[The following commentary was written by Steve Houck,a longtime investor in bullion and knows the markets well. He is also a friend and a former business partner. RA ]

Looking at the froth in silver, it became apparent it was time to rotate from overvalued to undervalued once again. Selling precious-metal ETFs like SLV and AGQ meant cash was available for the next trade, but where to go? While silver has been on a relentless tear, the miners have only grudgingly moved higher. Yes, there have been good moves in many of the miners, but quite a few trade with a ball and chain weighing them down in the form of fear. That’s because the last two times silver surpassed $50, in 1980 and 2011, it collapsed and went into long, grinding bear markets. Silver mining stocks get caught up in this because the public doesn’t believe prices will hold, and that silver will fall back to earth.

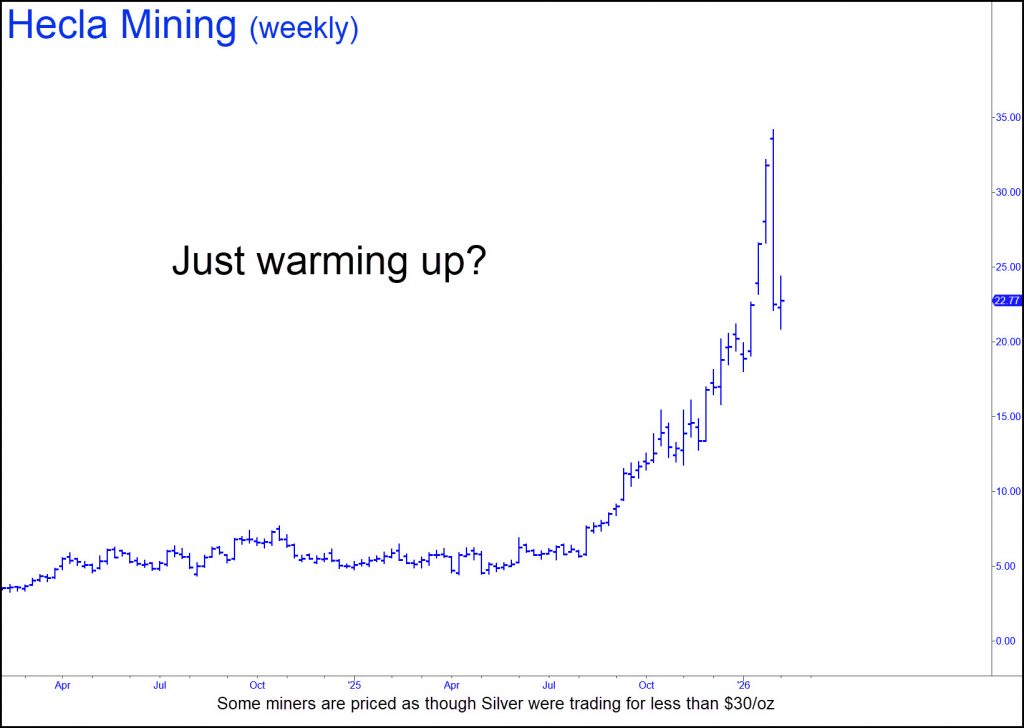

But what if the new floor is $55 to $70, and not the $15 to $25 range that obtained for decades? This silver run-up is different because it’s about one thing: physical metal. Just look what;s happening: China, the U.S. and the rest of the world are hoarding and trying to secure metals. That puts the miners in the catbird seat, because they produce and control the supply. Their shares, however, are still being priced as though silver were selling in the $20s even though it averaged close to $50 for the entire fourth quarter 2025. The miners wil start to report earnings next week, beginning on February 16. Because many of them will announce blowout earnings, now is the time to capitalize!

How to Play It

How to play this? Over the last two decades of investing in silver miners, the most important lesson I’ve learned is to stick with producers and developers with projects slated for the near-term. I want the companies I invest in to be extracting metal from the grown now, or within no more than 1-2 years. I start with the major producers and such crowd favorites as Coeur Mining (CDE), Hecla (HL), and Pan American Silver (PAAS). Once I have a good group of the majors, I’ll move to junior producers whose stocks have the potential to appreciate by 500% to 1000%. My largest junior positions are Avino Silver & Gold (ASM), Americas Silver (USAS) and Santacruz Silver Mining (SCZM). These major and junior producers Guanajuato Silver (GVSRF). Silver Storm (SVRS: Vancouver); and Vizsla Silver (VZLA). Here’s a link to comments on ‘X’ that corroborate the essay above with added details.