Last week's commentary was skeptical that the short squeeze begun two weeks ago in the broad averages would prove to be just a bear rally. Based on the latest technical evidence, it now seems likely that stocks are headed to new all-time highs. This is despite the fact that the world is going to hell in a handbasket, Biden's wrecking-ball presidency has a thousand days to go, China and Russia have joined forces to hobble the U.S. however they can, and there is even talk that America could be in for its first-ever food shortage. This comes on top of soaring prices for gas, groceries and nearly everything else, as well as a looming earnings recession. Throw in Fed tightening to the horizon line and you have quite a list of things about which Wall Street evidently cares little if at all. As always, we need look no further than Apple's chart to understand exactly where the market is headed. AAPL is a perfect proxy for institutional mindset, a one-decision stock since 2009 that has made erstwhile chimpanzees look like geniuses. DaBoyz have hung together on AAPL for 13 years, selling almost none of it from their portfolios, and buying every dip. A 4-for-1 stock split back in August 2020 allowed the rubes and riff-raff to join in the fun -- an opportunity to play AAPL stock and options with relatively small change. It became the biggest-cap stock in the world as a result and is likely to grow even fatter on perpetually spun news that, this time, it's teaming up with Porsche to have yet another vague but promotable go at the car business. Sunny and Mild: Ugh! The chart shows that buyers shredded their way past a 'midpoint Hidden Pivot' at 167.80 last week. This all

Rick Ackerman

Nailing a Shortable Top in AAPL

– Posted in: Tutorialshttps://vimeo.com/692022709/761f046dbc/ We used a potentially important rally target at 172.05 in AAPL to execute an inspired 'reverse-pattern' short that must be seen to be appreciated. The expiring at-the-moneys (Mar 25 172.50 puts) were not acessible due to a problem with Tradestation, but for the record, they went from 1.66 to 2.23 in the minutes after the stock topped 18 cents above the target. AAPL has been struggling for loft since, so you should check out its chart when you read this to see how things turned out.

TNX.X – Ten-Year Note Rate (Last:2.37%)

– Posted in: Current Touts Free Rick's Picks

Ten-Year rates hit my 'max' number today exactly: 2.39%. The chart also shows rates above the maxed-out, 2.31% target of a larger, 'reverse' pattern. Together, these two Hidden Pivot resistance points should offer challenging resistance, notwithstanding the Fed's determination to tighten for the foreseeable future. However, if 10-year yields continue higher, I will need to haul out some very-long-term charts to project a new target. This is even though yields on the 30-Year T-Bond still have room before they hit a 3.02% target that we've been using for about the last six months.

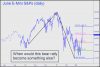

ESM22 – June E-Mini S&Ps (Last:4453.50)

– Posted in: Current Touts Rick's Picks

Use the pattern shown, with a 4584.50 rally target, to confidently trade and second guess this vehicle. It has already produced a nearly $50,000 'mechanical' winner from x=4216.75 and looks reliable for doing so again if the futures should surprise with another swoon to the green line. More upside to D=4584.50 is not quite a done deal, since we'll need to see this short-squeeze take out p2=4461.75 decisively first. Notice that if 'D' is achieved, that would generate the first major, bullish impulse leg we've seen on the daily chart since a presumptive bear market began on the second trading day of the year. At that point, we bears had better not be so complacent, since the crooks running this gaff would stand an excellent chance of achieving new record highs.

AAPL – Apple Computer (Last:174.10)

– Posted in: Current Touts Free Rick's Picks

I offer this view of AAPL to complement the menacingly bullish look of last week's short squeeze in the E-Mini S&Ps. Together, the two charts cannot fail to tell us whether new all-time highs are coming. Although both need more upside to make this bet and D=172.05 a lock-up, AAPL's thrust through p=161.08 on Friday strongly implies it won't be a problem getting to at least p2=166.50. That will generate a strong enough impulse leg on the daily chart to put permabears' fond vision of global ruin in jeopardy. Trade the stock with a bullish bias for now, but you'll need to tune to the chat room or your email 'Notifications' to exploit this lamb chop with Hidden Pivot voodoo. [Note: I have revised my numbers to accord with the chart. I am not sure what planet my brain was on when I typed the original numbers.] _______ UPDATE (Mar 24, 12:59 a.m.): AAPL spent most of the day diddling the 172.05 target before relapsing in the final hour. It took two months to get there, so we should expect a pullback that lasts for more than just a few days. Anything less would be quite bullish, but we'll let the stock decide this rather than speculate. ______ UPDATE (Mar 24, 10:40 p.m.): AAPL's take-no-prisoners institutional handlers took all of one day to push the stock past a daunting Hidden Pivot resistance at 172.05, signaling a continuation of the uptrend to at least p2=182.86. I've altered the point 'A' low, slightly lowering the 'D' target to 193.78.

