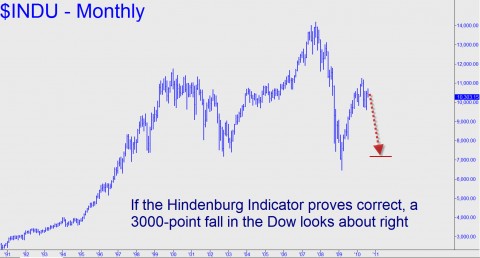

The Hindenburg Omen is once again predicting a stock market crash, and we don’t know whether to ignore it and relax because (even) the Wall Street Journal has picked up on it this time, or to instead batten the hatches because sometimes even lousy indicators can be right. Over time, the indicator, invented by a blind mathematician named Jim Miekka, has compiled an unimpressive track record. While virtually every crash since 1987 has indeed been signaled by the Omen, there have been so many false signals that the indicator’s overall accuracy has been a dismal 25 percent. Now, according to Miekka, the Omen is signaling a crash in September, having registered two key statistical events. For one, NYSE highs and lows both exceeded 2.5%; and for two, a rising 10-week moving average for the NYSE diverged relative to a negative McClellan Oscillator.

The Journal had no trouble rounding up the usual skeptics to comment on the voodoo aspects of an indicator that takes its name from the fatal and still-unexplained 1937 explosion of a German passenger airship docked at Lakehurst (NJ) Naval Air Station. Thirty-six people died, including 35 people of the 97 people who were on board, and the cause of the fire was never determined. “We always love good conspiracy theories,” market strategist Joseph Battipaglia told the Journal. “I for one dismiss all these things because they usually erupt most numerously during bear markets.” Well, at least Battipaglia seems to be acknowledging that stocks are in a bear market. Many in his and the Wall Street Journal’s line of business – i.e., telling the public what it wants to hear about the economy — have yet to accept that all of those “green shoots” that supposedly were springing up a little more than a year ago were just hallucinations. For the hard-core optimists, the stock market’s weakness over the last three years, including the Dow’s horrific, 7728-point plunge from the October 2007 high, has been a mere correction in a long-term bull market begun in August 1982.

When ‘Everyone’ Is Right

What do we think about this latest Hindenburg signal? Not much, even though we do believe that a major crash is long overdue. Still, we’re on record from a couple of months ago predicting a boring summer, and that has so far been the case. Granted, that’s just dog-bites-man fare in the forecasting world, much like predictions of crashes in early autumn are the only game in town come Labor Day. Sometimes, though, the canny contrarian has to allow for the possibility that “everyone” – i.e., the multitudes who are expecting an autumn crash – will be right for a change. Will this be the year of the October un-surprise? Perhaps. For all we know, the crash may already have begun with last Wednesday’s 260-point fall.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick The Hindenberg Omen is about 40% accurate if you also use the times the market was down 15% after the numbers hit. Check it out. Bill