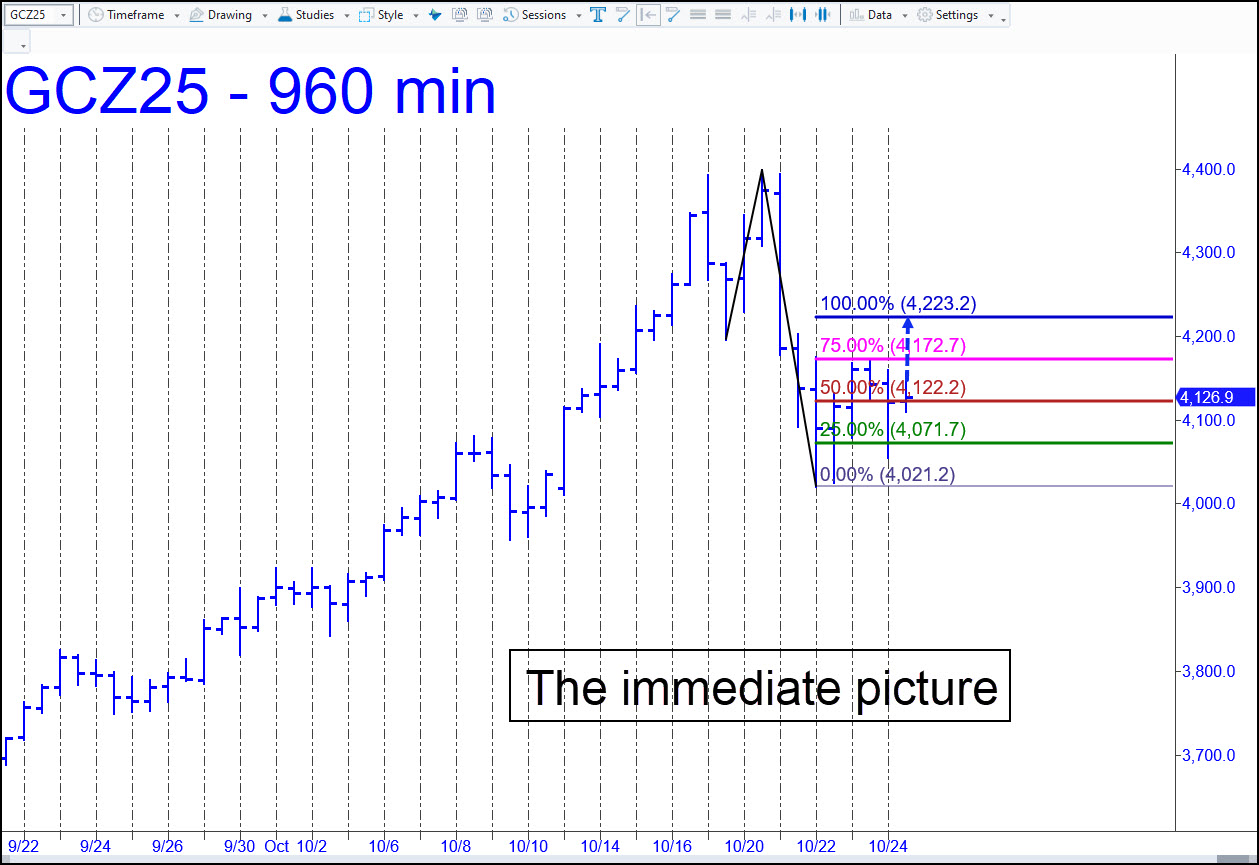

The ‘reverse’ pattern shown has worked perfectly so far, triggering no fewer than three consecutive trades that produced a profit. The first was a conventional long at the green line, followed by a short at the secondary Hidden Pivot (p2) at 4172.70. The last, an easy winner initiated as a ‘mechanical’ buy at the green line (x=4071,70), remained ‘live’ as the week ended. This series of winners strongly implies that December Gold will achieve the 4223.20 target shown. The futures would become a compelling short at that price, assuming you’ve made some money on the way up and that you know how to limit entry risk to small change. I have one outstanding target at 5020 that was identified here earlier. Its provenance is not nearly as clear as the targets we’ve been using, however, and that’s why I am going to stick with the lesser charts for the foreseeable future. If the current move should impale d=4223.20, that would open up a clear path to at least 4351.30, a tad beneath the old high at 4398; or to 4461.30 if any higher. (For a detailed discussion of a somewhat bigger picture, see my 13:51 post in the chat room on Saturday.) _____ UPDATE (Oct 29, 11:28 a.m. EDT): While we were waiting, a $10,000 trade dropped neatly into our lap. See the chat room thread from yesterday and this morning for precise details. _______ UPDATE (Oct 30, 6:50 p.m.): I used a big-picture chart in the chat room last Saturday to lend perspective to a discussion about gold’s so-far mild correction. EWT forecasters appear to disagree about where and when the retracement will end. Since then, a lesser chart using Hidden Pivot levels has evolved to suggest the correction could already be over. This interpretation would be strengthened by a pop above C=4046.20 that looks imminent. Until that happens, however, my conclusion will remain speculative. The chart’s incipient bullishness stems from the fact that a textbook ABCD pattern that goes against the trend has reversed almost precisely from the midpoint Hidden Pivot (p=3918.90). This behavior follows a key idea associated with the Hidden Pivot Method — i.e., that strong trends usually produce relatively weak corrections that don’t reach their D targets. If C=4046.20 is breached to the upside and the futures continue higher, exceeding the three closely spaced peaks recorded a week ago, that would imply new record highs are coming, and soon.

