The Morning Line

Zuckerberg’s Huge Branding Problem

[Your editor is taking a busman’s holiday in San Francisco. Although trading touts will update as usual and I’ll be active in the chat room, this commentary and the next come from the archive. You can judge for yourself whether they were sufficiently on-target to still be relevant. RA]

Stocks looked leaden as the week ended, adding to the impression that the aging bull market is topping. The Dow tacked on a perfunctory 104 points, or 0.22%, and it wasn’t pretty. There was little life in the lunatic sector (aka ‘the Magnificent Seven’), which until recently could be relied on to celebrate its wildest flights of fantasy on Fridays. The biggest winner in the bunch was META, which rose 1.80% on news that Zuckerberg is having second thoughts about his all-in bet on a metaverse.

If you’re unfamiliar with the term, it refers to a virtual world in which users interact online through avatars. Zuckerberg evidently thought there were hundreds of millions of us, if not billions, eager to escape the pain and drudgery of day-to-day life. He was so certain about this that he changed the name of his company in 2021 from Facebook to Meta. But after sinking $70 billion into the concept, there has been precious little payback. Even more troubling to investors is that there are no obvious ways to make back what has been spent already, nor to recoup any further sums Meta might pour into the idea.

Counting on Investors’ Stupidity

To cover up this boo-boo, and to avoid being thought clueless, Zuckerberg did what any muckety-muck CEO in the digital world would have done: a twisting somersault onto the AI bandwagon. “AI is the most important technology we are working on,” he said, evidently hoping investors have forgotten that he spent the last four years taking pains to separate the supposed;y lucrative potential of metaverse from the vague and so-far profitless promises of AI. This latest statement to the press was a smart move if you believe that the $10 gain recorded by META on Friday was the beginning of a lasting rally. More likely is that it will be reversed on Monday or Tuesday, adding to the disillusionment that has been weighing on the broad averages for the last few months.

Meanwhile, Facebook is stuck with a moniker and a concept that are perceived as dead on arrival. Although Zuckerberg is known as a smooth talker, watching him try to extricate himself from this memic trap promises to be entertaining. Faced with a branding problem that is not merely tricky but potentially fatal, he doesn’t dare return to the name ‘Facebook’, since that would be admitting failure and the stupidity of his biggest-ever idea. But if he changes the company’s name a second time to some as-yet-unclaimed, nebulous variant of AI, he will look like a flake. My guess is that he will stick with Meta, forever associating himself with a virtual Edsel. Like Johnny Cash’s boy named Sue, Zuckerberg will have to work three times as hard to be taken seriously, particularly by his billionaire cohort who are already well aloft in their splendiferous AI hot-air balloons.

Why Stocks Look Like Hell

[Events in the Middle East have overshadowed my narrow economic critique of President Trump in the commentary below. His alliance with Israel to knock out global jihad’s command structure is likely to change the world in ways no one can predict. It will also test the idea that only military might can secure a lasting peace. RA ]

