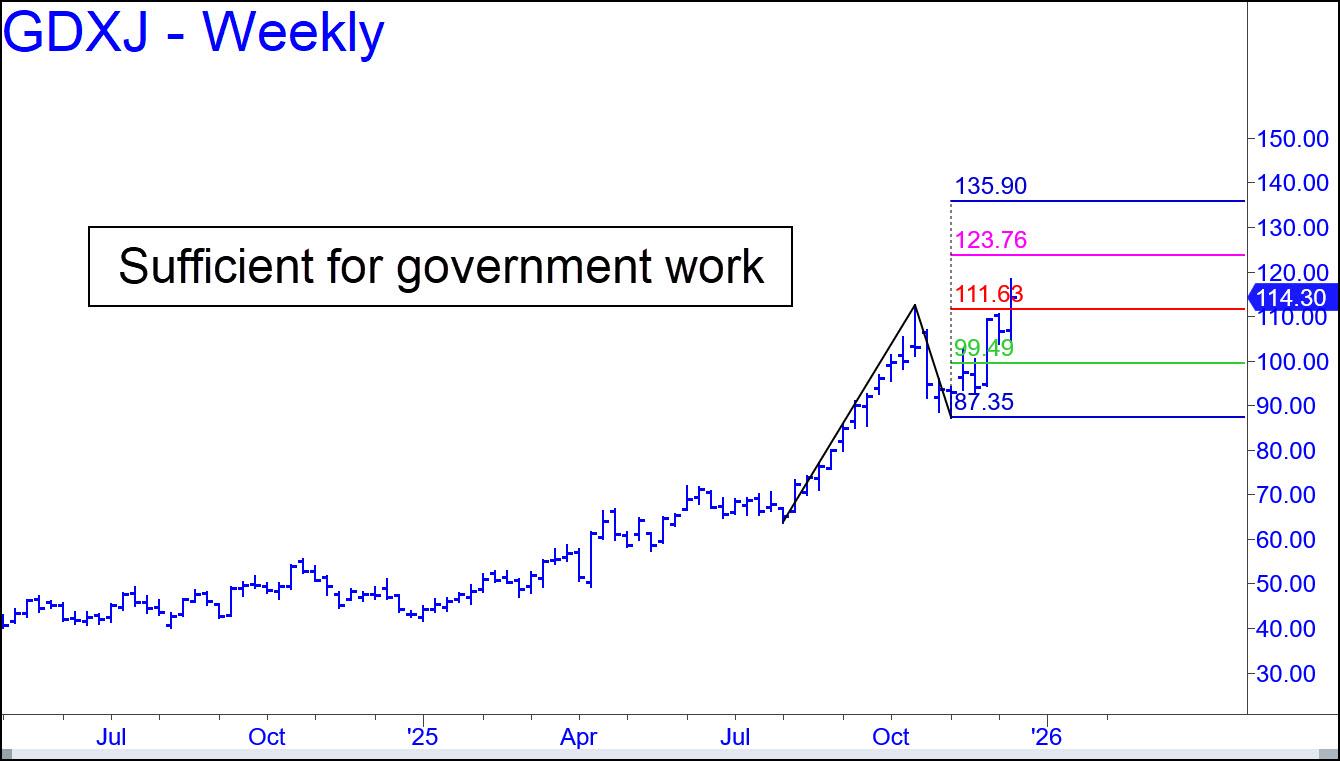

With its weak point ‘A’ low and its obviousness, the pattern shown should not be considered reliable for predicting a precise top. However, it can still serve us in several ways. For one, the easy move through p has shortened the odds of a rally to at least D=135.90. Also, a pullback to the green line would trigger a ‘mechanical’ buy sufficiently enticing that we should not want to miss it. And if p2=123.76 shows stopping power, that would validate the pattern itself and its target. ______ UPDATE (Dec 20): Bulls further distanced this vehicle from the red line last week, increasing the likelihood that the 135.90 target will be achieved. A pullback to the green line (x=99.49) in the meantime, however unlikely, should be viewed as an opportunity to get long or to augment an existing position ‘mechanically’.

With its weak point ‘A’ low and its obviousness, the pattern shown should not be considered reliable for predicting a precise top. However, it can still serve us in several ways. For one, the easy move through p has shortened the odds of a rally to at least D=135.90. Also, a pullback to the green line would trigger a ‘mechanical’ buy sufficiently enticing that we should not want to miss it. And if p2=123.76 shows stopping power, that would validate the pattern itself and its target. ______ UPDATE (Dec 20): Bulls further distanced this vehicle from the red line last week, increasing the likelihood that the 135.90 target will be achieved. A pullback to the green line (x=99.49) in the meantime, however unlikely, should be viewed as an opportunity to get long or to augment an existing position ‘mechanically’.

GDXJ – Junior Gold Miner ETF (Last:117.63)

Posted on December 14, 2025, 5:13 pm EST

Last Updated December 20, 2025, 10:47 am EST

Posted on December 14, 2025, 5:13 pm EST

Last Updated December 20, 2025, 10:47 am EST