The steep, slick wall created by last summer's plunge left us with no 'external' peaks to judge the staying power of the bounce since October's 91.85 low. I've used an unconventional 'reverse' pattern to provide some clues, and it would seem to imply that TLT will rally to at least D=113.78. This is affirmed by its unwillingness to provide bulls with any good 'mechanical' buying opportunities on the daily or weekly charts. We'll want to pay close attention if the rally exceeds 113.78 and pushes toward a test of the 120.69 peak recorded in August. Its decisive breach would be a big deal, since that would suggest interest rates are likely to keep falling.

I still think this is the pattern that will usher gold futures above $2,000 for the fist time since since April -- just not on our schedule. It did nothing as the week ended to monetize the 'mechanical' buy triggered on Thursday, although the position was showing a slight gain at the closing bell. I cannot 'guarantee' D=2017.70 will be reached, since buying died precisely at the 1966.60 midpoint Hidden Pivot resistance (p was a decent speculative short, actually, for subscribers who trade this vehicle aggressively). If the futures dip below the green line and you hold no position, try bottom fishing at 1921.2 with a stop-loss at 1920.80. This is a speculative play based on the 60-minute chart where a= 1966.10 on 1/26 and b=1935.10. _______ UPDATE (Jan 31, 6:42 a.m.): Last week's stall at the p midpoint pivot of D=2017.70 is about to have consequences, with the futures poised to negate the pattern noted above with a marginal dip (or worse) below C=1915.50. They'll come down to around 1900 if they slip any lower, or possibly even to 1891.10 to test an important low recorded there on January 12. _______ UPDATE (Jan 31, 10:23 p.m.): Ha ha very funny. The futures' dive on the opening bar failed by a tick to stop out the bullish pattern and its 2017.70 target. If the April contract hits p=1966.6 and then falls again to x=1941.10, that's would trip a 'mechanical' buy that I'd recommend, subject to the usual caveats. _______ UPDATE (Feb 1, 6:26 pm.): The drop from just shy of 1966 only came down to 1955.40, so there was no trade. It left this pattern, with a short-term target at 1982.30. The pattern looks opportune for a 'mechanical' buy following a one-level pullback to either p=1968.90 or x=1962.10. Attempt the

I've altered the view somewhat, lowering point A' and its target to make the chart seem less discouraging. Previously, there was an unachieved rally target at 24.95 that stayed perpetually out of reach despite gold's having achieved a corresponding target. The justification is that Silver is in a bull market, which implies that the two-month struggle to achieve D has been accumulation rather than distribution. Even so, March Silver may have to fall out of its tedious range to get a running start on a new recovery high. In the meantime, it remains untradeable, other than by those who enjoy hunkering down on the 15-minute chart for days on end.

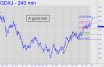

Having topped last week a penny below a longstanding Hidden Pivot target at 41.17, GDXJ presumably will need a little rest for the next upthrust. When this mining ETF takes flight, the 43.49 Hidden Pivot shown in the chart can serve as a minimum price objective. The pattern is less than ideal, since B is a 'sausage' peak that failed to surpass some external peaks well to the left. However, the subsequent dance so close to p= 38.71 has made up for the typical sausage drawbacks of unreliability and inaccuracy. Moreover, it's hard to imagine GDXJ lacking the power to reach D no matter how illegitimate the pattern. A vicious swoon to x=36.31 would trigger a screaming 'mechanical' buy. In this case, however, given the relentless persistence of the trend, it can be attempted on a pullback to p=38.71 with a stop-loss at 37.11. Paper-trade this one if you still need persuading that the preponderance of 'mechanical' trades posted here and in the chat room are winners. _______ UPDATE (Feb 3, 11:37 a.m. EST): If this unusually vicious takedown continues, X=36.31 should be bought 'mechanically', stop 33.92. A 'camo' trigger should be used to reduce entry risk by perhaps 90%. This gambit is 'textbook', but paper-trade it if you are not yet comfortable with 'mechanical' set-ups.

I'd said shorting 4118.00 would be a no-brainer on Friday -- except that the futures didn't get there. Instead, they topped almost exactly at the 'D' target of the lesser pattern shown in the chart (inset). Bears shouldn't get their hopes too high however, since I expect the futures to reverse Sunday night or Monday and reach D=4118.00. It can be shorted with a very tight stop-loss -- preferably with a tight 'camo' set-up on a lesser chart -- but we'll need to pay close attention in any case to how the rally interacts with a D resistance that has been three weeks in coming. There are no 'mechanical' buys left in the pattern no matter how hard ES falls, since it is spent. ______ UPDATE (Jan 30, 9:36 a.m. EST): Like many of you, I don't trust my lying eyes when I see the bear market rally fall precipitously ahead of the opening, as it is doing today. Usually that means DaBoyz are fixing to exhaust sellers, the better to short-squeeze stocks an hour later. We should know shortly if their scheme is doomed and the bear rally begun in October has ended, since the decline has triggered a textbook 'mechanical' buy at 4053, stop 4027. If the stop is hit and no sharp rally follows immediately after, that would suggest that the heavily engineered celebration on Wall Street since mid-October is over. As of Friday, ES had not quite reached a juicy target at 4118 where I'd suggested getting short. The top actually occurred nine points below it, at the exact 'D' target of a lesser pattern noted at the time. Stocks supposedly fell overnight because earnings announcements due out this week from four behemoths -- Apple, Amazon, Google and Facebook -- might have to acknowledge deepening (albeit

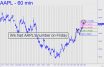

We had AAPL's number on Friday, allowing all you option junkies to get short with puts just a hair off the top. Don't count your chickens, though, even if a nimble subscriber reported a quick, $600 profit in the final minutes. The finale featured a panic-induced short-squeeze to slightly above the day's previous peak, then a collapse cleverly timed so that it wouldn't have enough time to snowball and cause real damage. Here's what the end-of-day plunge looked like on the lesser charts: a mash-up of AAPL's weaselly sponsors and little guys who never give up on the challenge of beating them at their stupid, nasty little game.

