[Events in the Middle East have overshadowed my narrow economic critique of President Trump in the commentary below. His alliance with Israel to knock out global jihad’s command structure is likely to change the world in ways no one can predict. It will also test the idea that only military might can secure a lasting peace. RA ]

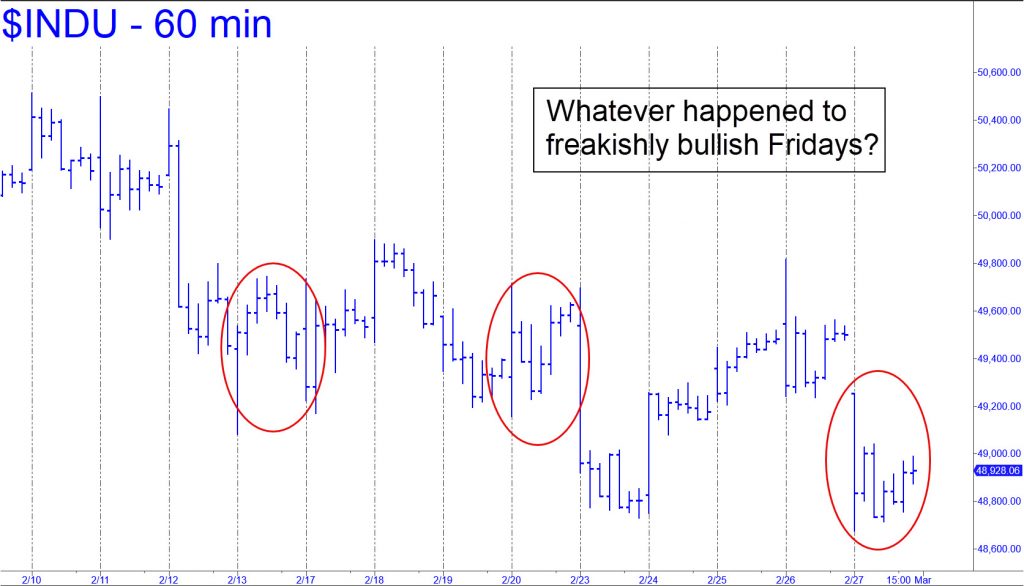

Stocks used to turn feisty toward the end of the week, but as the chart shows, the last few ‘Freaky Fridays’ have been pretty tame. My gut feeling is that this picture of tedium is the calm before the storm, and that stocks are being heavily distributed ahead of a major breakdown. Although I promised a few weeks ago that I wouldn’t mention the words ‘topping process’ again, the alternative would make me sound like a Wall Street shill. The Street’s best and brightest have been flat-out bullish on stocks since the 1929 Crash, having failed to issue a sell signal even on stocks implicated in some of the biggest scandals of the last hundred years. To cite a particularly notorious example, many of them were gung-ho on the shares of Equity Funding until the moment regulators halted trading in the stock one day in March 1973. Read about it here.

So why have shares been unable to develop a head of steam on Fridays, when irrational exuberance has typically been highest? There are two likely reasons. For one, the AI Bubble has popped. This occurred without much fanfare on January 29, when Microsoft shares dove $60, or 12%, overnight. The shills initially took this for a one-off event, an ‘adjustment’ in the share price of a big company they felt was heavily over-invested in AI. Rick’s Picks saw it as the beginning of the end for AI mania and said so in a commentary out that weekend. Trillions of dollars of valuation have since leaked from the ‘lunatic sector’ (aka the Magnificent Seven) and other stocks, but the deflation is likely to grow much worse before the bloodletting ends.

The second reason shares are acting so punk is that Trumpmania is over. The President effectively killed it with a State of the Union speech last week that bragged about how the economy is going great guns, and how he crushed the inflation caused by his sock-puppet predecessor, ‘Joe Biden’. Any middle-class American who heard the speech recognized it for what it was: more dubious hype than fact. Workers and small-business owners are struggling harder than ever to stay afloat, but inflation is crushing them anyway. And although the cost of eggs, gas and some other staples may have fallen since Trump took office, prices for all the big-ticket items are soaring out of control: health insurance, automobiles, homes, tuition, property insurance, you name it.

Under the circumstances, an exuberant leap to new highs seems most unlikely for the broad averages. The Dow Industrials have eased somewhat after head-butting 50,000 for a few days. DaBoyz are waiting for a news catalyst to drive a short-covering panic. This is the primary force powering all big rallies, the only source of buying strong enough to push stocks past previous peaks and thick layers of supply. If your imagination tells you what bullish news will cause this to happen, then you should be buying stocks hand-over-fist now, not even waiting for a significant dip. I must confess, however, that I am out of ideas. There are plenty of things that could go wrong, though, and the interview I did Friday on This Week in Money discusses them in detail. Click here to access it.