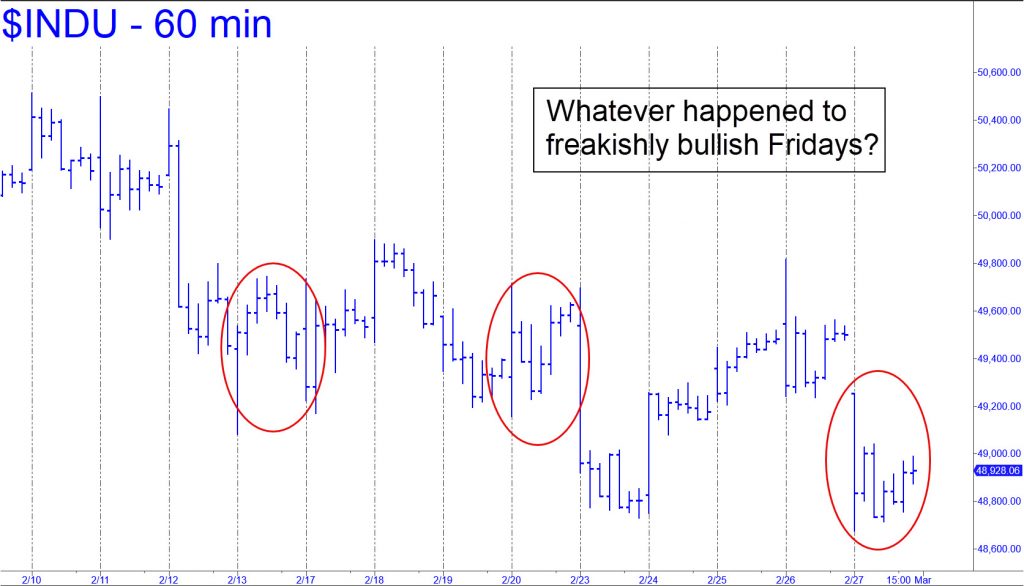

Stocks used to turn feisty toward the end of the week, but as the chart shows, the last few ‘Freaky Fridays’ have been pretty tame. My gut feeling is that this picture of tedium is the calm before the storm, and that stocks are being heavily distributed ahead of a major breakdown. Although I promised a few weeks ago that I wouldn’t mention the words ‘topping process’ again, the alternative would make me sound like a Wall Street shill. The Street’s best and brightest have been flat-out bullish on stocks since the 1929 Crash, having failed to issue a sell signal even on stocks implicated in some of the biggest scandals of the last hundred years. To cite a particularly notorious example, many of them were gung-ho on the shares of Equity Funding until the moment regulators halted trading in the stock one day in March 1973. Read about it here.

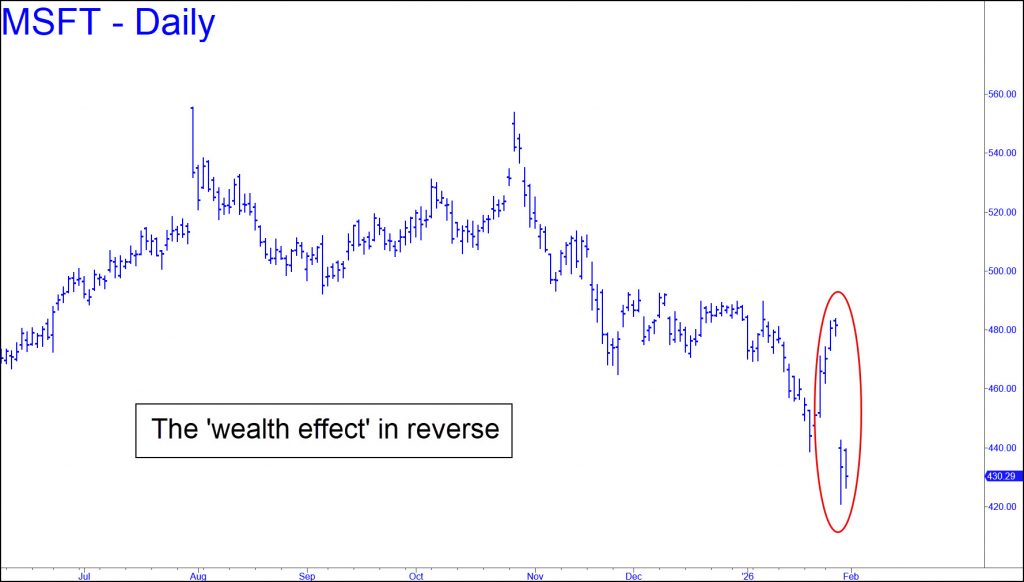

So why have shares been unable to develop a head of steam on Fridays, when irrational exuberance has typically been highest? There are two likely reasons. For one, the AI Bubble has popped. This occurred without much fanfare on January 29, when Microsoft shares dove $60, or 12%, overnight. The shills initially took this for a one-off event, an ‘adjustment’ in the share price of a big company they felt was heavily over-invested in AI. Rick’s Picks saw it as the beginning of the end for AI mania and said so in a commentary out that weekend. Trillions of dollars of valuation have since leaked from the ‘lunatic sector’ (aka the Magnificent Seven) and other stocks, but the deflation is likely to grow much worse before the bloodletting ends.