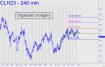

Although I track crude because it's the world's most important commodity, its gratuitous feints and swoons are too tiresome for me to follow closely enough for day- and swing-trading by the relative handful of subscribers who seem interested. Be that as it may, tradeable highs and lows are as easy to nail as a balsa two-by-four. Perfect opportunities do not materialize every day, but when they do they are easy to spot and work reliably. And, of course, when price action turns freakish, the task of setting up winning 'mechanical' trades is a piece of cake. The foregoing is not meant to discourage you, but rather the opposite. If subscribers can come up with Hidden Pivot ideas to trade this rabid mongoose, I'll be happy to vet them. For starters, focus on the pattern shown in the chart, but after it has taken out the point 'C' low, 78.45, by just a few ticks, then reverses. For now I'll highlight the 86.95 target anyway so as not to seem clueless about where this contract is headed: tortuously higher. That's how the little sonofabitch works, but I'll make it your job to find the opportunities. _______ UPDATE (Jan 30, 1:52 p.m.): March Crude provided precisely the opportunity this morning I had detailed above. Please check my chat room posts from this morning about this, since they describe in detail, with text and charts, how you might have proceeded. ______ UPDATE (Jan 30, 7:52 p.m.): Here's part of my chat room post from this morning, with a chart showing a clear path down to 77.05: For all of crude's spastic price action, it is relatively easy to read and to trade, provided you are willing to work at it. The linked chart shows the pattern that is commanding March Crude at the

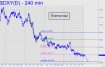

I've simplified the outlook with a single target at 100.18, stripping out another at 101.03 that is likely to be just a weigh station. A fall to 'par', if not lower, seems fated. Even if the downtrend has seemed relentless and interminable, it would amount to a relatively moderate 12.7% correction off the September high at 114.78. There is of course another possibility: If DXY heads decisively lower after testing 100, that would suggest the deflationary endgame for the global economy is farther off than I'd imagined. It is inevitable, but the most promiscuous credit stimulus in history has simply delayed it.

[This week's commentary was written by David Isham, a real estate investor from Northern California who has subscribed to Rick's Picks since its inception more than 20 years ago. RA ] With the ongoing financial turmoil and the potential start of another world war, gold is behaving as we would expect, showing exceptional strength. Although we are nowhere near the top as open interest is still low, we still must be on the lookout for a short-term top. The gold bull has traditionally carried as few riders higher as possible, and I suspect this time will not be any different. Rick has identified targets above $2,000, and there are two peaks at $2078 where there will be plenty of buy stops for the algos to run and establish short positions. If they do run the buy-stops, they would then look to attack sell-stops under $1,600 so that they could cover profitably and get long again. A long-term Fibonacci fan (aka 'speed resistance lines') with a red 2/3 line has acted as both resistance and support since this bull market started in 2001 and would be a likely target on the downside. Such a dramatic move would also set up a slingshot move to the upside. If we do get one more, dramatic move down I would also expect gold stocks to hold up well relative to physical. My strategy is to accumulate gold and silver mining stocks and not try to time buying and selling my core positions, since I could get left behind if I am wrong about a big drop. However, any large move down would be an opportunity to add to my positions. A Golden Slingshot Martin Armstrong does not think the US dollar will last beyond 2028. It has the distinction of being the only currency

The minor, bullish pattern shown, with a 2000.50 target, has the potential to put gold over $2000 and set up a shot at the all-time high at 2078 notched last March. Price action goes back only to a low recorded less than three weeks ago, on January 5, so I made certain the A-B segment was legitimately impulsive. You cannot see the 'external' peak that the leg surpassed, but rest assured it is there and that its conquest portends a continuation of the uptrend with no breach of the 'C' low. This implies that 'mechanical' trades to get long will enjoy exceptionally good odds for producing a profit. Stay tuned. _______ UPDATE (Jan 26, 12:31 p.m.): Feb Gold is tracking the touted pattern (see thumbnail inset) perfectly, with a nasty pullback from within two ticks (0.20) of p=1949.6. The pattern looks opportune for making money on either side of the market, including shorting at D=2000.50 with tight risk control. (Be prepared for some niggling stop-outs up there, since my merely having published the target could subject it to front-running.) More immediately, gold has triggered a 'mechanical' buy at x=1924.10, stop 1898.50. The usual caveats apply, but I would encourage you to paper-trade this one if you lack complete confidence in the 'mechanical' set-ups I've been posting in the chat room. About 90% of them have been profitable, not that that is a guarantee of future success. Here's the chart.