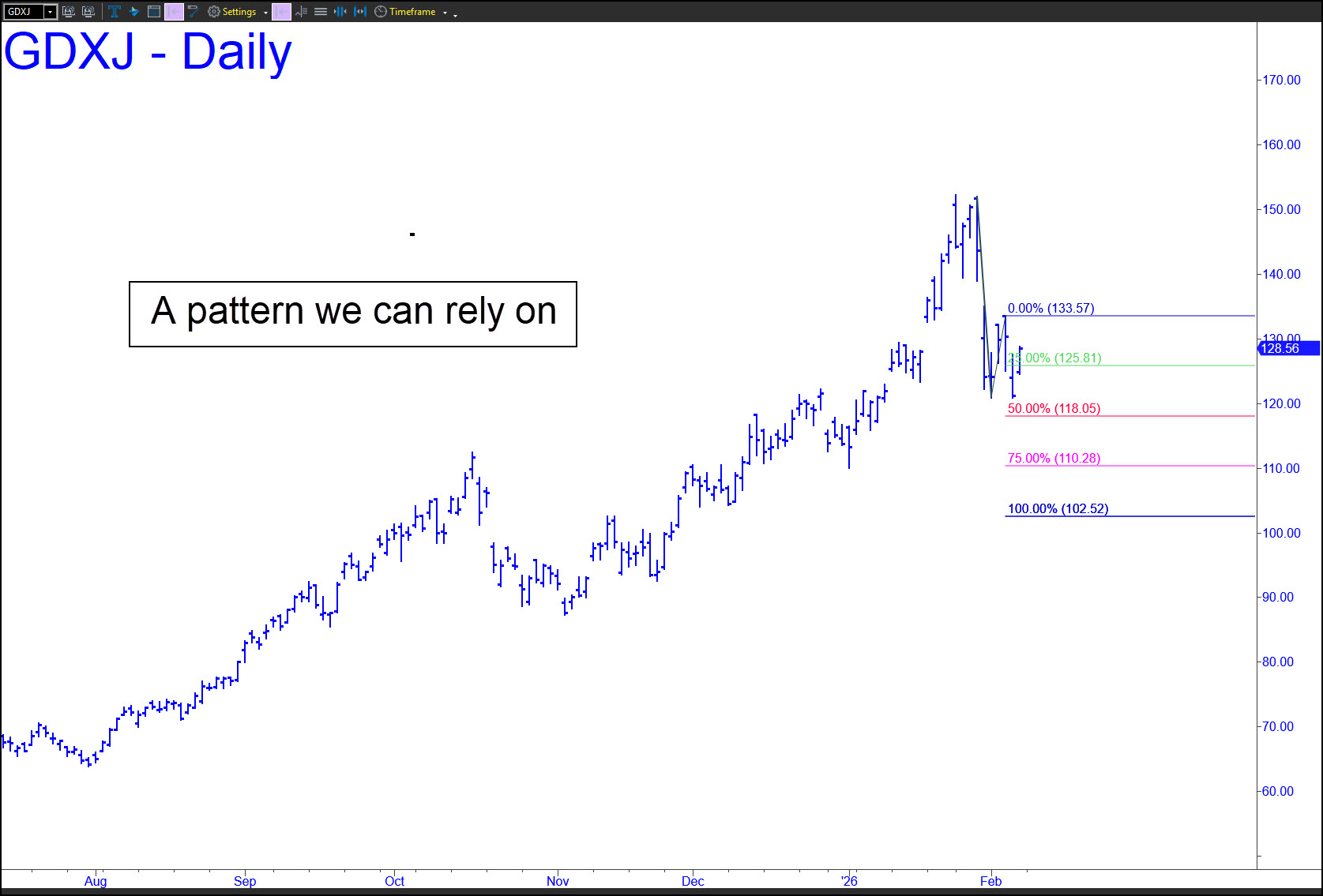

I’ll spare you the boring details, but the pattern shown, wih a 202.52 target that lies 20% below, has everything I look for. It tripped a conventional sell signal when it touched the green line last Wednesday, and the choppy downtrend since should be presumed bound for a minimum 118.05 over the near term. If that midpoint Hidden Pivot support is easily exceeded to the downside, it would portend more slippage to as low as D=102.52. We’ll let price action speak for itself, but take it as a bullish sign if buyers push above C=133.57 before p=118.05 is touched.

I’ll spare you the boring details, but the pattern shown, wih a 202.52 target that lies 20% below, has everything I look for. It tripped a conventional sell signal when it touched the green line last Wednesday, and the choppy downtrend since should be presumed bound for a minimum 118.05 over the near term. If that midpoint Hidden Pivot support is easily exceeded to the downside, it would portend more slippage to as low as D=102.52. We’ll let price action speak for itself, but take it as a bullish sign if buyers push above C=133.57 before p=118.05 is touched.

GDXJ – Junior Gold Miner ETF (Last:128.56)

Posted on February 8, 2026, 5:13 pm EST

Last Updated February 8, 2026, 1:10 am EST

Posted on February 8, 2026, 5:13 pm EST

Last Updated February 8, 2026, 1:10 am EST