The second reason shares are acting so punk is that Trumpmania is over. The President effectively killed it with a State of the Union speech last week that bragged about how the economy is going great guns, and how he crushed the inflation caused by his sock-puppet predecessor, ‘Joe Biden’. Any middle-class American who heard the speech recognized it for what it was: more dubious hype than fact. Workers and small-business owners are struggling harder than ever to stay afloat, but inflation is crushing them anyway. And although the cost of eggs, gas and some other staples may have fallen since Trump took office, prices for all the big-ticket items are soaring out of control: health insurance, automobiles, homes, tuition, property insurance, you name it.

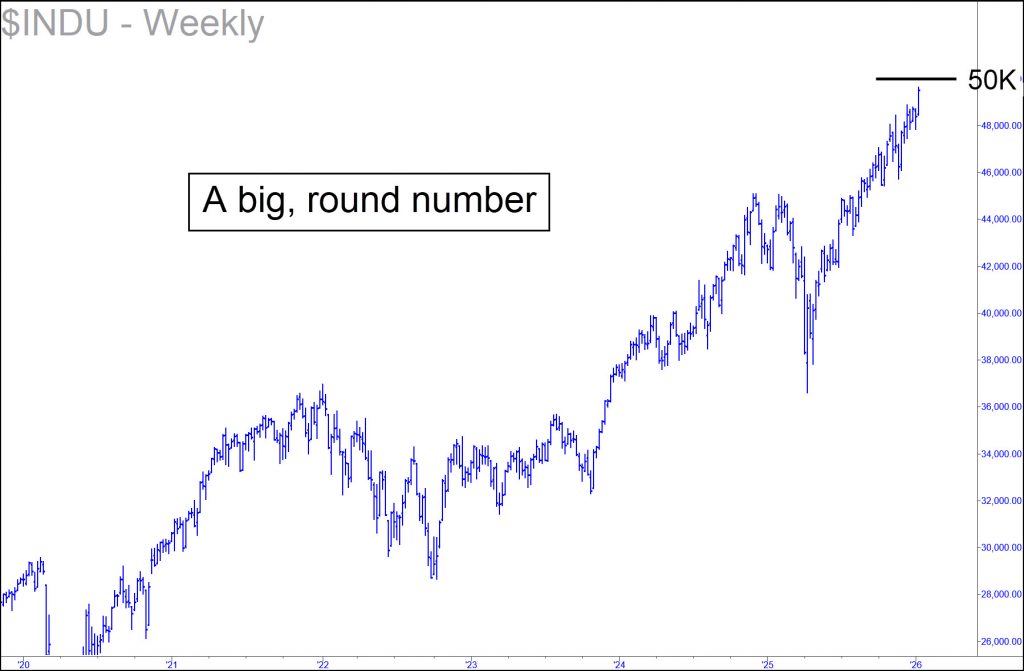

Under the circumstances, an exuberant leap to new highs seems most unlikely for the broad averages. The Dow Industrials have eased somewhat after head-butting 50,000 for a few days. DaBoyz are waiting for a news catalyst to drive a short-covering panic. This is the primary force powering all big rallies, the only source of buying strong enough to push stocks past previous peaks and thick layers of supply. If your imagination tells you what bullish news will cause this to happen, then you should be buying stocks hand-over-fist now, not even waiting for a significant dip. I must confess, however, that I am out of ideas. There are plenty of things that could go wrong, though, and the interview I did Friday on This Week in Money discusses them in detail. Click here to access it.

Was China’s Kung Fu Moon-Shot Real?

Robot demonstrations are notorious for going comically awry. Seat Robby at a staged dinner and he will stab himself in the eye with a forkful of make-believe mashed potatoes. Have him put a butter dish back in the refrigerator and he’ll slam the door on his head. So what, then, are we to make of this video, which showcases China’s latest entry in the global competition to build robots that are more human?

Stunning, isn’t it? This is a kung-fu ballet, performed by acrobatic children and a troupe of robots who move with the gracefulness of dancers at the barre. When they abruptly shift gears, vaulting into ten-foot-high somersaults, they land squarely on the rubberized balls of their feet, perfectly balanced. Even more impressive is that there are a dozen of them doing these elaborately choreographed moves in perfect synchronicity.

