[All hell broke loose in the Rick’s Picks forum yesterday after Mario Cavolo, an unapologetic optimist who tends to see the glass as three-quarters full, let fly with the rosiest pronouncements we’ve heard so far on a U.S. dollar that has been sinking in value for nearly ten years. “So okay then,” wrote Mario. “We’ll devalue the dollar and a few years later, when U.S. assets are more and more attractively cheap, the money and investment and growth will start to flow back in.” This was just too much for Robert Moore, an intrepid blogger and occasional guest essayist on this page. Mario’s entire post can be found by clicking here. Below is Robert’s response. RA]

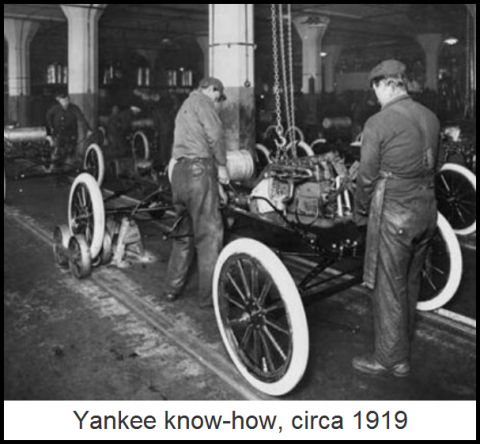

And how exactly does a weakening currency result in more attractive domestic prices? Or, are you suggesting that as the currency weakens that it will mean stronger U.S. exports, and therefore greater domestic growth? if so, then how, exactly, will these miraculous exports be manufactured? The cynic in me says that the U.S. will have to hit a very deep and rocky bottom before manufacturing and the ability to export the surplus ever returns to these shores. Our manufacturing infrastructure is decomposing, our labor rate to productivity ratios are the most God-awful on the entire planet (they are now even worse than the UK’s, and that is really saying something), and, as Wisconsin demonstrates, the people in this country still seem to feel that they are entitled to a six-figure gross income in exchange for doing manual labor that requires no more than 200 hours of vocational school training to qualify for.

We are a long way from Mario’s utopian renaissance. However, I do agree that at some point, the “genius” target of Mario’s man-crush will succeed in devaluing the dollar past a heretofore unknown/unseen inflection point where foreign dollar holders, no longer able to trade dollars for oil or local currencies, will instead repatriate these dollars back onto U.S. shores. The result will not be real growth in the U.S. economy or increasing real incomes for American citizens. The result will be unreal nominal growth in American prices.

I firmly contend that the global repudiation of the dollar which is just now getting under way will end up yielding a domestic repudiation of the dollar within the next 5-10 years. There are simply too many dollars in global supply for this not to come to pass. And I know you are all thinking, But what about the Fed soaking the excess supply back up by raising interest rates? Really? Look what a measly 125 basis-point increase in the prime lending rate did to our housing market in 2007. What do you think a real increase of 500-800 basis points will do to our economy? Now consider what a Paul Vockerian 1000-2000 basis point increase would do. I don’t think I even have to mention what a five percent increase would do the ability of the Government to service our existing debt, not to mention all the new debt that emerges from year-over-year budget deficits.

Dollar Is Finished

Here’s a hint: It wouldn’t stimulate our manufacturing and exporting machine, that’s for damn sure. Simply put, the dollar is finished as a valid measure of qualified economic capital. Finished. The game is over, even thought there still seem to be a lot of players on the field thinking that if they pick up the ball and run for the goal that they will make a difference on the scoreboard.

Basic, untenable economic facts: 1) The dollar is a measurement of debt; therefore the supply of dollars indicates the supply of unpaid debt; 2) all debts must either be paid in full, or defaulted on. The U.S. money masters can only have one real goal in mind, and that is to keep the dollar on life support long enough for the Chinese real estate market to implode, and for Chinese price inflation to hammer the underprivileged hard enough for the “Egyptian effect” to hit Shanghai.

I am convinced that there is a metric. I don’t know if it is a pre-conceived dollar level on the DXY, or if it is some level of backwardation in the Gold market, but I do know that when that metric (whatever it is) is reached, there will be a statement by Bernanke (that is probably already prepared) to Congress where he makes the soft “observation” that Gold “seems” to be acting more like a global currency than simply as an input commodity to the jewelry industry. And that will be quite a day.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

given there’s STILL confusion over the effect of QE on mks & $US Fx rates, here are two more key comments

1) reminder that bank lending is NOT affected by reserves

see: “QE Isn’t Adding Liquidity To The Market”

http://www.businessinsider.com/john-hussman-shreds-the-myth-that-qe-is-adding-more-liquidity-to-the-market-2011-2

2) when the FED says it’s “buying Treasuries”, you still have to ask “from whom?”

http://moslereconomics.com/2011/02/28/central-bankers-comment-on-qe/

[ a) the FED/Primary-Dealers must buy {& often resell} as many Treasuries as Congress wants to spend, regularly, by law; that’s the normal part;

b) QE = FEDs buying back specific-ranges {say, 10 year bonds} of existing Treasuries FROM Primary Dealers, at whatever level convinces them to sell;

all this does is pump even more capital into banks; partly to protect them from ongoing mortgage losses, & partly in the “hope” that they’ll be forced to do other things with their cash reserves; (no sign of that yet anyway, since there are few profitable options for now-finally-conservative banks)

]

What’s that all got to do with private investors? Well, roughly nothing. Much ado about nothing – just a lot of confusion stemming from not reading the FED fine print (which even the FED itself doesn’t seem to understand anyway).

You can’t make this stuff up.