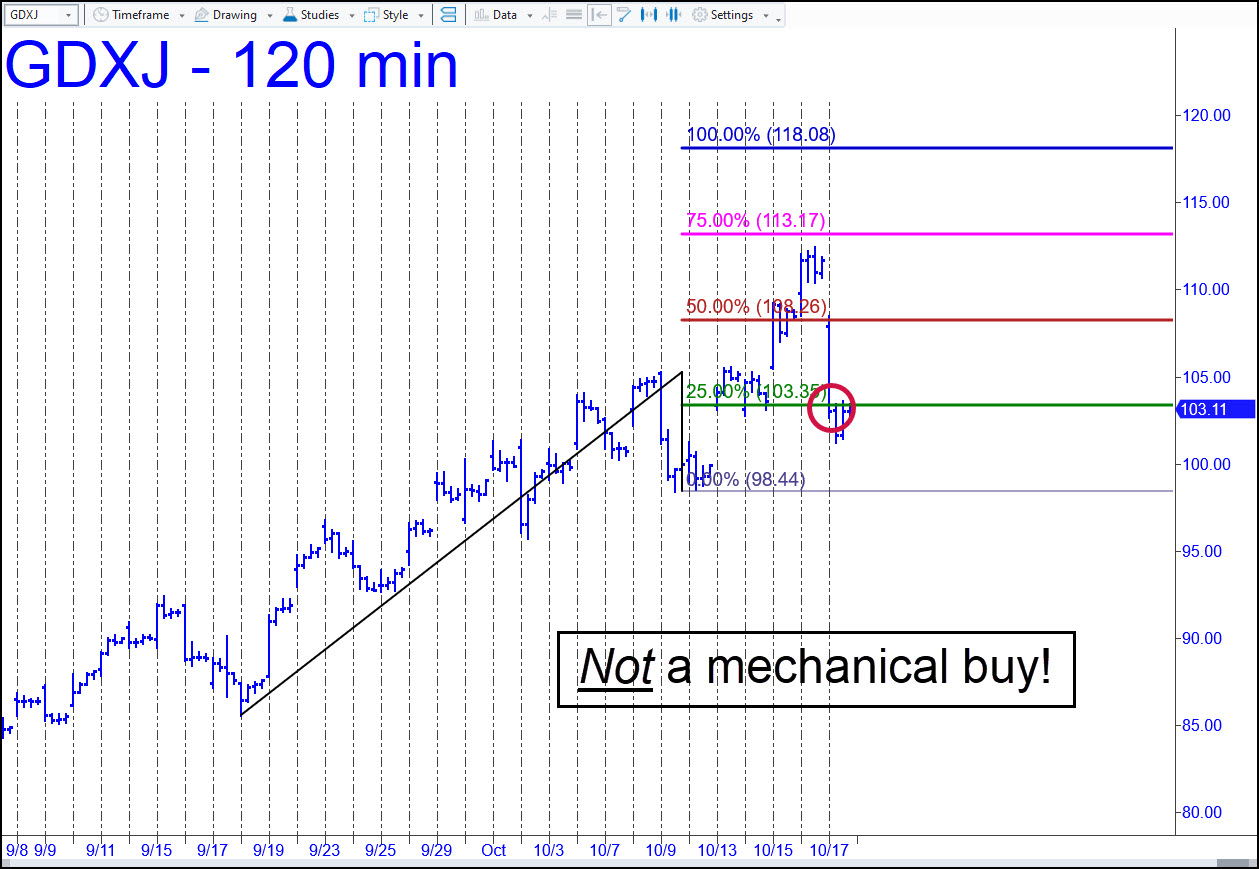

Nasty relapses usually improve our odds of making a profit when we do a ‘mechanical’ buy, but in this instance the gap-down plunge was too strong for me to suggest putting a bid at the green line (or slightly below it, as was possible at the close on Friday). It is not the punitive behavior of the selling per se that has put me off, but rather the protracted A-B leg that amounts to just a weak impulse leg. We’ll watch from the sidelines for now, but please note that the D target at 118.08 will remain viable until such time as C=98.44 is exceeded. ______ UPDATE (Oct 22, 1:16 a.m.): Even if the midpoint support at 92.38 shown here does not turn GDXJ toward new highs, it will still be worth bottom-fishing with an rABC trigger of minute degree. As always, a decisive penetration of the Hidden Pivot support on first contact would be bearish. That could also set up a ‘mechanical’ short eventually at the green line. Whatever happens, Mr Market — known elsewhere in the Milky Way Galaxy as ‘Sid’ — is unlikely to fool this pattern.

Nasty relapses usually improve our odds of making a profit when we do a ‘mechanical’ buy, but in this instance the gap-down plunge was too strong for me to suggest putting a bid at the green line (or slightly below it, as was possible at the close on Friday). It is not the punitive behavior of the selling per se that has put me off, but rather the protracted A-B leg that amounts to just a weak impulse leg. We’ll watch from the sidelines for now, but please note that the D target at 118.08 will remain viable until such time as C=98.44 is exceeded. ______ UPDATE (Oct 22, 1:16 a.m.): Even if the midpoint support at 92.38 shown here does not turn GDXJ toward new highs, it will still be worth bottom-fishing with an rABC trigger of minute degree. As always, a decisive penetration of the Hidden Pivot support on first contact would be bearish. That could also set up a ‘mechanical’ short eventually at the green line. Whatever happens, Mr Market — known elsewhere in the Milky Way Galaxy as ‘Sid’ — is unlikely to fool this pattern.

GDXJ – Junior Gold Miner ETF (Last:95.11)

Posted on October 19, 2025, 5:13 pm EDT

Last Updated October 22, 2025, 10:20 am EDT

Posted on October 19, 2025, 5:13 pm EDT

Last Updated October 22, 2025, 10:20 am EDT