GCJ22 – April Gold (Last:1962.30)

– Posted in: Current Touts Rick's Picks

The punitive selloff from the $2078 all-time high recorded on March 8 has generated sufficient downforce to imply that a snap-back rally is unlikely. To be sure, however, let's focus minutely on the lesser charts. The one shown has a corrective target at 1915.10 that was narrowly missed at Friday's low. The target remains viable, but if the so-far-tentative bounce continues, each new peak it surpasses would have increasingly bullish implications. A key number is 1945.60, the midpoint pivot of a big, bullish pattern projecting to as high as 1973.80. _______ UPDATE (Mar 24, 10:50 p.m.): Two days of robust buying has shifted the focus to the bullish pattern shown in this chart. Expect minimum upside to p=1988.50, but if buyers bore through it effortlessly, a possible new all-time high at 2081.50 would come into view.

SIK22 – May Silver (Last:25.97)

– Posted in: Current Touts Rick's Picks

Silver bulls shouldn't give the seemingly nasty selloff of the last two weeks a second thought, since it is correcting an impulse leg that surpassed no fewer than three significant peaks on the weekly chart, including a bad-ass 'external' at 26.87 recorded last July. In fact, even a selloff into the low $20s would not much change the bullish look of the long-term chart. It allows for a minimum projection of 34.74 and a maximum 40.12 (A=11.64 on 3/20.20). That last target has been validated theoretical with the print through x=26.08 two weeks ago. Here's a bullish pattern to guide you this week with Monday's action included. _______ UPDATE (Mar 24, 1:10 a.m.): Here's another bullish pattern, since Monday's low wrecked the previous one. It is not very impressive. _____ UPDATE (Mar 24, 11:01 p.m.): Buyers turned on the turboboost, all but clinching more upside to p=26.34, shown here. An easy push past it would shift our gaze up to D=28.13.

Just a Bear Rally?

– Posted in: Free The Morning Line

With the supposed bear rally about to enter its fifth week, I am reminded of Gideon Drew, "the thing that wouldn't die" in the 1958 horror movie of that name. Like Drew, the stock market has become a disembodied monster, able to command loyalty and teacherous obedience with just a creepy movement of the eye. The fictional Drew was beheaded for devil-worship by Sir Francis Drake, but the evil-thinking piece of him came back to life when the crate in which it was buried got dug up by some hapless D-list actors. They are akin to today's investors, who for 13 years have been mesmerized by a stock-market bull that long ago decoupled from the corpus of reality. The bull will eventually send them over a cliff, as all bull markets inevitably do. But until that happens, the delusional herd will remain transfixed by the incantations of greedy Wall Street hucksters who can spin alluring dreams from even the scariest headlines. Cocksure, Sort of... And scary they are -- so much so that the potentially world-shaking geopolitical disaster in Ukraine ranked only seventh on one well publicized list of Americans' biggest concerns. With such a formidable catalogue of troubles, it seemed more than a little plausible that the powerful selloff of stocks that began on January 4 was the start of a bear market. That is still what many, including some of my most astute guru colleagues, seem to believe. We were pretty cocksure about this when the S&P 500 dove 600 points, or 12%, in the first three weeks of the year. When a powerful bear rally intervened in late January/early February, most of us stood our ground; and then we doubled down on costless certitude when stocks began to plummet anew at the end of February. Now they

Dancing a Jig Around Violence

– Posted in: TutorialsStocks were in an epic short-squeeze, allegedly reacting to “hopeful” news from Ukraine. This allowed yet another demonstration of ways in which Hidden Pivot entry tactics can dance a sprightly jig around even the most violent price action. Trade set-ups during the session focused mainly on the E-Mini S&Ps, where we squeezed off two easy winners in 30 minutes, the first of them good for a very quick, $800 gain on paper. The larger goal was to get short ahead of a potentially important top in this bear rally -- and so we did, as you can see for yourself.

DXY – NYBOT Dollar Index (Last:99.71)

– Posted in: Current Touts Free Rick's Picks

I've been shouting about this for many years, but let me repeat it once again: The last thing the world needs is a strong dollar, since it will lead inexorably toward ruinous deflation. Over several decades, I've never wavered in my hyper-bullish outlook for the dollar, even amidst current headlines screaming about inflation, and regardless of what most economists were saying. That's because I see no resolution for the global debt bubble other than via massive liquidations that would be tantamount to deflation. A stock market bear will be the catalyst, assuming some 'black-swan' asteroid does not hit us first. From a technical standpoint, the dollar index is rallying sharply after the briefest of corrections. That is quite bullish, but even moreso because the recent 99.42 peak whence the correction began had hugely overshot its Hidden Pivot rally target. _______ UPDATE (Apr 7, 12:09 p.m.): This chart, too, should have been included earlier, since it shows a can't-miss minimum rally target at 103.25. It is predicated on an easy move past p2=99.74, but I doubt that will be a problem. ______ UPDATE Apr 13, 11:012 p.m.): Here's a pattern I somehow overlooked that shows why DXY topped exactly where it did. The weakness presumably is corrective, since we have the outstanding target at 103.25 noted above..