March Silver's best day last week still fell shy of a technically important 'external' peak at 28.01 recorded back in mid-September. That means the larger rally begun nearly a month ago from 91.60 has been for naught, at least so far, since it failed to generate an impulse leg on the daily chart. It would be premature to write off this possibility, but even if it happens the result would be less bullish than if buyers had exceeded the benchmark on the first try. There's no urgency about trying to get aboard in the meantime, since it will take more of a correction to ease this task when the time comes.

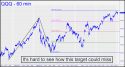

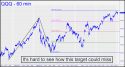

Like a few other bellwethers we've been watching closely, QQQ has been loitering near a potentially important Hidden Pivot target for weeks without being able to get past it. The target lies at 312.29, a mere 31 cents above the record high recorded on December 18. Although the shallow retracement so far suggests buyers are eager for more, there is no telling how much supply may be out there at these levels, especially if the headlines should take a menacing turn. We own some Feb 19 240/250/260 put butterflies in any event, since bulls are long overdue for a comeuppance, but also because the 312.29 target looks so compelling. A financial collapse -- The Big One that we all know is coming -- is never going to be an odds on bet for timers, but our odds are certainly improved when the charts are as closely aligned for a multi-index top as they are now. _______ UPDATE (Dec 28, 5:54 p.m. EST): The Cubes topped our benchmark by half an angstrom, earning a begrudging 'So what?'. ______ UPDATE (Dec 29, 7:50 p.m.): And now they've closed above it for two straight days, although not by much. Let's give bears another day to show us what they are made of. _______ UPDATE (Dec 30, 7:30 p.m.): Bulls, too, are acting pretty timid, but if some stray piece of 'good' news should buck them up, look for the rally to continue to 321.43, or 329.40 if any higher. Both of these Hidden Pivots are shortable, tightly stopped. Their provenance is shown in this chart.

Last week's mighty blast pushed this projectile precisely to the 30.93 target shown. Since it took ten weeks to get there, we should expect buyers to take a breather for perhaps a week or two. Instead, they have so far ignored a price gap between $16 and $17 created earlier in the week that cries out to be filled. At the same time, they have also managed to shinny back up the first corrective price bar to finish on the high of the day. Clearly, buyers are feeling little remorse and remain eager to push GBTC still higher. We'll need a couple more bars on the daily chart to gauge whether this is just a show of bravado or the start of yet another insane leg up. If the latter, 2018's all-time high at 38.71 will make a better minimum price objective than any Hidden Pivot resistance I could conjure up. _______ UPDATE (Dec 22, 8:07 p.m.): The rally pattern shown in this chart looks well suited to trading, but it will need a pullback from above the red line (p=32.50) to set up an appealing 'mechanical' buy at x=29.82. There are no guarantees the ambitious 37.86 target will be reached, but it seems likely because of the way bulls flouted huge gaps in the A-B liftoff phase. Let's see how they do on first contact with this midpoint Hidden Pivot.

There are signs that precious metals may be breaking out after correcting since August. That is why I am featuring a longer-term chart with an ambitious target at 2166.90 that equates to a 15% move above current levels. The pattern tripped a theoretical buy signal at 1867 two weeks ago that is associated with a midpoint pivot at 1967.10 we can use as a minimum upside objective. We should allow 2-3 weeks for the rally to play out. That's assuming the four-month retracement bulls have just endured has discouraged enough of them to lighten the burden of their profit-taking on the way up. Please note that the February contract still needs a modest push above November 16's 1904.30 'external' peak to generate an impulse leg on the daily chart. It would be the first since April. ______ UPDATE (Dec 21, 5:57 p.m. EST): The bad guys used pandemic news to smack down gold in thin trading overnight, but they failed to inflict any further damage after activity began to pick up Bulls could tactically concede a little more ground, but watch for them to turn things around decisively from p=1868.30 in this chart. _______ UPDATE (Dec 22, 8:25 p.m.): Apologies, since I neglected to link the chart I'd prepared for last night's update. Here's a new one, however, that offers a somewhat more bullish prognosis for those who got long. It shows a midpoint Hidden Pivot support at 1866.60, $1.70 below the one given previously, where a tradeable bounce was likely. A bounce has indeed occurred, but the small breach of the red line will warrant caution. This means taking a partial profit this evening, with the futures trading $3 above the original entry price; and using a break-even stop-loss for what remains. Another partial profit is suggested if the

DIA has been playing pattycakes with my 304.07 target for weeks, headbutting it repeatedly without generating any significant pullbacks. There is no question that buyers are feeling the resistance. A two-day close above it, or a print exceeding 307 (or so) intraday, would imply a bullish breakout, but until such time as it happens, the burden of proof will be on bulls for a rare change. I'd suggested buying February 19 250 puts for 0.80, but Friday's mild weakness left them just out of reach. Keep trying, but only if DIA has not traded above 304.07. If that should occur, I will update this guidance. ______ UPDATE (Dec 21, 6:04 p.m.): I still like the puts for 0.80, but ratchet it down a nickel at time if DIA moves above 304.07. ______ UPDATE (Dec 22, 8:31 p.m.): In the chat room today I recommended scaling in a few puts on rallies, even if the Feb 19 250s have remained just out of reach. The smell of distribution is so thick you could cut it with a knife, and you will have noticed by now that even though DIA has been head-butting my longstanding Hidden Pivot target at 304.07 for weeks, it has not been able to penetrate it. Here's a chart that shows this distribution clearly.