Search Google for a skeptical take on all this and you have to call up a fifth page of results to find anyone who doubts the video is real. Ever the skeptic, my instinct is to disregard all the oohs and ahhs and focus on the doubters, just as many of us do with product reviews on Amazon. Here’s a jibe on X from an observer who supposedly witnessed a similar demonstration in Shenzen a month earlier: “The [robots were] slow, shaky and could barely shuffle, let alone do any of this. This isn’t the first time [Chinese manufacturer) Unitree has used CGI to fake capability.”

“13 Billion Views”

So who’s telling the truth? It’s an important question, since the video reportedly has attracted 13 billion views so far. That’s according to Chinese news sources, but does the outside world have any reason to trust them? The country’s leaders have a strong incentive to show off the nation’s technological prowess, especially when it is not a nuclear missile glowering at the world from Tiananmen Square. The kung fu demonstration was a very big deal in the world of technology, and if the video was not enhanced, the robots’ performance would be on a par with America’s moonshot in 1969 with Apollo 11.

Even Musk concedes that China is “kicking ass” in humanoid robotics. However, as we went to press, he had not commented publicly on the kung-fu demonstration, which was televised during China’s recent Spring Festival Gala. If the video turns out to have been undoctored, he’ll have his work cut out for him. Is there a cage-fight-of-the-century on the horizon?

Musk Will Be the Last AI Entrepreneur Standing

AI hubris has got itself in a bind, trapped between two conflicting stories, neither of which seems likely to end well. One story has the boys in the billionaire’s club throwing untold sums of money at a technology that seems increasingly unlikely to produce commensurate returns. The other story has been threatening whole sectors of the economy with creative destruction: software development, financial, legal and accounting services, money management, entertainment and even trucking. Each day, there’s a menacing new headline about some industry whose workers, mostly white-collar, are about to be replaced by thinking machines.

The recent trucking news concerned the logistical problem of routing vans so that they are filled with cargo all the time. Artificial intelligence has taken on this challenge, squeezing out inefficiencies in ways that human workers could not have imagined just a few years ago. The shares of companies that do this work crashed last week, victims of AI’s Grim Reaper. It won’t end there, either, since driverless fleets of trucks are coming, and soon. Humans will be needed to load and unload them — that is, until Musk robots come along to relieve them of their jobs.

A Chimpanzee Reflex

Whenever creative-destruction stories hit the tape, the chimpanzees entrusted with America’s 401(k) savings instantly dump the shares of all companies likely to be impacted. The trouble is that the list is growing so fast that it has become hard to imagine an area of the economy that will not be affected. We are talking mainly about job losses, and there seems to be no end to the number and variety of positions in AI’s crosshairs.

So what’s an investor to do? Our money is on Musk, arguably the only player with a strategy imaginative enough to encompass and integrate AI’s myriad possibilities while also tackling its biggest challenges. Some laughed at his demand for a trillion-dollar paycheck, but it grossly understates his ambitions. With plans to be on the moon in just a few years, he is thinking not only outside-the-box, but outside-the-planet. Lunar manufacturing and assembly done by robots will not only solve the problem of how to cool and power GPU server farms, but also provide a low-gravity launching pad to slingshot building supplies to Mars. Humans will get there in rockets, already engineered, that can be refueled and reused within hours of returning to Earth.

Musk has repeatedly demonstrated that he can take multibillion-dollar losses without flinching if an idea hits a dead end. The tens of billions he supposedly overpaid for Twitter has come to seem like relative chump-change for him. And he has the technological means to put Uber, Lyft, Waymo and even Apple out of business in mere months if he wanted to. But he has bigger fish to fry. Musk will be the last man standing when the huge AI shakeout now under way buries the Billionaire Boy’s Club (although not Palantir’s Alex Karp, whose mind is as sharp as Musk’s). Musk makes them all look like amateurs, and the planned merger of SpaceX and xAI, his AI startup, will be the most significant business deal ever hatched. Take a piece of it and you can’t lose. [Here’s a link to my latest interview with Jim Goddard at HoweStreet. The headline alludes to ‘downside targets for silver and gold,’ but that was but a minor concern in this interview. RA]

