Alas, the devil is in the details for Europe’s latest attempt at financial alchemy. Much to the investment world’s apparent dismay yesterday, it turned out that the ECB’s Draghi had nothing very specific in mind when he pledged last week to defend Europe’s monetary union by any means necessary. In theory, and most immediately, such a rescue would entail using printing-press money to mop up Spain’s leprous bonds, lest rates push above 7%. Seven percent is the generally accepted danger threshold for sovereign borrowers, but we’d lower the red zone to around 2% ourselves. Our argument is that even a “mere” 2% rate imposes an asphyxiating burden in real terms, given the combination of deflation and fiscal austerity that has put Europe in a choke hold. Regardless, we won’t quibble over a spread of five measly percentage points if Europe’s bankers have indeed convinced themselves, as they seem to have, that servicing loans at a rate above zero is do-able in a negative-growth environment that could linger for years.

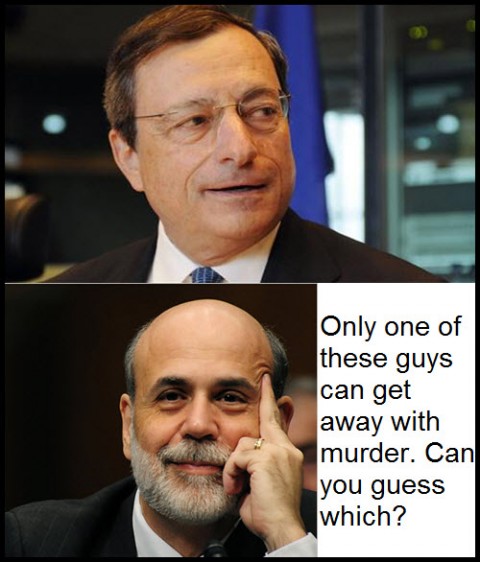

No doubt Mr. Draghi feels a twinge of Helicopter envy whenever he is called on to make heroic promises. His colleague Mr. Bernanke can say and do things that would get Draghi hauled in front of a tribunal – if not in his native Italy, which has always thrived on gray markets, then in Germany, where bankers continue to vex the rest of Europe with their prissy insistence that i’s be dotted and t’s crossed. With Germany riding herd on any tactic that Draghi might attempt, his task of fixing Europe is akin to Bernanke trying to bail out California with Ron Paul holding a veto. And while Bernanke could be counted on to evade even the most deadly surface-to-air inbounds, Draghi lacks the experience and political cover to stay airborne. Whatever unfolds, the Germans cannot be comfortable with Draghi’s idea of doing “whatever it takes” to suppress market rates. Germany is owed quite a sum of money by everyone else, you see, and one can hardly blame them for acting as though their neighbors are conspiring to pay them back in crapola.

Next, a 300-Point Dow Rally?

Recall that it was barely a week ago that stock markets around the world soared on Draghi’s words, meaningless though they may have been. There was also a week’s worth of anticipation that the Fed would launch QE3. When that failed to happen, stocks hovered for an entire day above the abyss, suspended in the air like Wyle E. Coyote; and then, yesterday, they fell. The delay is puzzling, but perhaps it took a one-two punch from the ECB and the Fed to send shares reeling. Even so, we could not help noticing that the Dow Industrials managed to recoup half of their losses yesterday after being down almost 200 points. Is the glass half-empty? Or perhaps half-full, but of hemlock? Rather than speculate about such things, we’ll rely on a purely mechanical reading of our stock charts for the answer, focusing for now on the sometimes omniscient price action of index futures. Difficult as it is to believe, the E-Mini S&Ps look like they could explode for 40 points – equivalent to a 300-point Dow rally – if traders catch what they initially take to be a pleasant whiff from Cucina Draghi. We’ll be watching from the sidelines ourselves, waiting as we so often do for the flatulence to subside.

***

Trading stocks, options and commodities in these treacherous times calls for great patience and skill. Click here if you’d like to see how Rick’s Picks approaches the challenge.

The Genius Of The Crowd

by Charles Bukowski

there is enough treachery, hatred violence absurdity in the average

human being to supply any given army on any given day

and the best at murder are those who preach against it

and the best at hate are those who preach love

and the best at war finally are those who preach peace

those who preach god, need god

those who preach peace do not have peace

those who preach peace do not have love

beware the preachers

beware the knowers

beware those who are always reading books

beware those who either detest poverty

or are proud of it

beware those quick to praise

for they need praise in return

beware those who are quick to censor

they are afraid of what they do not know

beware those who seek constant crowds for

they are nothing alone

beware the average man the average woman

beware their love, their love is average

seeks average

but there is genius in their hatred

there is enough genius in their hatred to kill you

to kill anybody

not wanting solitude

not understanding solitude

they will attempt to destroy anything

that differs from their own

not being able to create art

they will not understand art

they will consider their failure as creators

only as a failure of the world

not being able to love fully

they will believe your love incomplete

and then they will hate you

and their hatred will be perfect

like a shining diamond

like a knife

like a mountain

like a tiger

like hemlock

their finest art