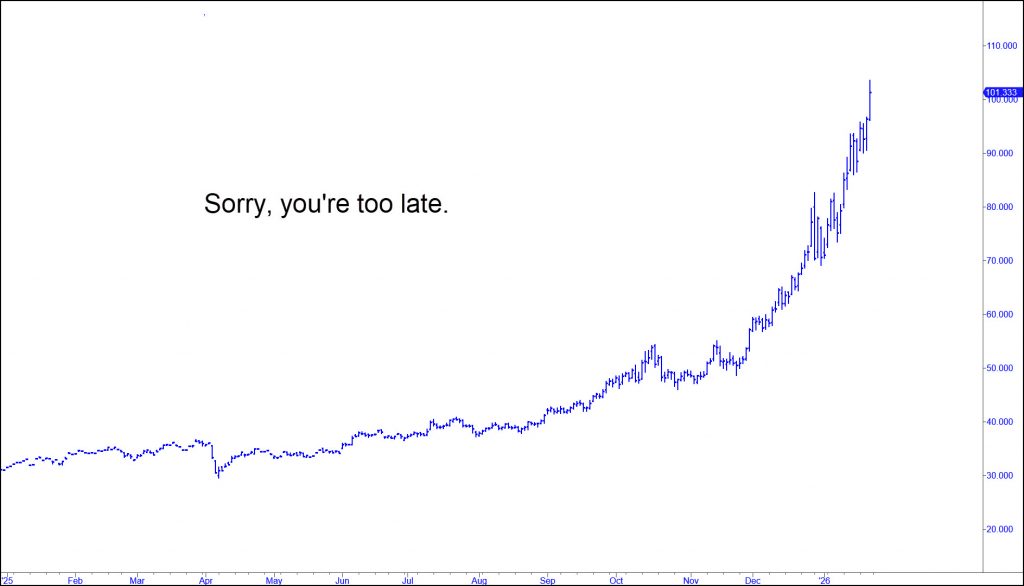

If you can’t guess what commodity the chart shows, you must be living on Mars. It is in fact a long-term picture of silver, which went ballistic in December. The price has doubled since, blowing out a $50 top that had stood since 1980. That price became a part of silver’s legend, since it is where one of the wealthiest men in the world, oil tycoon Nelson Bunker Hunt, met his financial Waterloo. With his brothers, Lamar and William, ‘Bunky’ had attempted to corner the market by buying up silver and futures contracts amounting to about a third of the world’s supply. Comex regulators responded by raising margin requirements so high that there were just two players left in the game: the Hunts and Eastman Kodak, a huge industrial user of silver. From a record $50.45 per ounce, the price plunged by half in mere days, forcing the Hunts to sell nearly everything they owned to meet margin calls. In retrospect, they seem not to have broken any rules. However, the Comex was forced to crush them in order to stabilize the metals market.

If you can’t guess what commodity the chart shows, you must be living on Mars. It is in fact a long-term picture of silver, which went ballistic in December. The price has doubled since, blowing out a $50 top that had stood since 1980. That price became a part of silver’s legend, since it is where one of the wealthiest men in the world, oil tycoon Nelson Bunker Hunt, met his financial Waterloo. With his brothers, Lamar and William, ‘Bunky’ had attempted to corner the market by buying up silver and futures contracts amounting to about a third of the world’s supply. Comex regulators responded by raising margin requirements so high that there were just two players left in the game: the Hunts and Eastman Kodak, a huge industrial user of silver. From a record $50.45 per ounce, the price plunged by half in mere days, forcing the Hunts to sell nearly everything they owned to meet margin calls. In retrospect, they seem not to have broken any rules. However, the Comex was forced to crush them in order to stabilize the metals market.

What Does It Mean?

Silver’s current rise has been orderly, more or less, but with a pitch so steep that it caught many players with their pants down. No reason to feel sorry for them, since they are ethically and morally on a level with child molesters, broad-tossers and cannibals. But the radical shift in precious-metal prices relative to all other classes of investable assets raises a question that should concern us all. For it is not happening in a vacuum, and we can only guess at what it will mean years down the road. Will silver resume a monetary role? Is Trump licking his chops over the prospect of borrowing against all of the gold supposedly stored in Ft. Knox? Is gold predicting a crisis that would leave the global money system in wreckage? We’ll have our answer eventually, but it could already be very late in the game for those seeking the bomb-proof safe haven that gold has always offered.

“Will silver resume a monetary role? Is Trump licking his chops over the prospect of borrowing against all of the gold supposedly stored in Ft. Knox? Is gold predicting a crisis that would leave the global money system in wreckage?”

In short, Rick — and as much as this pains me to say — no, to the first two, and, “yes and no” to the third. There won’t be silver and gold money (see links, below, for what we will have). And gold is predicting to what is about to come…

https://youtu.be/Wd3KZTol1Ks

https://youtu.be/3y0hnxRx-mQ

They know the system and currencies are ready to blow, hence gold is doing what it’s doing. But gold and silver are not the currency of the future. It will be digital “stable coin”, with blockchain and AI forming the foundation of this new financial system and currency, both soon to be unveiled (to the mainstream; it is already operational, as the second video discusses).

I don’t think the charts — for anything — will matter for much longer. They’ll just go defunct, relics of the soon to be past. And there’s a zero percent chance of this NOT happening because this has obviously been planned for some time, now, and by many minds. We can only go along with what is to come…