Time to Jump on the Miners

[The following commentary was written by Steve Houck,a longtime investor in bullion and knows the markets well. He is also a friend and a former business partner. RA ]

Looking at the froth in silver, it became apparent it was time to rotate from overvalued to undervalued once again. Selling precious-metal ETFs like SLV and AGQ meant cash was available for the next trade, but where to go? While silver has been on a relentless tear, the miners have only grudgingly moved higher. Yes, there have been good moves in many of the miners, but quite a few trade with a ball and chain weighing them down in the form of fear. That’s because the last two times silver surpassed $50, in 1980 and 2011, it collapsed and went into long, grinding bear markets. Silver mining stocks get caught up in this because the public doesn’t believe prices will hold, and that silver will fall back to earth.

But what if the new floor is $55 to $70, and not the $15 to $25 range that obtained for decades? This silver run-up is different because it’s about one thing: physical metal. Just look what;s happening: China, the U.S. and the rest of the world are hoarding and trying to secure metals. That puts the miners in the catbird seat, because they produce and control the supply. Their shares, however, are still being priced as though silver were selling in the $20s even though it averaged close to $50 for the entire fourth quarter 2025. The miners wil start to report earnings next week, beginning on February 16. Because many of them will announce blowout earnings, now is the time to capitalize!

How to Play It

How to play this? Over the last two decades of investing in silver miners, the most important lesson I’ve learned is to stick with producers and developers with projects slated for the near-term. I want the companies I invest in to be extracting metal from the grown now, or within no more than 1-2 years. I start with the major producers and such crowd favorites as Coeur Mining (CDE), Hecla (HL), and Pan American Silver (PAAS). Once I have a good group of the majors, I’ll move to junior producers whose stocks have the potential to appreciate by 500% to 1000%. My largest junior positions are Avino Silver & Gold (ASM), Americas Silver (USAS) and Santacruz Silver Mining (SCZM). These major and junior producers Guanajuato Silver (GVSRF). Silver Storm (SVRS: Vancouver); and Vizsla Silver (VZLA). Here’s a link to comments on ‘X’ that corroborate the essay above with added details.

Microsoft’s Plunge Pricks AI Bubble

Pity the J-school rookies who are paid to explain why the stock market did what it did on a given day. On Thursday, Microsoft shares lost nearly a half-a-trillion dollars of value. But why? Bloomberg’s Evening Briefing called it a ‘rap on the knuckles’ for the company’s huge spending on AI projects that seem increasingly unlikely to pay off. But isn’t a rap on the knuckles the way nuns used to deal with minor behavioral lapses in young boys? If so, then Microsoft deserved 40 lashes with a rattan cane. Although the story was treated by the hacks who wrote it as a news event, what it portends is nothing short of financial calamity, reported in daily installments. For it is not just Microsoft that has squandered hitherto unimaginable sums on failing AI projects, but a dozen other corporate behemoths, including lunatic-sector (aka ‘Magnificent Seven’) stalwarts Amazon, Google, Facebook, Nvidia and Tesla.

Pity the J-school rookies who are paid to explain why the stock market did what it did on a given day. On Thursday, Microsoft shares lost nearly a half-a-trillion dollars of value. But why? Bloomberg’s Evening Briefing called it a ‘rap on the knuckles’ for the company’s huge spending on AI projects that seem increasingly unlikely to pay off. But isn’t a rap on the knuckles the way nuns used to deal with minor behavioral lapses in young boys? If so, then Microsoft deserved 40 lashes with a rattan cane. Although the story was treated by the hacks who wrote it as a news event, what it portends is nothing short of financial calamity, reported in daily installments. For it is not just Microsoft that has squandered hitherto unimaginable sums on failing AI projects, but a dozen other corporate behemoths, including lunatic-sector (aka ‘Magnificent Seven’) stalwarts Amazon, Google, Facebook, Nvidia and Tesla.

