I have outstanding projections as high as 5.5%, but the ponderous weight of supply just below 5% could conceivably put a lid on the bull move that began in March 2020 with covid. If rates fall to the red line (4.24%) as appears likely, price action at that midpoint Hidden Pivot will tell us whether they are headed still lower. A strong bounce would imply yields are about to resume their upward skew. However, if the downtrend crushes p=4.24%, or if TNX closes for two consecutive months below it, look for a further fall to d=3.67%.

The rally from mid-January's low may seem impressive, but don't expect much to come of it. The ascent has occurred in two discrete upthrusts, neither of which exceeded an external peak. The failure to do so was a matter of inches, but that's all the more telling since it demonstrated that bulls manifestly lack the vigor and conviction to generate impulse legs on the daily chart, let alone effortless ones. I'll remain skeptical until such time as TLT pops decisively above the 88.91 peak notched on December 20, then stays above it for two consecutive days. _______ UPDATE (Feb 5, 10:19 p.m. EST): I've been fighting off every bullish sign, but there is no denying the bullish implications of today's breakaway gap through a clear Hidden Pivot target at 89.81. Buyers will need to do a little better, pushing past the 90.99 'external' peak recorded on December 17, to demonstrate their new prowess, but that shouldn't be a problem given the power of today's move.

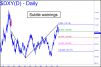

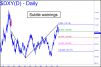

Some think the dollar's bull run is over because of Trump, but I doubt it. Trump is viewed by conservatives and libtards alike as the cause of just about everything these days, but let them try to explain why stocks keep going up even though everyone is so upset about his tariffs. A strong dollar threatens to crush an era of easy credit and make it painful for all who owe dollars to pay them back. The dollar's main source of strength is that the world simply cannot afford for the dollar to keep rising. It will undo all the assumptions that have made the 'wealth effect' the most popular invention in the history of civilization. From a technical standpoint, the Dollar Index is in a so-far moderate correction from mid-January's 110.18 high. I expect it to come down to at least 105.99, but we should see a strong bounce from that number, a midpoint Hidden Pivot, if new highs are coming. Alternatively, an easy breach of the support would imply more slippage to as low as 101.78.

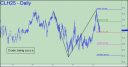

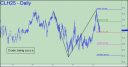

Crude has the distinction of being the nastiest, most uncooperative vehicle I track. It doesn't give a damn about voodoo numbers; its long-term, $20 swings are gratuitous, and it is the shameless bitch of the most heavily rigged market on earth. And just look at what a tease it's been, feinting for six straight days toward the p=71.73 midpoint Hidden Pivot in the chart. Ordinarily, I would bet the ranch bottom-fishing at that red line. However, the March contract's week-long avoidance of it has sapped its value. It could still work, but that's not the point; it absolutely would have worked if it had touched 'p' a week ago like it was supposed to. No one mentions crude in the chat room anymore, not even Artie. Time to scrape it off the home page? If I hear by Tuesday from 350 subscribers who want to save it, then by gummit it, save it I will! _______ UPDATE (Feb 7): I heard from, like, five subscribers, so here's a commensurately taciturn update that probably will still be the most simple, accurate and reliable forecast you're going to find on the internet. Having topped near $80 a few weeks ago, March Crude is midway into the obligatory $15-$20 decline that follows every big rally to wherever. If you plan to bottom-fish, use p2=67.90 or D=64.07 (a back-up-the-truck number from the daily chart, where A= 78.97 on July 5). _______ UPDATE (Feb 21): Zzzzzzzzzzzzzz.

Bloggers were revved up when last week began, trumpeting a warning that China's DeepSeek R1 threatened to crush America's capital-intensive effort to lead the world in AI development. ZeroHedge was among the first to jump on the story. "The future of humanity is being decided as we speak," wrote Mark Whitney. "This is a full-blown, scorched-earth free-for-all that has already racked up a number of casualties, though you wouldn’t know it from reading headlines that typically ignore recent ‘cataclysmic’ developments." What had the Chinese done to upend the status quo? Mark Button, a technology expert quoted in the article, describes the situation: "Imagine we’re back in 2017 and the iPhone X was just released. It was selling for $999 and Apple was crushing sales and building a wide moat around its ecosystem. Now imagine, just days later, another company introduced a phone and platform that was equal in every way, if not better, and the price was just $30. That’s what unfolded in the AI space today. China’s DeepSeek released an open-source model that works on par with OpenAI’s latest models but costs a tiny fraction to operate. Moreover, you can even download it and run it free (or the cost of your electricity) for yourself." An Ostentatious Yawn Predictably, the mainstream media threw everything they had at DeepSeek in the days that followed. The Wall Street Journal led the charge with an ostentatious yawn and a list of bullet points intended to suggest that China's supposedly killer solution was about as impressive as a set of Lincoln Logs assembled into a working toaster oven. By week's end, Wired chimed in with a pantywaist report that university researchers had baited DeepSeek with 50 malicious prompts, and that it failed to block even a single one. If this story had broken

