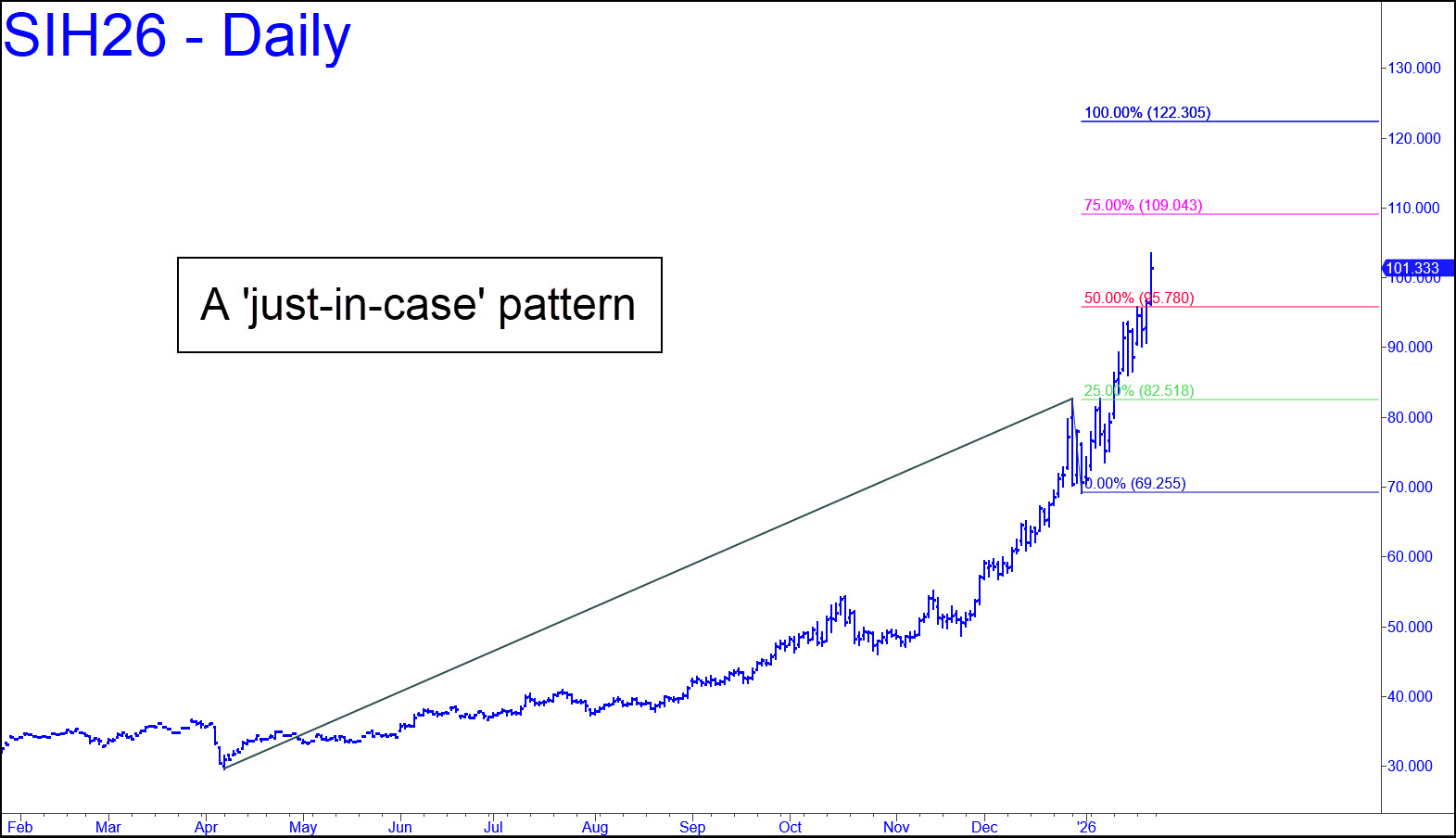

The ballistic, $30 climb since December appears to have topped within spitting distance of my 103.215 target. That could be it, but I’m not counting on it, especially since I have higher targets outstanding in gold. The chart shows an alternative possibility at 122.305 that leaves room for a further rally of 18% above Friday’s high. The pattern itself is unusual, but I am comfortable using it to project yet another, potentially important, high because I’ve seen this one work before in a roughly matching time frame. Be prepared for a stall or worse at 109.043, the secondary Hidden Pivot. ______ UPDATE (Jan 26, 5:30 p.m.): Everyone’s been telling themselves they’d buy this little monster on weakness. Well, here it is. The 98.575 target shown in this chart is almost certain to be achieved, but it is tied to a pattern that every clown in the trading world sees and is planning to use. If you plan to join them, make sure its with a ‘camo’ trigger that they wouldn’t know from a barstool. Alternatively, shorting x=107.035 ‘mechanically’, stop 109.860, will enjoy better odds. I’ll publish more correction targets if and when they become available. For now, though, there are only ‘conventional’ patterns to use for that purpose. Because I’d rather not bump heads with a thousand clowns, you’ll have to be patient until more rABCs develop, including the obscure ones I prefer. _______ UPDATE (Jan 27, 8:29 a.m.): Silver picked up strength overnight and never looked back, never mind fulfill the 98.575 correction target identified above. The major Hidden Pivot at 122.305 will likely be achieved and still deserves caution, but I am not going to lay odds that it will cap the bull market.

The ballistic, $30 climb since December appears to have topped within spitting distance of my 103.215 target. That could be it, but I’m not counting on it, especially since I have higher targets outstanding in gold. The chart shows an alternative possibility at 122.305 that leaves room for a further rally of 18% above Friday’s high. The pattern itself is unusual, but I am comfortable using it to project yet another, potentially important, high because I’ve seen this one work before in a roughly matching time frame. Be prepared for a stall or worse at 109.043, the secondary Hidden Pivot. ______ UPDATE (Jan 26, 5:30 p.m.): Everyone’s been telling themselves they’d buy this little monster on weakness. Well, here it is. The 98.575 target shown in this chart is almost certain to be achieved, but it is tied to a pattern that every clown in the trading world sees and is planning to use. If you plan to join them, make sure its with a ‘camo’ trigger that they wouldn’t know from a barstool. Alternatively, shorting x=107.035 ‘mechanically’, stop 109.860, will enjoy better odds. I’ll publish more correction targets if and when they become available. For now, though, there are only ‘conventional’ patterns to use for that purpose. Because I’d rather not bump heads with a thousand clowns, you’ll have to be patient until more rABCs develop, including the obscure ones I prefer. _______ UPDATE (Jan 27, 8:29 a.m.): Silver picked up strength overnight and never looked back, never mind fulfill the 98.575 correction target identified above. The major Hidden Pivot at 122.305 will likely be achieved and still deserves caution, but I am not going to lay odds that it will cap the bull market.

SIH26 – March Silver (Last:111.395)

Posted on January 25, 2026, 5:14 pm EST

Last Updated January 27, 2026, 7:21 pm EST

Posted on January 25, 2026, 5:14 pm EST

Last Updated January 27, 2026, 7:21 pm EST