Analysts have projected total global AI spending of $2.6 trillion across all companies and markets in 2026. Here’s where the math gets interesting. Microsoft share of those outlays would be an estimated $140 billion. Investors knocked three times that from the company’s valuation last week, while also imploding the world’s gaseous ‘wealth effect’ by a rich but still-invisible multiple. If equal punishment were to be inflicted on the companies planning to spend the $2.6 trillion, the haircut would amount to nearly $8 trillion. That is arguably the approximate size of the AI deflation that lies just ahead, and it will activate a black hole that could double or triple losses in other classes of investible assets. Treasury paper will go bounding in the other direction, finally getting some respect as a safe haven.

When to Take Heart

Granted, neither the math nor the logic is airtight. But the $8 trillion guesstimate is probably more credible than the rap-on-the-knuckles summation offered by Bloomberg. Their reporters are too lazy and too poorly trained to attack the real story, which will soon spread far beyond Microsoft. As it develops, and stocks begin to fall with increasing momentum, the op-ed columnists will catch the scent of panic and write more explicitly about the AI bubble’s collapse. Reporters will eventually follow suit, and that’s when you can take heart, since the bear market will be half-way to a bottom by then. (Click here for my latest interview — “Let it all hang out!” — with Jim Goddard at Howe Street.)

What Rough Beast?

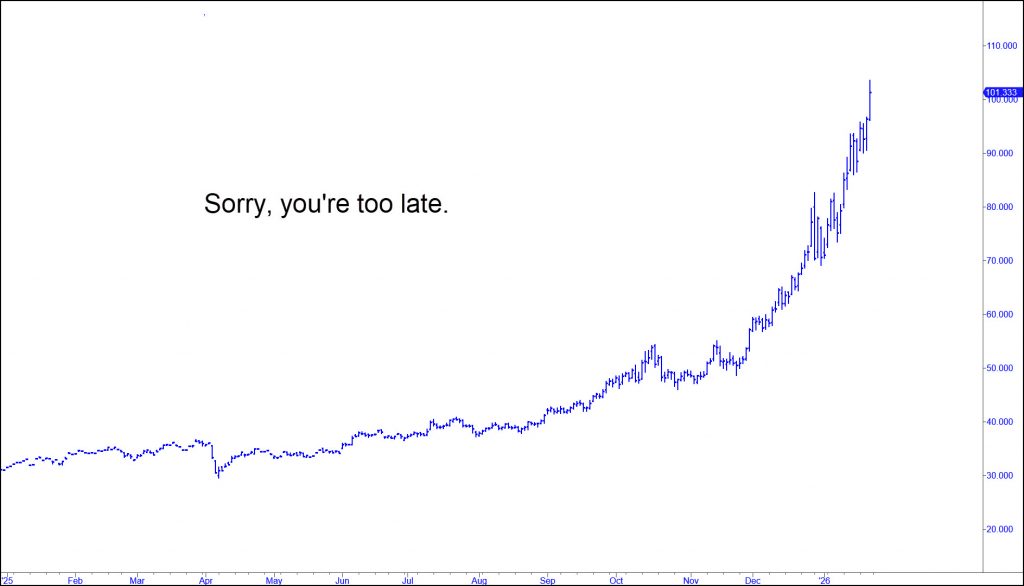

If you can’t guess what commodity the chart shows, you must be living on Mars. It is in fact a long-term picture of silver, which went ballistic in December. The price has doubled since, blowing out a $50 top that had stood since 1980. That price became a part of silver’s legend, since it is where one of the wealthiest men in the world, oil tycoon Nelson Bunker Hunt, met his financial Waterloo. With his brothers, Lamar and William, ‘Bunky’ had attempted to corner the market by buying up silver and futures contracts amounting to about a third of the world’s supply. Comex regulators responded by raising margin requirements so high that there were just two players left in the game: the Hunts and Eastman Kodak, a huge industrial user of silver. From a record $50.45 per ounce, the price plunged by half in mere days, forcing the Hunts to sell nearly everything they owned to meet margin calls. In retrospect, they seem not to have broken any rules. However, the Comex was forced to crush them in order to stabilize the metals market.

