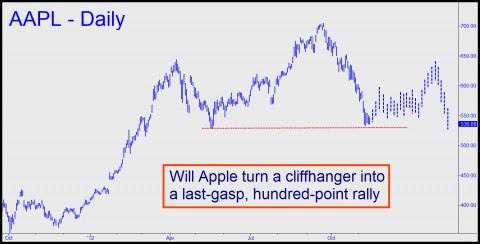

[DaBoyz attempted to goose stocks in the final hour yesterday, though without much success. Perhaps this was because they had already sprung the same stupid trap on bulls earlier in the day with a short squeeze on the opening bar. Now, even if They manage to close stocks higher ahead of the weekend, the mood is unlikely to linger into next week, since most of the bellwether stocks mentioned below decisively breached fail-safe supports intraday. Apple, in case you’re interested, did fall off the cliff, telegraphing a further plunge of nearly 5%, to 501.74, over the near term. RA]

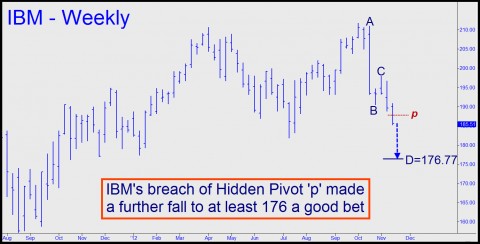

A stall has turned into a power dive on Wall Street, with some bellwether stocks plummeting toward key supports flagged here just a short while ago. One of them, IBM, actually breached a “midpoint Hidden Pivot” support yesterday at 187.78, and that spells more trouble for investors. The actual low at 185.25 was not far beneath the 187.78 support, but the latter number should have held very precisely if the stock is to avoid yet more carnage. Under the circumstances, IBM looks primed to fall a further $8, to at least 177.56, before it has another chance to get traction.

Meanwhile, Google, another stock whose year-end performance will weigh heavily on portfolio managers’ bonuses, relapsed to an important Hidden Pivot support of its own at 650.69. We’d drum-rolled a possible reversal from that number last week, and it came in the form of $20 rally from exactly 650.30. But if Google were about to recover its mojo, the rally should have lasted perhaps 8-12 days. Instead, it appears to have petered out in just a day-and-a-half, strongly hinting of significantly lower prices to come. Our minimum downside projection for the stock is now 605.83, a number you should jot down if you trade this vehicle or hold it as an investment.

Apple at Cliff’s Edge

If portfolio managers didn’t have trouble enough already, Apple was threatening to take another leg down after having fallen nearly 25% since mid-September from 705. Now, technically speaking, the stock’s best hope for the near-term would seem to lie in completing an incipient head-and-shoulders pattern on the long-term chart. The stock is sitting on the right-side neckline at the moment, and if the pattern traces out a textbook ending, it could propel Apple into a last-gasp rally of as much as $100. But hoping that the pattern continues to develop by-the-book is like hoping, when your parachute has failed to open, that you’ll be able to find a fluffy haystack to land on in the backwoods of New Hampshire.

A welcome exception to yesterday’s weakness was Facebook, a stock in which Rick’s Picks subscribers were advised to accumulate March 30 calls at prices ranging from 0.50 down to 0.25. Yesterday, with the Dow Industrials on their way to a 185 loss, our calls doubled in value as Facebook surged, yielding a theoretical gain of 50% over their 0.375 average cost. The underlying stock rallied 2.50, to 22.36, for a one-day gain of about 12.5%. Terrific as the stock looked, however, we’ve warned subscribers not to expect it to continue to swim against the tide. However, our hunch is that even if the Dow were to take a thousand-point plunge, the factors that have been pushing Facebook shares higher, whatever they might be, are probably sufficient to put a floor under the stock not far below.

Winds of War

There are so many negatives weighing on the stock market right now that it’s difficult to single out one of them as the cause of the sharp break since early October. There’s Obama’s re-election, of course, and although that could conceivably push fiscal debt to new extremes, it’s not likely to have any economic effect on a deflationary juggernaut that has been gathering force for nearly 30 years. Perhaps the most significant piece of news to have emerged in recent days, overshadowing even headlined rioting in Spain, Portugal and Greece, is the heightened threat of war in the Middle East. In retaliation for the nearly 200 rockets that rained down on southern Israel from Gaza a few days ago, Israel took out Hamas’ military chief officer and a few others with some air strikes. Things took a turn for the worse, diplomatically speaking, when Egypt yesterday recalled its ambassador from Tel Aviv. Israel has warned that any Hamas operative who shows his face above ground is as good as dead. For its part, Hamas has threatened to step up the rocket attacks.

Petraeus: Who Cares?

Meanwhile, the same unregenerate, leftist shitheads in the news media who took a see-no-evil, hear-no-evil approach toward scandal before the election are tripping over themselves to expose every sordid detail of Petraeus’s love affair. Will the headline orgy cease when it threatens to engulf Obama himself? Who cares. Whatever happens, we’ll stay focused on Gaza while tuning out all distractions related to the so-called fiscal cliff. As we all absolutely, positively know, the shiftless dorkwads we’ve elected to Congress are only going to kick the can further down the road when it comes time to fix the budget.

If war is about to break out in the Mideast and become above-the-fold news in America, the so-far 1120-point drop in the Dow Average since early October would not even begin to discount the economic damage that will come in its wake.

***

If you’d like to learn more about “camouflage” trading and the Hidden Pivot Method, click here.

Heh. I’ve been watching DRYS as my proxy for retail dry goods shipping with consternation as DRYS has been edging upward. Not anymore! Good luck Gary, you’re sure gonna need it.