Although in recent years October has not lived up to its reputation for scaring the pants off investors, we should take Friday’s punitive reversal seriously, since it could mark the start of a bear market that is arguably years overdue. Although we have grown accustomed to ‘freaky’ Fridays producing headline events now and then, there was something especially disconcerting about this latest episode. It was driven unmistakably by news that Trump had threatened to slap a 100% tariff on Chinese goods in retaliation for restrictions they placed on so-called rare-earth exports to the U.S.

These minerals, while not actually rare, are essential to the production of powerful magnets that are used in electronic hardware, including components vital to the aerospace industry and the military. The U.S. was already focused on establishing alternative sources for rare earth minerals, but it will take time and money, since extracting ‘rare earths’ from dirt requires processing that is costly and complicated.

Downplaying China’s Threat

In any event, Western factories and computers are not going to grind to a halt simply because of China’s threat. And it is likely to be no more than that, since Trump has cards of his own to play, including access to advanced computer chips that China is presently unable to produce.

The foregoing is all secondary to the matter of why U.S. stocks plunged on the news. The broad averages were up sharply in the early going, but by day’s end the Dow had reversed by nearly 1200 points. A corresponding reversal took place in the institutionally-driven lunatic sector (aka the Magnificent Seven), wiping trillions of dollars of dubious ‘wealth effect’ lucre from the macro ledger. Clearly, this was an extreme overreaction to the news, since investors had grown used to Trump’s frequent tariff shenanigans.

Although the mainstream media will insist there was a direct link between Trump’s retaliatory threat and the stock market’s plunge, I would disagree. I have always maintained that little-understood cyclical forces cause the stock market’s swings, and that it is the swings themselves that color our perception of the news. This implies that the stock market was ready to fall hard on Friday, regardless of the news.

Unusually Powerful Whipsaw

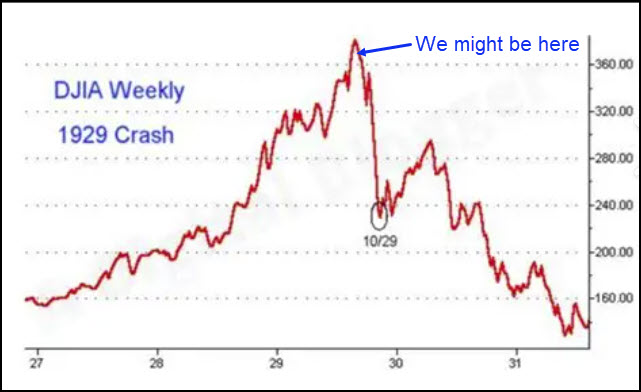

You can take the unusually vicious whipsaw as evidence that investor psychology has finally synchronized with 1929. The Smoot-Hawley tariff laws under consideration at the time were an obsessive concern. These days, tariff news has become just background noise — Trump’s stupid little game, worthy of no more than a shrug and a yawn. This is true partly because not a single economist ensconced in the benighted world of punditry can remotely predict what changes the tariffs will bring, let alone whether the changes will be good or bad for the U.S. and global economy.

Now that the news media have elevated tariff news to our top concern, we can infer that the bull market begun in 2009 has entered an endgame that will track 1929’s ups and downs more closely. A bear market, therefore, lies just ahead, and there is nothing Wall Street’s fraudsters and hype mongers can do to prevent it. Their lies and obfuscations, even with a boost from shills in the news media, cannot mask the fatal economic problems of a middle class that is suffocating under the weight of rising unemployment; wages that will never catch up with inflation; manufacturing ‘growth’ that will occur largely without human workers, if at all; and debt we cannot possibly outgrow before it crushes what little remains of the American Dream.

Yeah, it’s pretty difficult to get everything back into Pandora’s Box _and_ close it back up tight. Trump has NO chance. No mortal does. We all see the confluence of natural reasons why this must fail, but there are also deep and very old supernatural reasons at work.