I shrugged off a remark in the chat room that the Dollar Index did not exactly follow my bullish script last week. I noted at the time that the long-term trend is unambiguously bullish, and that the rally from October's low has been nothing short of spectacular. However, when I looked very closely at the chart while preparing this tout, there were some subtle signs of possible trouble. For one, the most recent rally peak failed to surpass any external peaks. I've circled the closest on the chart, a look-to-the-lefter so subtle that it is not even visible in the SnagIt reproduction. Nevertheless, a basic rule of my system is that healthy rallies must exceed at least one prior peak with each upthrust, and this one didn't. Also, notice that the selloff from last week's 110.18 high triggered a theoretical 'sell' signal when it breached the green line (x=108.08). We should take this seriously because the reverse pattern itself, although highly unorthodox, comprises three 'locked' coordinates whose authority cannot be denied. The implication is that DXY may have begun a fall that could take it all the way down to 101.77. If so, that would be quite bullish for gold.

Although I hate to haul out a chart that shows a clear path to at least 116,807 for this gypsy-grade scam, it's all I've got at the moment. The pattern is obvious enough to have attracted the attention of ten thousand clowns, so we shouldn't expect the levels to work with the usual precision; however, they should be good enough for government work. With regard to the 144,586 target, I'll reserve some skepticism until such time as BTCUSD blows a gaping hole in p=116,807, the midpoint Hidden Pivot. Regardless, you should plan on shorting there if you know how to set up a 'camo' trigger that limits risk to theoretical pocket change.

The nutty-looking pattern and its 6224.00 rally target picked up credibility with some coy interaction at p and p2. Although we don't usually do our 'mechanical' buying at the red line, in this case it will be warranted if you know how to pare the entry risk with a 'camouflage' trigger. The textbook stop-loss would be at 6071.00, but that would risk initial exposure of about $7500 on four contracts -- too much for dabbling. If the futures should surprise by plunging to the green line, the 'mechanical' buy signaled thereof would be an opportunity too juicy to pass up. ______ UPDATE (Jan 27, 10:10): All bets are off this morning as the investment world contemplates news that China has developed an AI solution much cheaper to train and use than the one in which U.S. tech giants have invested trillions of dollars. ES crushed my Hidden Pivot supports and appears headed down to at least 5906.00, a Hidden Pivot support that should produce tradable turn.

I have placed no notes on the chart so you can look at it yourself without experiencing my bias. I am skeptical that the stock is about to launch to new record highs, but we shouldn't presume too heavily against this. It 'feels' like a ratcheting move higher will not suffice to blast through granite layers of supply; rather, a bold blast that leaves immediate resistance in the dust is what is called for. Any progress above 450 will turn December's 456 peak magnetic, beckoning a test that MSFT seems likely to pass, literally. At that point, a voodoo resistance at 462.26 will be in play, and it should be used to get short with a very tight reverse-pattern trigger. This recommendation will hold unless the stock spears the voodoo number on first contact.

Careful! Feb Gold topped Friday at a double resistance of daily-chart degree. One of the impediments is shown in the chart: the 'd' target of a reverse pattern dating back to September. The second was a voodoo number that came even closer to nailing the actual high at 2794.80. Taken together, these 'hidden' obstacles made shorting the top relatively easy. The 19-point reaction move was worth as much as $7600 to any subscriber who took my 9:34 post in the chat room seriously enough to squeeze off a trade. Of course, if the futures push past this double-trouble spot effortlessly next week, it would be a very bullish sign, leaving gold on track for a move to at least 2865.90 (A= 2525.40 on Sep 4). ______ UPDATE (Jan 30, 1:08 p.m.): February Gold’s fist-pump this morning through the red line, a ‘midpoint Hidden Pivot resistance’, has cleared a path to $3018, 7% above the current $2822. (That equates to $3041, basis the April contract.) Bullion’s dramatic burst of strength is being attributed to various factors, including Trump’s threat of tariff restrictions and safe-haven demand, but that is like saying the moon has been affecting the tides. Far more likely is that gold has caught a whiff of Big Trouble ahead that we can only guess about. I am already on record as saying stocks have topped, even if Bitcoin has yet one or two more lunatic upthrusts in it to set the hook for the most egregious speculators. The Indoos and the S&Ps may notch marginal new highs as well, but they would occur in the context of a choppy top that does significantly exceed recent peaks.