Investors enamored of gold now have two supposed contrary indicators to worry about: the New York Times, which did a front-page feature over the weekend on bullion’s growing popularity as an asset class; and CNBC, where a Deutsche Bank analysts on Friday predicted a $75 surge to $1300 an ounce over the next few days. Although we’ve never been comfortable following recommendations aired on CNBC, the ostensible endorsement of the Gray Lady is another story. Our respect for the Times’ business section goes back to the summer of 1976, when they were the first big newspaper to notice that a small company called Resorts International had opened an office in Atlantic City. Resorts’ common shares were selling for about $2 at the time, but – gold bugs take note – after the Times story ran in August, RTA class ‘B’ shares began a steady ascent over the next two years to around $160.

So don’t think that just because gold investments have gotten front-page treatment in the New York Times that that will be the kiss of death for precious metals. The Times, after all, is not merely some upscale cousin of the mentally retarded Newsweek. And for every half-competent, politically warped bloviator like Paul Krugman who writes for the paper, there is a top-flight reporter elsewhere in the newsroom like Floyd Norris, who gets his facts straight and covers the issues of the day with the kind of balance and understanding that can truly help readers get a handle on the news.

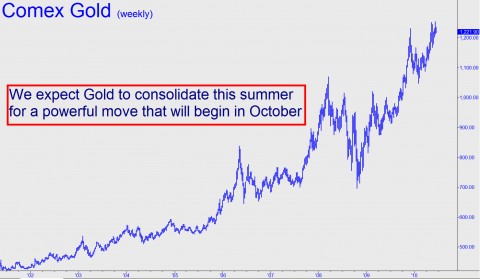

Gold Will Take No Prisoners

Contrary indicators aside, our own technical runes suggest that gold’s long-term bull market remains healthy and robust but that deep-pocketed buyers are in no particular hurry to push quotes up to new levels. Under the circumstances, we’d be surprised if the CNBC guest’s prediction of $1300 this week pans out. But if he returns to the airwaves in October – which is when we expect gold bulls to stop taking prisoners — he’ll probably have more luck. In the meantime, we attribute gold’s reluctant posturing of late to Europe’s newfound austerity. Whether or not Europe can handle the pain of fiscal deflation is an open question. For the present, however, no one should doubt that the countries that plan to cut back – at this time, Britain, Germany, France, and of course Greece – fully understand that a printing-press solution will only make the eventual day of reckoning worse, if not to say catastrophic. Whether or not you believe they will stay the course, this is not the time to bet against the euro – or on runaway inflation.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

“Genesis 2:12 And the gold of the land is good: there is bdellium and the onyx stone.

Haggai 2:8 The silver is mine, and the gold is mine, saith the LORD” via Robert

Gold is definitely a wonderful commodity but it should not be used for money and given an artificially inflated value (idolatry).