(Are stocks and Treasury bonds w-a-a-y too revved-up over the prospect of more quantitative easing? Our good friend Doug B. thinks so, and he is predicting that it’s all about to end badly for the bulls. Americans are about to experience a collapse in the standard of living, says Doug, and there is nothing we can do about it. The good news is that the pain and sacrifice that lie ahead will allow us to rebuild a balance sheet that has left the nation asphyxiated by debt. A financial advisor based in Boulder, Colorado, Doug is a disciple of the legendary Bob Farrell and an occasional contributor to Rick’s Picks. He is an outside-of-the-box thinker who has gotten the big trends right over the decade we have known him. In the essay below, he builds his argument one brick at a time with “gozinta” and “gozouta” — sophisticated accounting terms representing the generic sum of all inputs into an entity and the generic sum of all outputs from that same entity. RA)

I have two long held and very strong opinions — one about the stock market and the other about the Treasury bond market. I believe that, before the secular bear market in stocks that began in 2000 runs its course, we will be lucky if we do not achieve lower valuation levels than were typical of previous secular bear market lows. That implies a 6% dividend yield and a P/E multiple of eight on the S&P 500. (And I mean the index as a whole — more on that later.) In addition, I believe that the Great Bull Market in bonds, which began in 1981, will end in parabolic fashion. The consensus will believe that inflation is off the table for at least a generation and deflation is a certainty. A 1.5% yield on a 10-year bond will be rationalized because, with 1% or 2% deflation, that’s 3% real! I believe the time is ripe for these two events to come together, providing us with a spectacular opportunity for a great gozouta and an even greater gozinta.

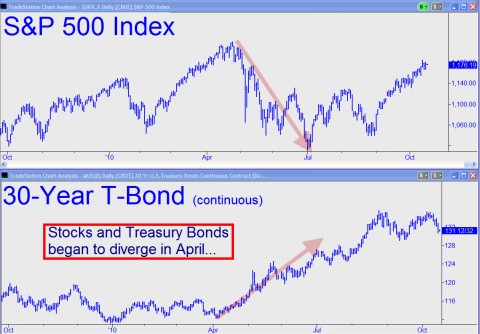

Since the S&P 500 completed its 80% “B Wave” bear-market rally in late April of this year at 1220, it has retreated 17% to the end of June (1010) and rallied back 15% (1160) to form the right shoulder, down 5% from the April peak (funny how the math works). The 10 year Treasury bond yield peaked in early April at 4% and yields have declined continually to 2.4% today with the bond price up over 10%. (In fact, the last time yields were 2.4% the S&P was at 800). What caught my eye was the fact that the S&P and bond yields have dramatically diverged since July 1, when the process of forming the right shoulder began. Normally, stock prices and bond yields move together, so it raises the question of which is accurately forecasting the future. Then again, what is the formation of a right shoulder other than an opportunity for the smart money to sell?

Since the S&P 500 completed its 80% “B Wave” bear-market rally in late April of this year at 1220, it has retreated 17% to the end of June (1010) and rallied back 15% (1160) to form the right shoulder, down 5% from the April peak (funny how the math works). The 10 year Treasury bond yield peaked in early April at 4% and yields have declined continually to 2.4% today with the bond price up over 10%. (In fact, the last time yields were 2.4% the S&P was at 800). What caught my eye was the fact that the S&P and bond yields have dramatically diverged since July 1, when the process of forming the right shoulder began. Normally, stock prices and bond yields move together, so it raises the question of which is accurately forecasting the future. Then again, what is the formation of a right shoulder other than an opportunity for the smart money to sell?

Wall Street ‘Wisdom’

Conventional Wall Street wisdom interprets the divergence as follows: Since the outlook for growth is challenged, the Fed will most likely engage in quantitative easing in the event that the economy falters. That will be good for stocks because some significant portion of the money they “print” (whatever that means) will find its way to buyers of stocks. It is assumed that the buyers of stocks are the proprietary trading desks of the primary dealers that the Fed injects with cash in exchange for the Treasury bonds they buy in the QE; and the hedge funds that those same banks supply leverage to in their role as prime brokers. Under normal circumstances, the public would be in there somewhere too, but they seem to have left the building. The Treasury bonds are rallying (yields falling) because investors are anticipating the Fed buying them when they embark on QEII. Of course, that is kind of circular, but let’s move on. In addition to stocks and bonds going up, so are gold and commodities because the dollar is becoming more of a fiat (or was that Alfa Romeo?) currency. One has to believe that dollars are somehow different from Treasury securities, but, once again, let’s move on. One also has to believe that Europe and Japan somehow have it more together than the good-old USA, which is ridiculous (it’s actually Brazil and China and India that are such garden spots).

Layered across the whole conventional wisdom (because we all need to invest for the long haul) is the idea that the Fed will succeed eventually in engineering a self-sustaining expansion and inflation (or hyperinflation if we’re really fortunate) will be the by-product. In this way, the long bond can be finally proven to be an irresponsible asset allocation choice and the Ibbotson Chart can return to its former glory. Asset appreciation will once again outperform compound interest!

