Just one more push could exhaust a bull market that is coming up on its seventeenth year. Although that’s only about three dog years, it equates to about 120 human years. In fact, no other bull market has lasted even remotely that long. The next-oldest, birthed at the low of the October 1987 Crash, was 13 years old before a crash in tech-sector stocks ended the dream for millions of investors grown stupid on greed.

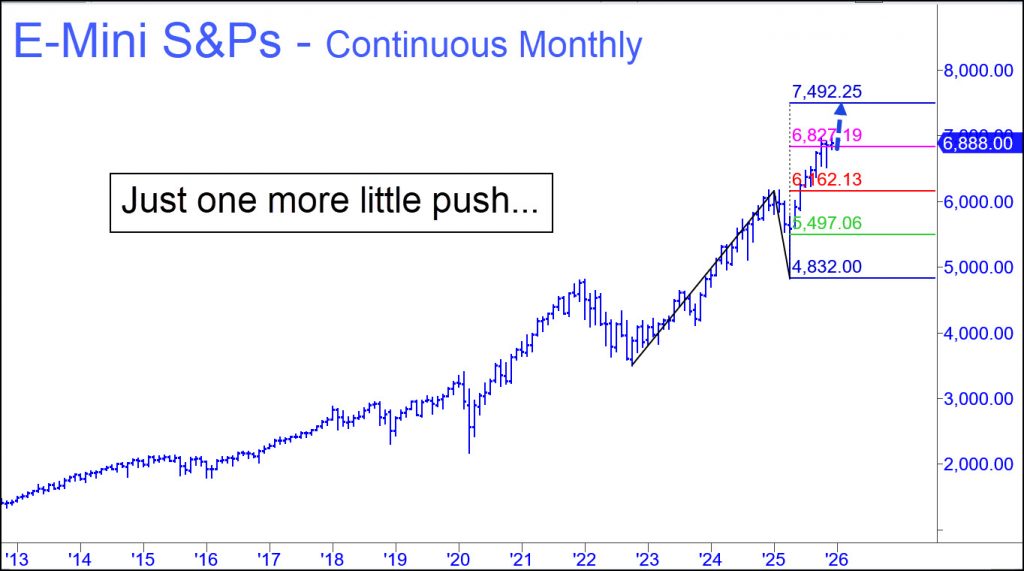

Could it happen again? Only a fool would ask that question. My recent commentaries have warned with increasing shrillness that stocks are in a topping process. I have purposely left the details vague, since bull-market tops are notoriously full of deceptions. However, the chart above provides a compelling number for the party to end, a 7492 Hidden Pivot target for the E-Mini S&P futures that lies 8.6% above.

Last week featured the second straight Friday on which bulls and bears did little more than screw the pooch. Usually, Fridays are fun, or at least interesting, for one group or the other. But lately it’s been like watching a heavyweight slugfest that turned bloody in the seventh round. Bears have lacked the guts to deliver the haymaker, but the buy-the-dips junkies, who have been winning on points since 2009, seem too fatigued and lacking in conviction to counterpunch. Thus did stocks fall to end the week, although not enough to worry anyone, much less spook the herd.

Paralyzed by Doubt

All the excitement was in gold and silver, which have been rising since early 2024 in a steepening trajectory. The uptrend is practically vertical now and in need of a rest. But that is not how bull markets work, as many bulls are discovering. Although they’ve been praying for a big move for years, now that it is finally happening, they are paralyzed with doubt, unable to board an uptrend that left them waiting at the station months ago. And so they sit on their thumbs, hoping to scoop up bullion near the bottom of a big correction that never comes.

Some who frequent the Rick’s Picks trading room are notable exceptions. They have been sitting on bullion stocks and ingots for months or even years. As one of them notes, the big money is made not by playing the whipsaws and joining in the madness, but by waiting patiently for an enduring bull market that was always certain to come sooner or later. It is here now, and those with the patience and conviction to stay with it are reaping outsize rewards that implicitly rebuke the trader mentality.

“Although they’ve been praying for a big move for years, now that it is finally happening, they are paralyzed with doubt, unable to board an uptrend that left them waiting at the station months ago. And so they sit on their thumbs, hoping to scoop up bullion near the bottom of a big correction that never comes.”

Well, they’re about to get a kick in the rear, very shortly. Samsung allegedly just announced (over the weekend?) that their solid state battery tech — which uses grams of silver per unit (so I’m told) — is ready for production, which will begin in 2026.

If true, this will be HUGE for EVs and, of course, silver. I WOULD be skeptical of this news but for the Trump factor. Trump has recently made some changes in the manufacture of cars: he has given the okay to begin making tiny cars in the US and he has given the mfgs. an invisible ultimatum…

https://youtu.be/ToMzAkfH0lM

Bottom line: they can either push their already fragile engine designs to the utter breaking point in trying to conform with ridiculous CAFE standards that are all but set in stone… OR they can start making hybrids and full EVs and, in order to bring the price down so they can actually sell the damn things to the non-rich, they can make them teeny-tiny now.

We’ve just been invisibly forced into tiny EVs and hybrids. But it’s okay because Trump did it and not some Democrat (right, conservatives?). And at least they’ll have better batteries now (supposedly).