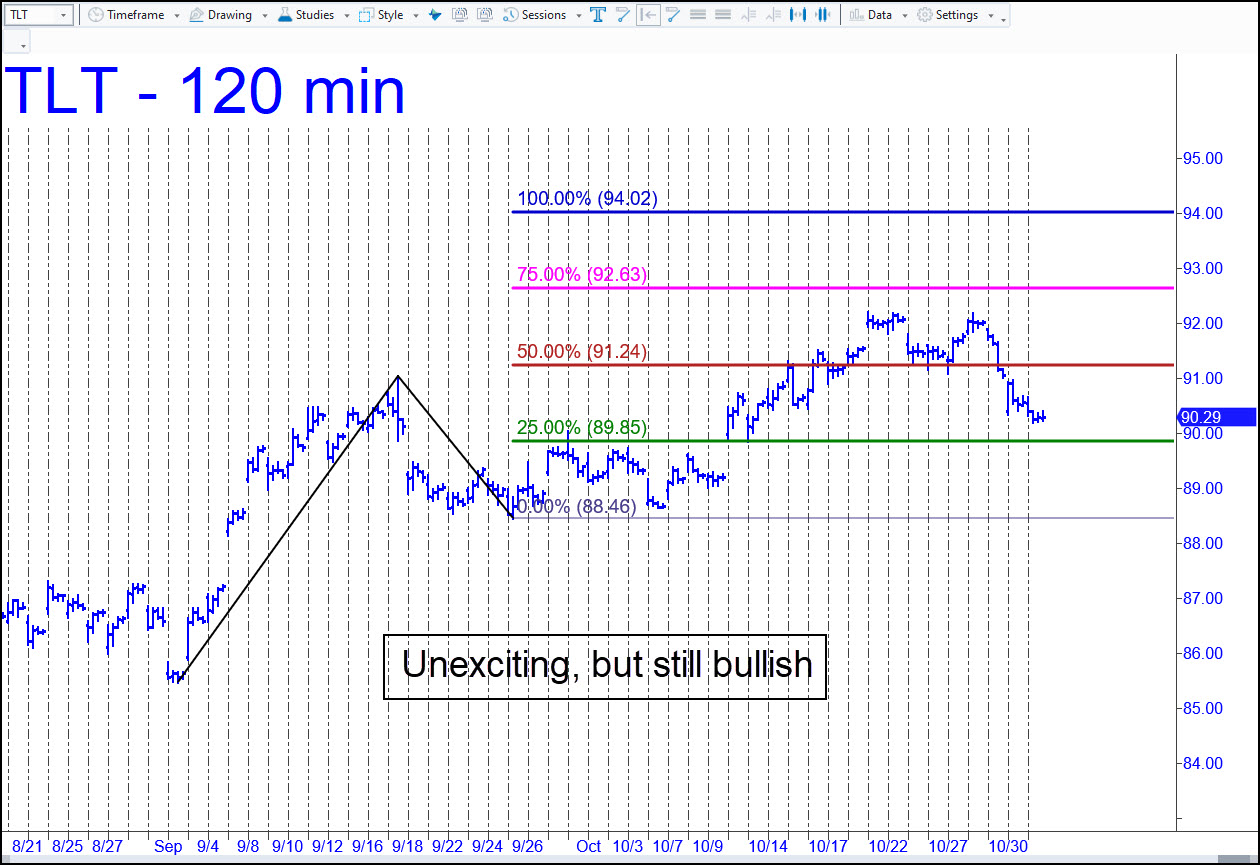

TLT continues to grind higher, perhaps to deny skeptics the inspiration they need to climb aboard early in this bull market. It is still in its adolescence, too early to predict which tectonic financial event(s) it is signaling. The trend flouts Trump’s persistent efforts to cheapen the dollar, if not to say trash it. This is a paradox that I’ve explained here before, to wit: the president’s bold leadership has been attracting hordes of T-Bond buyers from around the world, providing an offset to the fiscal and credit excesses Trump believes will lift the U.S. economy. Grotesquely inflated asset prices belie the fact that, for most Americans, the economy has slipped into a deep, intractable recession. For the lucky winners, a debt deflation and bear market in stocks awaits those whose net worth has soared mainly due to Fed easing. Regarding TLT, don’t pass up an opportunity to buy it ‘mechanically’ on a pullback to the green line (x=89.85), stop 88.45. ______ UPDATE (Nov 7): A nasty, six-day selloff triggered the ‘mechanical’ buy I’d suggested at 89.85. The futures continued to fall but didn’t stop out the position, since the downtrend went no further than 88.88. Maintain the 88.45 stop-loss for now and hope for a push above 90.66, since that’s what it would take to put bulls back in charge. A decline that touches the stop would be the most bearish event we’ve seen in this vehicle since last April.

TLT continues to grind higher, perhaps to deny skeptics the inspiration they need to climb aboard early in this bull market. It is still in its adolescence, too early to predict which tectonic financial event(s) it is signaling. The trend flouts Trump’s persistent efforts to cheapen the dollar, if not to say trash it. This is a paradox that I’ve explained here before, to wit: the president’s bold leadership has been attracting hordes of T-Bond buyers from around the world, providing an offset to the fiscal and credit excesses Trump believes will lift the U.S. economy. Grotesquely inflated asset prices belie the fact that, for most Americans, the economy has slipped into a deep, intractable recession. For the lucky winners, a debt deflation and bear market in stocks awaits those whose net worth has soared mainly due to Fed easing. Regarding TLT, don’t pass up an opportunity to buy it ‘mechanically’ on a pullback to the green line (x=89.85), stop 88.45. ______ UPDATE (Nov 7): A nasty, six-day selloff triggered the ‘mechanical’ buy I’d suggested at 89.85. The futures continued to fall but didn’t stop out the position, since the downtrend went no further than 88.88. Maintain the 88.45 stop-loss for now and hope for a push above 90.66, since that’s what it would take to put bulls back in charge. A decline that touches the stop would be the most bearish event we’ve seen in this vehicle since last April.

TLT – Lehman Bond ETF (Last:89.57)

Posted on November 2, 2025, 5:11 pm EST

Last Updated November 7, 2025, 11:46 pm EST

Posted on November 2, 2025, 5:11 pm EST

Last Updated November 7, 2025, 11:46 pm EST