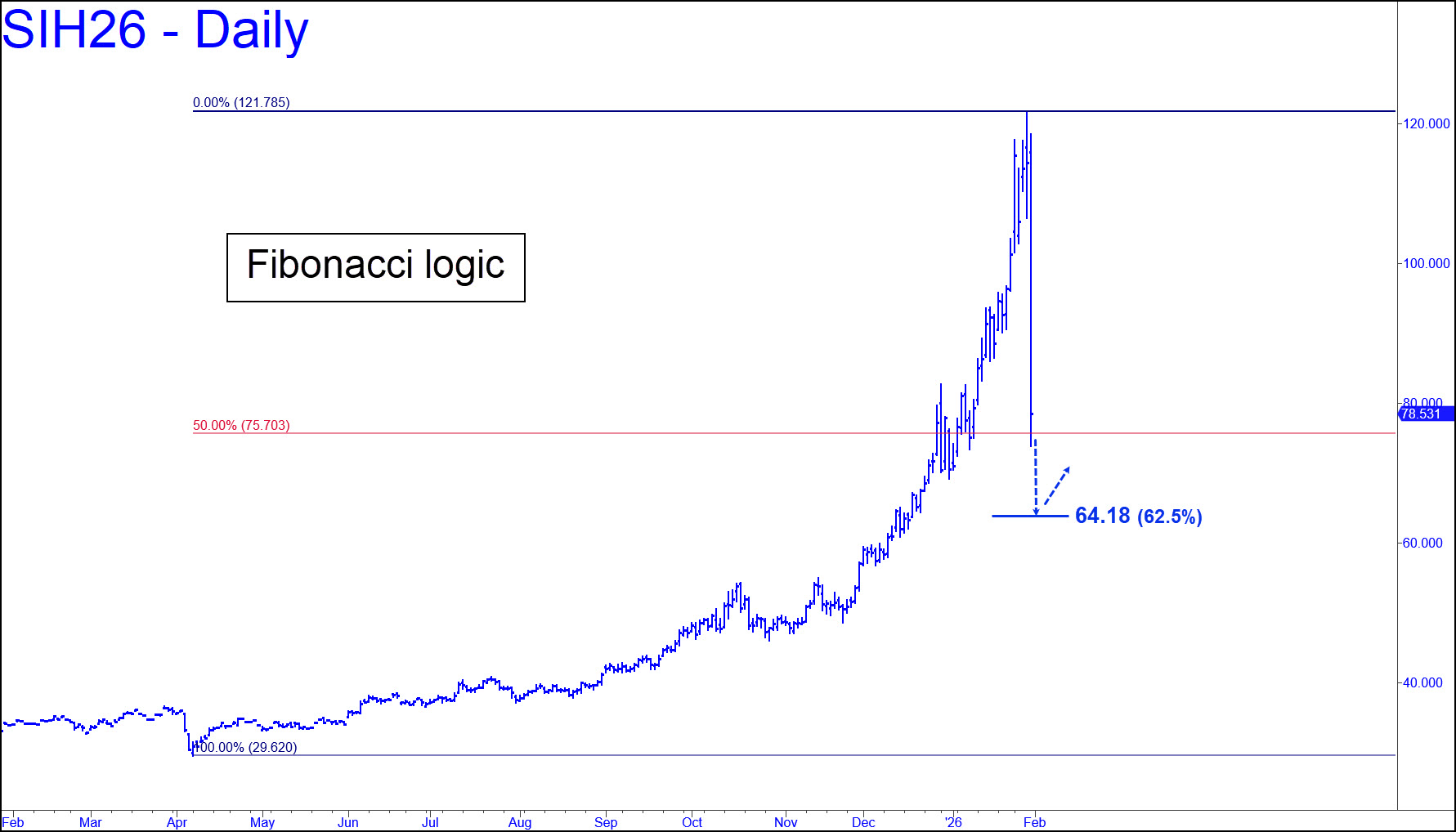

The chart is similar to the one I’ve drawn in Gold, with a 0.625 retracement serving as a target for Silver’s breathtaking correction. It came off a record high on Thursday that missed a 122.215 Hidden Pivot target I’d drum-rolled by a millimeter. Friday’s bounce left the futures sitting nearly $3 above the 50% line, but if the correction is going to match Gold’s, a retracement to 64.18 is needed. Be prepared to bottom-fish there with a ‘camo’ trigger, since 64.18 is not going to be on the radar of most traders, derived as it is from a low recorded last April that is idiosyncratic, although not obscure. ______ UPDATE (Feb 2, 7:55 a.m.): I’ve switched the view, since trying to synch the charts of gold and silver grew confusing. This picture affords ‘safe passage’ to at least d=91.285, a Hidden Pivot that lies $6.80 above. If it shows little resistance, I will adjust by lowering point ‘a’ to produce a higher target. In the meantime, a pullback to the green line (x=76.221) can be bought ‘mechanically’ with a 71.190 stop-loss. That implies more than $5000 of entry risk per contract, so the trade is recommended only to subscribers able to craft a ‘camouflage’ trigger. _______ UPDATE (Feb 4, 10:59 p.m.): The suggested trade racked up a monster profit of $75,320 per contract for anyone who boarded at 76.221 and exited two days later at my target, 91.285. What happened next should not have surprised subscribers: the futures wafted slightly (47 cents) higher, then fell moments later into a hellish dive that took them all the way back down to, so far, 73.415, a tad below the trade-entry price.

The chart is similar to the one I’ve drawn in Gold, with a 0.625 retracement serving as a target for Silver’s breathtaking correction. It came off a record high on Thursday that missed a 122.215 Hidden Pivot target I’d drum-rolled by a millimeter. Friday’s bounce left the futures sitting nearly $3 above the 50% line, but if the correction is going to match Gold’s, a retracement to 64.18 is needed. Be prepared to bottom-fish there with a ‘camo’ trigger, since 64.18 is not going to be on the radar of most traders, derived as it is from a low recorded last April that is idiosyncratic, although not obscure. ______ UPDATE (Feb 2, 7:55 a.m.): I’ve switched the view, since trying to synch the charts of gold and silver grew confusing. This picture affords ‘safe passage’ to at least d=91.285, a Hidden Pivot that lies $6.80 above. If it shows little resistance, I will adjust by lowering point ‘a’ to produce a higher target. In the meantime, a pullback to the green line (x=76.221) can be bought ‘mechanically’ with a 71.190 stop-loss. That implies more than $5000 of entry risk per contract, so the trade is recommended only to subscribers able to craft a ‘camouflage’ trigger. _______ UPDATE (Feb 4, 10:59 p.m.): The suggested trade racked up a monster profit of $75,320 per contract for anyone who boarded at 76.221 and exited two days later at my target, 91.285. What happened next should not have surprised subscribers: the futures wafted slightly (47 cents) higher, then fell moments later into a hellish dive that took them all the way back down to, so far, 73.415, a tad below the trade-entry price.

SIH26 – March Silver (Last:85.395)

Posted on February 1, 2026, 5:14 pm EST

Last Updated February 4, 2026, 11:39 pm EST

Posted on February 1, 2026, 5:14 pm EST

Last Updated February 4, 2026, 11:39 pm EST