If you can’t guess what commodity the chart shows, you must be living on Mars. It is in fact a long-term picture of silver, which went ballistic in December. The price has doubled since, blowing out a $50 top that had stood since 1980. That price became a part of silver’s legend, since it is where one of the wealthiest men in the world, oil tycoon Nelson Bunker Hunt, met his financial Waterloo. With his brothers, Lamar and William, ‘Bunky’ had attempted to corner the market by buying up silver and futures contracts amounting to about a third of the world’s supply. Comex regulators responded by raising margin requirements so high that there were just two players left in the game: the Hunts and Eastman Kodak, a huge industrial user of silver. From a record $50.45 per ounce, the price plunged by half in mere days, forcing the Hunts to sell nearly everything they owned to meet margin calls. In retrospect, they seem not to have broken any rules. However, the Comex was forced to crush them in order to stabilize the metals market.

What Does It Mean?

Silver’s current rise has been orderly, more or less, but with a pitch so steep that it caught many players with their pants down. No reason to feel sorry for them, since they are ethically and morally on a level with child molesters, broad-tossers and cannibals. But the radical shift in precious-metal prices relative to all other classes of investable assets raises a question that should concern us all. For it is not happening in a vacuum, and we can only guess at what it will mean years down the road. Will silver resume a monetary role? Is Trump licking his chops over the prospect of borrowing against all of the gold supposedly stored in Ft. Knox? Is gold predicting a crisis that would leave the global money system in wreckage? We’ll have our answer eventually, but it could already be very late in the game for those seeking the bomb-proof safe haven that gold has always offered.

Don’t Worry, Be Happy: The Bots Are Coming

Readers can be forgiven for wondering how long the ‘topping process’ I’ve alluded to over the last several months will drag on. As you will have long since concluded, no one can answer that question with confidence. For all that we supposed experts know, the bull market begun in 2009 could still be chugging blithely along two years from now when Trump’s successor takes office. But this will be the last you’ll hear from me about a topping process, even if the bear market for which it will set the hook is as likely as tomorrow’s sunrise. It will be a doozy, catalyzed by the unwinding of an Everything Bubble that already owns us, up to and including M&A superstars and big-time real estate developers. The implosion will inflict hard times on most Americans, especially Baby Boomers who went all-in with Nvidia shares, private equity schemes and rental properties mortgaged to the eaves.

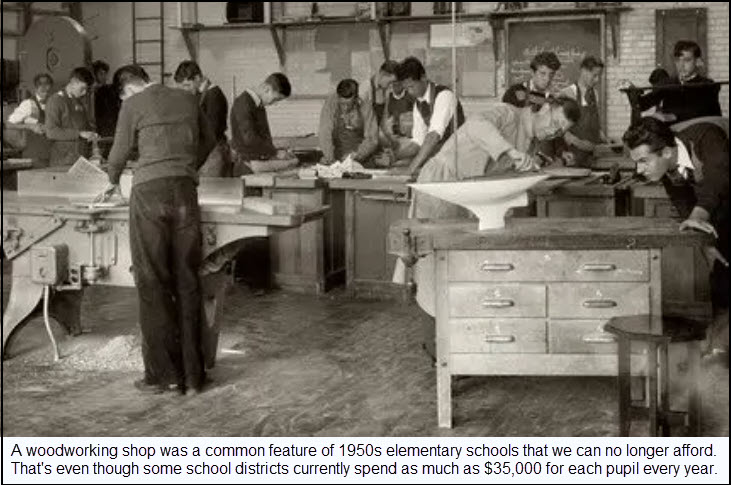

How worried should you be? I’d suggest taking doomsday predictions with a grain of salt. Speaking as a die-hard permabear who has been predicting a Second Great Depression for as long as anyone can remember, I’d be the first to concede there is no reason why the Dow Industrials and the S&Ps could not co ascend, possibly doubling or even tripling over the next 5–10 years. Just realize that any reported gains in the standard of living would be largely illusory, even as quality-of-life amenities that we took for granted in the 1950s continued toward extinction. Things like doctors making house calls, and mothers being able to stay home with their children. That was America’s Renaissance, even if no one knew it at the time.

Science to the Rescue!

