Stocks were struggling to get airborne late Sunday night after dive-bombing the tarmac Friday on news that the U.S economy had created a measly 120,000 jobs last month. Index futures traded just briefly on Good Friday before electronic markets closed at 9:15 a.m. for the holiday, but that was long enough for DaBoyz to take stocks down to fire-sale levels on near-zero volume. The E-Mini Dow futures plummeted 120 points in less than two minutes, setting the glum tone when trading resumed Sunday evening. However, our hunch is that shares will not go much lower on the opening, since the dirtballs who work the night shift are so good at shaking down the rubes on ostensibly bad news. We say “ostensibly” because, for every trader who was disappointed that the alleged economic recovery appears to be losing steam, there were undoubtedly others who saw a new excuse for yet more Fed easing.

A cynical calculation, to be sure, since everyone understands by now that even though the central banks have been running wide open for years, it is not benefiting employment, only stocks. Not that Wall Street cares. Who needs jobs when it’s possible to promote runaway asset inflation with less effort and at a fraction of the cost? Granted, that’s not the way Mr. Obama and his supporters on Capitol Hill would prefer it, since higher share prices alone are unlikely to fool voters come November. But for the time being, a rampaging stock market still holds the promise of reviving job creation and perhaps even of causing home prices to start recovering.

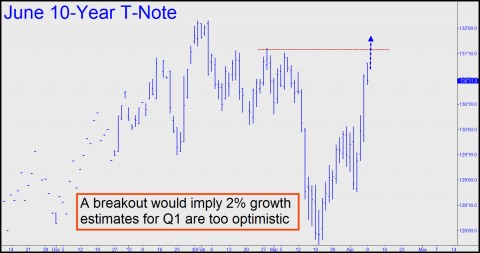

We see neither happening, implying that the stock market could be on shaky ground. For even as Q1 earnings estimates have come down, down, down, the broad averages have barely paused for breath since late November. Something’s got to give, and we think it will be share prices as it becomes clearer that first quarter GDP will be well under the 2% threshold the spinmeisters need to maintain the pretense that things are improving. Some of the smartest financial advisors we know are betting the figure will come in at around 1%, and they have heavily positioned their clients in Treasury paper to take advantage of this. From a technical standpoint, their logic will be hard to argue with if the price of the 10-Year Treasury Note pops above late February’s high. Note in the chart above that the June futures were close to this threshold Sunday night, just as stocks were potentially setting up for an avalanche once DaBoyz’ short-term shenanigans have run their course.

(If you’d like to have these commentaries delivered free each day to your e-mail box, click here.)

Seems like a lot of opinions about absolute immunity in office, except for High Crimes, which are first punished by the legislative body against said Man with immunity in office. Then there is the application of Master/ Servant Law under the 14th voluntary political act, a.k.a. 14th amendment creating equal corporate character at the federal union of states, where once stood several States in union. In normal times the Sheriff is the highest authority in any and all counties, the states themselves not having original jurisdiction in matters under the Common Law, as an absolute distinction to the legislative acts, or common law of the judicial branch which is now called ‘precedent’ law.

Everyone herein has been screwed over because the meaning of words has be supplanted by the tyranny of democracy. Common Law means the Mosaic Law. But, common law, means the legislative process of the courts in establishing precedent law were the Constitution does not play, but; contract and Roman Civil Law do. These are the ordinance of men, which passed 2000 years ago to be resurrected in the same abuses today.

You will read my first paragraph and believe it is goop and unintelligable. But, the truth is what it is. Maybe by the second paragraph the best will grasp the shell game of changing the meaning of words.

And finally, maybe the words of someone great ‘summarized’ will strike home “If one fails to know understand and exercise one’s rights One subjects one’s self to tyranny and so deserves.

The great We deserves what is at hand and what is comming because there is no ‘exercise’, only complaint.

I hope you get it; “the common law is the legislative precedent of the corporate administrative process of judicial legislation called ‘precedent’ wherein nothing new is judged against the Constitution, but against the Rule of Roman Law. The Common Law is the Mosaic Law that is Immutable. Under the Common Law trading in fiat is High Treason – period, end of subject. Under administrative ‘common law’ the masses in democracy can agree not to prosecute High Treason with money in agreement to Sin for illicit gain and unjust enrichment.

The Rules are not the Law. A real Sheriff can only be overruled by the Medicial Examiner in deaths. A corporate sheriff is inferior to the legislative body that created the office under Roman Civil Law. A real Sheriff is a minister to the court, and an elected official over all court matters, the Common Law Supreme Court of the County – formerly the County Comission.

Well, you get what a legislatively created slave sherif is, yes?