The pattern shown is so gnarly-perfect that I can scarcely imagine it not working. By this I mean to imply, looking ahead, that 1) QQQ will not thrust decisively above it soon, meaning within the next 2-3 weeks, and 2) Friday's top just 31 cents below the target could conceivably mark the start of a bear market. The E-Mini Nasdaq made a corresponding top not at a 'D' target, but at the p2 'secondary pivot' of a larger pattern. If you were able to buy put butterflies on QQQ using 240/250/260 options expiring on Feb 19, please let me know in the chat room so that I can determine whether to establish a tracking position. Unless the Cubes fall apart straightaway, there are likely to be additional opportunities to buy the 'fly on-the-cheap. _______ UPDATE (Dec 21, 6:10 p.m.): A bid of around 0.20 still looks about right for the butterfly spread, but you can go 2-3 cents higher if none come at the lower price. _______ UPDATE (Dec 22, 8:36 p.m.): Numerous subscribers have reported buying the butterfly spread for as little as 0.21. Accordingly, I will track four of them for 0.22. For now, do nothing further if you own the spread.

I've selected the simplest rally pattern that meets out rules in order to come up with a 3767.25 target. Although there is no reason to doubt it will be reached, we shouldn't presume to know whether it will be impaled. Although that would indicate significantly higher prices to come, it shouldn't inhibit us from laying out speculative shorts at the target. There is one other, lesser Hidden Pivot resistance that you should be aware of: 3744.00. The provenance of this 'D' target is shown in this chart. It looks like a high-odds spot to try shorting with a stop-loss as tight as you can abide. _______ UPDATE (Dec 21, 6:17 p.m.): The 3767.25 target is still viable as a minimum upside projection, and it would be a gift if we get an opportunity to lay out shorts up there. You can use a 3796.82 target in the cash index if you'd prefer to buy put options. Far-out-of-the-moneys expiring in mid-to-late February are suggested, with a $4 limit on vertical spreads.

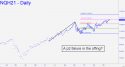

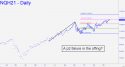

The bullish pattern shown does not square up with the charts of other indices, since last week's high in this vehicle did not reach its 'D' target. However, we can consider NQ as predictively aligned with the others, since it is hardly unusual for rallies to fail at the p2 'secondary pivot.' This holds true even for long-term trends, even bull markets. I have not advised shorting this vehicle as I did its QQQ cousin, however, because p2 tops are not often definitive, but also because intraday price movement in NQ has been too nerve-wracking to flirt with other than by way of relatively labor-intensive rABC set-ups. Stay tuned nonetheless, since an easy opportunity could open up. ______ UPDATE (Dec 22, 8:40 p.m.): Shorting QQQ still looks less stressful, but if you trade futures only, give me a shout in the chat room and I will attempt to provide timely guidance.

Statistical and anecdotal evidence suggest that if you are elderly and want to survive Covid-19, you should move to a red state. Here in Florida, Governor Ron DeSantis has imposed few restrictions, yet somehow we are not dropping like flies. The Sunshine State in fact is well down the list of places where the pandemic is alleged to be winning, but it is surely not because we are tightly locked down and masked 24/7. To the contrary, everyone who lives and works here is free to do pretty much as he pleases, subject to the test of common sense. I suspect there are millions of us who wear masks not because we are persuaded that the science behind them is correct, for it is muddled at best, but to be polite and to humor those who think a loosely attached, cotton face cone purchased from CVS could somehow shield one from Covid's submicroscopic, infinitely clever airborne spores. Life goes on hereabouts in any event. Outdoor concerts and street fairs, though not explicitly forbidden, are few and far between not because we are afraid of outdoor crowds, but because promoters fear they'll lose money on such events. A Witch-Hunt In my gated community, the three golf courses are more crowded than ever, and nearly all amenities are open, including dining rooms, fitness center, salon, neighborhood swimming pools, pickleball and tennis courts. Not everyone chooses to use them, however, and some neighbors, including one of my oldest friends, are so paranoid that they will not even touch a ping-pong ball or billiard cue that has been handled by someone else. Science tells us that Covid does not transmit very well on surfaces; but better not to touch anything at all, some evidently believe, than risk dying from contact with a contaminated ping-pong

Silver has pushed marginally above a three-month consolidation range, signaling minimum upside to a 26.66 target broached here earlier and shown in the chart. It is the terminus of a small, bullish pattern that has taken three weeks to play out. A move decisively exceeding the target would put the 28.30 midpoint Hidden Pivot of a much larger pattern in play. It is also shown in the chart and correlates with a D target at 34.67. I expect the lower resistance to be tested, but notice how that would put the March contract slightly above a cluster of 'external' peaks recorded in September. The result would be an impulse leg of significant decree. Overall, the picture suggests that minor things are happening now that could easily turn into major things. _______ UPDATE (Dec 21, 6:30 p.m. EST): Bulls impaled the 26.66 pivot, putting p=28.30 in play as a minimum upside target for the near term. _______ UPDATE (Dec 22, 11:12 p.m.): Silver's two-day slide is more worrisome than gold's, hinting of more downside to at least p2=24.929, or d=24.300 if any lower. Both are correcting strong impulse legs, however, so bulls should be given the benefit of the doubt for now. ______ UPDATE (Dec 23, 9:30 p.m.): Midgets duked it out with no clear winner, although the good guys were able to turn the futures higher from well above 24.92 benchmark cited above. This is faintly encouraging, but I wouldn't hazard much more than that predictively. However, a decisive thrust above 26.28 would hint of a break in the tedium.