Where We Are

OK, so here is my alternative interpretation of where we are: The decline in Treasury bond rates since early April is similar to the decline that began in June of 2007. The rate on the 10-year dropped from 5.3% to 3.5% between June 2007 and March 2008 (just before they taped the $2 bill to the revolving door at Bear Stearns headquarters). You can remind me why everyone thought the rally in bonds then didn’t mean anything. But it presaged the Financial Crisis. Back then, after the decline in rates (that was not accompanied by a drop in the S&P 500), the Treasury Department and the Fed came to the rescue and bailed out Br’er Stearns. (I mean Bear Stearns. Br’er Stearns was in the Uncle Remus stories). This time around, after the decline in rates (that has not been accompanied by a drop in the S&P 500); we will get the Economic Crisis. This time, the Fed and the Treasury Department are out of bullets. They do not have the tools to coax a return to private sector borrowing this early in a secular credit collapse. There is no one left to bail out.

QEII will replace Treasury bonds with free reserves at the really big banks. The really big banks already have zillions of free reserves and they are finding it challenging to find a suitable investment for them. Very Japanese. Adding another trillion will not make more money available to prop desks and hedge funds. So maybe we should just take the collapse in Treasury bond rates at face value. It has presaged the next contraction that has now begun without an intervening recovery to allow the economy to catch its breath. That, of course is a dire outlook and one fraught with deflation.

As for the stock market, it is priced at a 2% dividend yield and 18X trailing 12 months reported earnings. That 2% dividend yield includes 0% for Apple and 4.25% for Pfizer. In 1979 when “The Death of Equities” graced the cover of Business Week, the drugs were the growth stocks and sported 2% yields. The boring blue chips like GE paid 8% and the deep cyclicals like Ford paid 10%. Public Service of Colorado did a secondary offering at 11 1/8 with a 16% yield. Those were the days! The S&P in aggregate yielded 7.7%. The P/E was 7.2. Lots of smarter, younger guys and gals than me who can work a computer will explain why it’s different this time. The favorite reason is that, back then, Treasury bond rates were much higher. They were, and a bull market soon began for both stocks and bonds. Rather tortured, trying to equate the two, don’t you think? Rather like alchemy-or apples and oranges. Suffice it to say however, low Treasury rates as a rationale for expensive stock valuations doesn’t hold water. Crazy low P/E ratios were present in the 1940s and 1950s when Treasury rates were lower than today. Stocks get really cheap because the public gets really pessimistic about the outlook and they are afraid of losing money, because that has been their experience for years and years. Then you have more sellers than buyers persistently and usually an alternative asset class that seems so much more sensible and with a better track record too. Sound familiar?

Different, But Not Better

Today, we have some things that are different, but not for the better. The entire post-WWII period was a credit expansion until three years ago and it ended with a bang. Nobody wants to use the 19th Century as a template for the future. However, we did blow the pages out of the history books with our Real Estate Bubble. This was much bigger and broader than Tulips and all the rest of the manias. In addition we started this credit collapse with a bloated, underfunded bunch of entitlements and safety nets. The next Roosevelt has more fiscal constraints than the last one. And don’t even talk about demographics. Mother Nature appears to have really hit a home run this time.

So it looks like we are entering into the “war to end all wars,” but this time it is not against some foreign power. “We have met the enemy and he is us” (to quote Pogo). It is a battle to rebuild the national balance sheet and we certainly will win, but the national dialogue is still mired in the old paradigm. How can we resurrect demand? This is not a time to be investing for growth. Very soon, it will become clear to the nation that we need shared sacrifice to pay off the debt and that will involve an enormous hit to consumption. Capacity will continue to be eliminated and asset values will suffer. Revenues and household income will remain under pressure for quite a while and profit margins will revert to the mean (and not too far below, if we’re lucky). Sentiment toward risk in the stock market will continue to change as it has in the real estate market.

Hence the gozinta. How tough will it be to buy Wal-Mart when it trades at a 6% dividend yield? Won’t we be afraid that it is headed for 8% like GE in 1979? I think the answer lies in the idea that first, you have to have a gozouta. If the 2039 Treasury Strip goes to 2.5%, that’s up 40% from here. Maybe it’s going to 2.25%, but so what? We will need to remember what Baron Rothschild’s answer was when he was asked how he became the richest man in the world: “I never buy at the bottom and I always sell too early.” Gozinta!

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

I noticed that the responses are dominated by very emotional, dogmatic people. I thought my essay was really fun and inviting. In the meantime, we all need to allocate our assets and modify our behavior to prosper (in relative terms) to the secular credit collapse. My next essay will be titled “Thoughts on Jubilee” because we are staring it in the face with the latest developments in foreclosure. Also, the Fed is just now signaling that they don’t have the balls for QEII. What an exciting world we live in. Don’t just envy the long Strip, buy it!