Technology will come through for us as it always has, right? AI wizardry, huge productivity gains and millions of robotic workers are about to make life’s necessities plentiful for everyone, including baristas, down-and-out middle managers and college grads with useless degrees. If Elon Musk is right, savings will become optional, or at least less important, as thinking machines attend to our needs. They will help us navigate the shoals of daily life, sleeping with the homeless in doorways, and keeping them warm with blankets made from used styrofoam cups. They will cure cancer and make diesel fuel from spent cooking oil if an energy shortage should strand yachtsmen. And why not? If you believe Musk, the robots will be smarter than we are in five years. So deep and sincere is his faith in AI that we must assume he thinks the bots will be even smarter and more capable than he is. If such a world is coming, why worry about the stock market and the economy? Why worry about anything, really?

Why the Bull Market Doesn’t Need MAGA

The Dow is poised to hit 50,000 this week, a milestone that would have seemed surreal when the blue chip average, plagued by covid, was bottoming near 18,000 six years ago. Although there can be little doubt that Trump helped kick stocks into high gear, one could argue that a powerfully bullish economic cycle made the man rather than the other way around. Stated another way, the stock market’s spectacular rally reflects a cyclical mood-change across America that made Trump’s election not merely possible, but inevitable.

Would shares be at these heights with Kamala Harris in the White House? It seems implausible, since she could never have matched Trump’s ambitious agenda. This is not to suggest that all or even most of his initiatives will succeed. In fact, some of the most important ones could lay an egg. Tariffs, for instance. They amount to little more than a new tax on global trade, with consequences that have yet to produce a clear result, let alone a positive one. His promise to make life more affordable for most Americans could also be a non-starter for reasons explained here a couple of weeks ago. And his plan to revitalize Venezuela’s oil production has already been labeled ‘uninvestible’ by the CEO of ExxonMobil. As for the reshoring of manufacturing. no one is talking about how revived and new factories would have to be practically worker-less to compete with heavily robotized plants in South Korea, China, Japan and elsewhere.

What Jobs?

And what about Trump’s plan to radically reorganize the mortgage market so that young people can buy houses? Although this sounds appealing, what will be the source of their income? The job market is changing so rapidly, especially with AI increasingly replacing more white-collar workers, that even seasoned recruiters can no longer predict where the jobs will be in ten years.

Stocks have soared nonetheless, not because Trump will necessarily succeed at making American great again, but because, for better or worse, he is perceived by investors and the entire world as being solidly in command of the nation’s affairs. Realize that stocks rose sharply during Biden’s first two year in office. If shares could do that while a head of cabbage occupied the White House, their turbocharged performance under Trump should have surprised no one. Even a do-nothing Harris might have enjoyed the economic Grand Supercycle’s runaway finale by simply holding onto the reins.

So Much Is Riding on Silver!

The speculative frenzy in silver has provided welcome relief from AI claptrap, but will it last? There are a hundred theories about why silver has come exuberantly to life after lagging gold for so long. I’ve been puzzled myself, since my technical runes suggest that gold futures could make an important top at $5132, about $800 above Friday’s settlement price. Silver would likely peak at the same time, unless the squeeze on physical supply were to pick up enough climactic energy to cause an historical readjustment in the gold:silver ratio. The Founders thought 15:1 was the correct peg, implying silver could be trading for $342 with gold at $5132. That sounds farfetched, but stranger things have happened in the financial world, especially in markets caught in short squeezes.

What is most peculiar about the current run on silver is that it probably couldn’t have occurred without Trump’s blessings. He has said he wants a much higher gold price in order to monetize America’s few remaining, unhocked assets (including residential real estate). Letting silver off the leash would make almost everyone feel at least a little richer. The problem is, some of Trump’s most powerful buddies in the banking business are short silver up the wazoo. Citi and B of A alone reportedly have loaned out at interest $4.5 billion of silver they do not possess, exposing themelves to potentially catastrophic losses if AG quotes should soar anew.

Trump’s Fortunes

And what if gold goes no higher than $5132? A corresponding top in silver followed by a steep slide in both could cap Trump’s fortunes. It would certainly destroy the comforting illusion that financial markets are under control. Of course, crazy ideas like that can only persist in bull markets. If stock averages were to sell off by 30%-40%, which they absolutely will at some point, whoever is President at the time will be not just a lame duck, but a dead duck. Keen for more of my latest rantings? Find them on This Week in Money by clicking here.