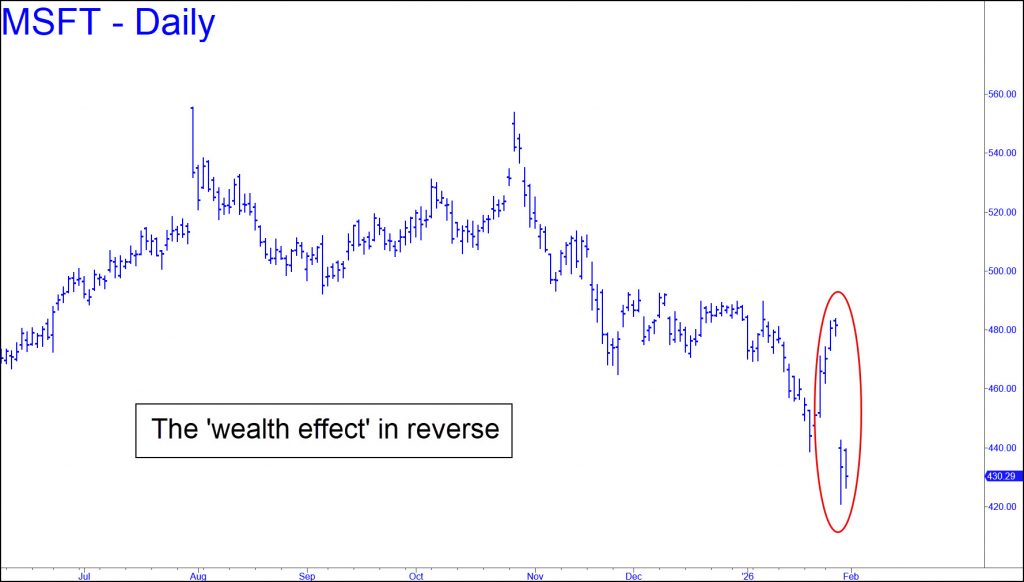

Pity the J-school rookies who are paid to explain why the stock market did what it did on a given day. On Thursday, Microsoft shares lost nearly a half-a-trillion dollars of value. But why? Bloomberg’s Evening Briefing called it a ‘rap on the knuckles’ for the company’s huge spending on AI projects that seem increasingly unlikely to pay off. But isn’t a rap on the knuckles the way nuns used to deal with minor behavioral lapses in young boys? If so, then Microsoft deserved 40 lashes with a rattan cane. Although the story was treated by the hacks who wrote it as a news event, what it portends is nothing short of financial calamity, reported in daily installments. For it is not just Microsoft that has squandered hitherto unimaginable sums on failing AI projects, but a dozen other corporate behemoths, including lunatic-sector (aka ‘Magnificent Seven’) stalwarts Amazon, Google, Facebook, Nvidia and Tesla.

Pity the J-school rookies who are paid to explain why the stock market did what it did on a given day. On Thursday, Microsoft shares lost nearly a half-a-trillion dollars of value. But why? Bloomberg’s Evening Briefing called it a ‘rap on the knuckles’ for the company’s huge spending on AI projects that seem increasingly unlikely to pay off. But isn’t a rap on the knuckles the way nuns used to deal with minor behavioral lapses in young boys? If so, then Microsoft deserved 40 lashes with a rattan cane. Although the story was treated by the hacks who wrote it as a news event, what it portends is nothing short of financial calamity, reported in daily installments. For it is not just Microsoft that has squandered hitherto unimaginable sums on failing AI projects, but a dozen other corporate behemoths, including lunatic-sector (aka ‘Magnificent Seven’) stalwarts Amazon, Google, Facebook, Nvidia and Tesla.

Analysts have projected total global AI spending of $2.6 trillion across all companies and markets in 2026. Here’s where the math gets interesting. Microsoft share of those outlays would be an estimated $140 billion. Investors knocked three times that from the company’s valuation last week, while also imploding the world’s gaseous ‘wealth effect’ by a rich but still-invisible multiple. If equal punishment were to be inflicted on the companies planning to spend the $2.6 trillion, the haircut would amount to nearly $8 trillion. That is arguably the approximate size of the AI deflation that lies just ahead, and it will activate a black hole that could double or triple losses in other classes of investible assets. Treasury paper will go bounding in the other direction, finally getting some respect as a safe haven.

When to Take Heart

Granted, neither the math nor the logic is airtight. But the $8 trillion guesstimate is probably more credible than the rap-on-the-knuckles summation offered by Bloomberg. Their reporters are too lazy and too poorly trained to attack the real story, which will soon spread far beyond Microsoft. As it develops, and stocks begin to fall with increasing momentum, the op-ed columnists will catch the scent of panic and write more explicitly about the AI bubble’s collapse. Reporters will eventually follow suit, and that’s when you can take heart, since the bear market will be half-way to a bottom by then. (Click here for my latest interview — “Let it all hang out!” — with Jim Goddard at Howe Street.)