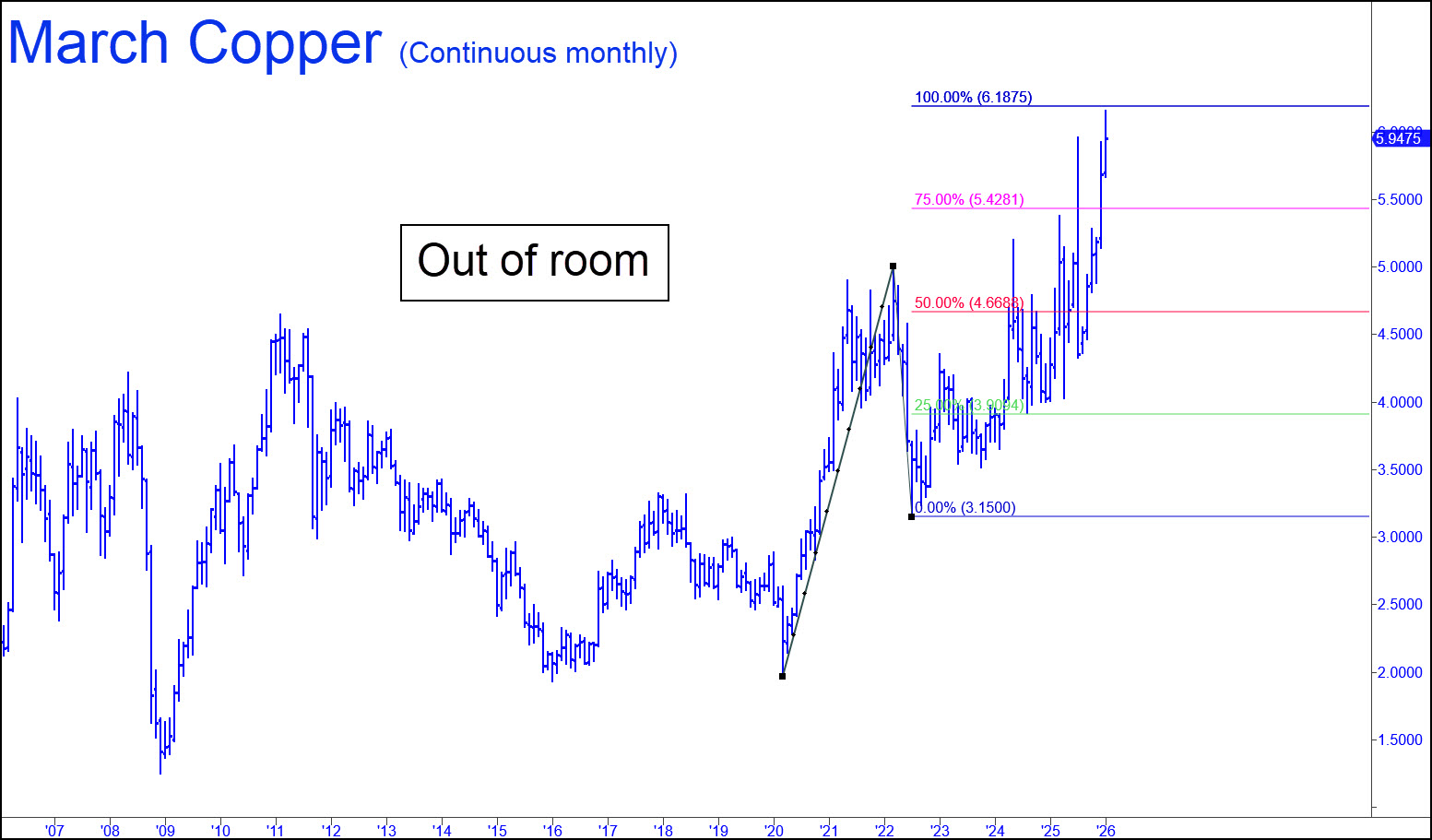

Copper and a rotating selection of popular symbols will be replacing Bitcoin on this page, although I will continue to provide timely analysis for Bitcoin on demand in the chat room. The chart shows how copper’s price has tripled since bottoming just beneath $2 a pound in March 2020, when covid fears seized the world’s machinery. ‘Doc’ Copper has seemingly done its job since in predicting an upswing in global industrial activity. In particular, it included a surge in demand caused by a worldwide push toward renewable energy and electric vehicles, which require a lot of copper for batteries, charging infrastructure and renewable energy systems. However, copper’s ascent has nearly reached a hard target at 6.18 a pound that suggests the bull market may have run its course. Does that mean a global recession-or-worse looms? We will not likely know until a recession is well under way. It is coming eventually, but in the meantime, a bull market that has been galloping along for 16 years should command our respect, if not our unquestioning confidence. If an important top is in at 6.1540 (basis the March contract), it would be corroborated by a pullback that decisively exceeds 5.36. A somewhat higher top would require an adjustment in that number, a Hidden Pivot, so stay tuned.

Copper and a rotating selection of popular symbols will be replacing Bitcoin on this page, although I will continue to provide timely analysis for Bitcoin on demand in the chat room. The chart shows how copper’s price has tripled since bottoming just beneath $2 a pound in March 2020, when covid fears seized the world’s machinery. ‘Doc’ Copper has seemingly done its job since in predicting an upswing in global industrial activity. In particular, it included a surge in demand caused by a worldwide push toward renewable energy and electric vehicles, which require a lot of copper for batteries, charging infrastructure and renewable energy systems. However, copper’s ascent has nearly reached a hard target at 6.18 a pound that suggests the bull market may have run its course. Does that mean a global recession-or-worse looms? We will not likely know until a recession is well under way. It is coming eventually, but in the meantime, a bull market that has been galloping along for 16 years should command our respect, if not our unquestioning confidence. If an important top is in at 6.1540 (basis the March contract), it would be corroborated by a pullback that decisively exceeds 5.36. A somewhat higher top would require an adjustment in that number, a Hidden Pivot, so stay tuned.

HGH26 – March Copper (Last:5.9475)

Posted on January 25, 2026, 5:22 pm EST

Last Updated January 25, 2026, 8:49 pm EST

Posted on January 25, 2026, 5:22 pm EST

Last Updated January 25, 2026, 8:49 pm EST