The ‘reverse’ pattern shown has worked perfectly so far, triggering no fewer than three consecutive trades that produced a profit. The first was a conventional long at the green line, followed by a short at the secondary Hidden Pivot (p2) at 4172.70. The last, an easy winner initiated as a ‘mechanical’ buy at the green line (x=4071,70), remained ‘live’ as the week ended. This series of winners strongly implies that December Gold will achieve the 4223.20 target shown. The futures would become a compelling short at that price, assuming you’ve made some money on the way up and that you know how to limit entry risk to small change. I have one outstanding target at 5020 that was identified here earlier. Its provenance is not nearly as clear as the targets we’ve been using, however, and that’s why I am going to stick with the lesser charts for the foreseeable future. If the current move should impale d=4223.20, that would open up a clear path to at least 4351.30, a tad beneath the old high at 4398; or to 4461.30 if any higher. (For a detailed discussion of a somewhat bigger picture, see my 13:51 post in the chat room on Saturday.) _____ UPDATE (Oct 29, 11:28 a.m. EDT): While we were waiting, a $10,000 trade dropped neatly into our lap. See the chat room thread from yesterday and this morning for precise details. _______ UPDATE (Oct 30, 6:50 p.m.): I used a big-picture chart in the chat room last Saturday to lend perspective to a discussion about gold’s so-far mild correction. EWT forecasters appear to disagree about where and when the retracement will end. Since then, a lesser chart using Hidden Pivot levels has evolved to suggest the correction could already be over. This interpretation would be strengthened by a pop above C=4046.20 that looks imminent. Until that happens, however, my conclusion will remain speculative. The chart’s incipient bullishness stems from the fact that a textbook ABCD pattern that goes against the trend has reversed almost precisely from the midpoint Hidden Pivot (p=3918.90). This behavior follows a key idea associated with the Hidden Pivot Method — i.e., that strong trends usually produce relatively weak corrections that don’t reach their D targets. If C=4046.20 is breached to the upside and the futures continue higher, exceeding the three closely spaced peaks recorded a week ago, that would imply new record highs are coming, and soon.

GCZ25 – December Gold (Last:4032.60)

Posted on October 26, 2025, 5:15 pm EDT

Last Updated October 30, 2025, 6:55 pm EDT

Posted on October 26, 2025, 5:15 pm EDT

Last Updated October 30, 2025, 6:55 pm EDT