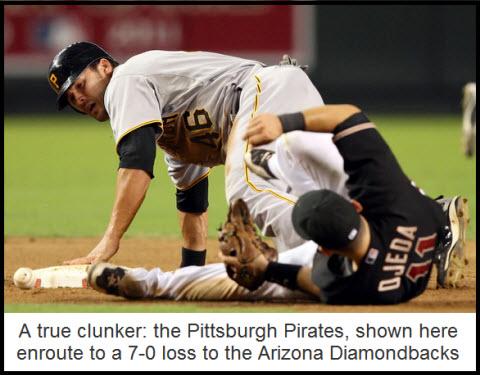

It’s almost official: the recession is maybe, probably, technically over. Helicopter Ben said so yesterday, and who are we to argue? You can hardly blame the guy for having his head in the clouds, considering how retail sales absolutely exploded in August. Sure, it was due almost entirely to a cash-for-clunkers program that taxpayers have yet to pay for. But the program will have been a bargain if it helps foster the impression Americans are in a spending mood again. And if that’s all it takes to get the economy rolling, then by all means, let’s extend clunker status to everything else in America that clunks, starting with Iron City’s peerless clunkmeisters, the Pittsburgh Pirates. We’ll personally chip in a TV set in our basement, a flat-screen behemoth that consumes more power than a diesel locomotive and weighs nearly as much.

Naturally, Bernanke’s message of Hope (and Change?) didn’t sit well with gimlet-eyed regulars in the Rick’s Picks chat room. But their mood brightened when someone posted a link to “The 4 Key Reasons an Economic Collapse Is Imminent”. Now that was more like it. Reason #1, in case you’re interested, is that there is a mountain of debt we are not only not dealing with, but which we are enlarging by the day. And we’re not talking about little stuff like the $1.8 trillion deficit baked into the current budget. No, we’re thinking about such longer-term shortfalls as the $102 trillion in unfunded liabilities from entitlements.

But we don’t blame Bernanke – and most Americans – for not worrying, since none of us has been taxed a dime yet to pay for it all. That’s the seductive aspect of the bank bailouts, the massive fiscal stimulus, the trillion dollar health care proposal and all the rest: taxes have yet to be raised to cover their costs. Maybe there really is such a thing as free lunch?

Shorting the Little Sonofabitch

Meanwhile, lest permabears grow sullen about the stock market’s tragicomic rally, we’ll mention that it’s possible to short the little sonofabitch every step of the way higher without risking much. We did so (again) yesterday, using a 1053.00 Hidden Pivot target in the E-Mini S&P. Here’s the recommendation exactly as it went out to subscribers Monday night: “That 1053.00 target may be so stale by now that it can be shorted without fear of bumping heads with amateur riff-raff. I won’t get in your way by suggesting the usual niggling stop-loss, but let me reiterate that the target itself is as clear and compelling as can be — a bet-the-ranch number if it had been hit last week on the first try. If you’re superstitious and would rather play the December contract, the equivalent target, a Hidden Pivot, lies at 1048.25.”

The trade could not have worked out more felicitously. The futures topped at exactly 1053.25 an hour before the day session began, then they dove nearly 11 points to an intraday low at 1042.75. Once again, we did NOT catch the Mother of All Tops. But we did manage to initiate a day trade that could have been worth as much as $500 per contract to anyone who followed our advice. Not bad for being “wrong” yet again. The best part is that one of these days we’re gong to be right.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick,

Admittedly there is a ton of money on the sidelines, if not new printed greenbacks. Who is to say they only find their way into “one” hot market. If there is so much new money and a crazy, who knows what’s really going on environment, can’t there be more than “one” bull or bear market? In a stretch, what a bull in both Gold AND the DOW? Isn’t the Gold market truly very small? I’d like to hear your take on this if you haven’t already made it clear, can’t this crazy moment in time chase two markets at once, maybe even for awhile?

TahoeBilly

&&&&

No question that liquidity is chasing stocks. But a true bull market? That event awaits the day when Americans decide they would rather hold anything but dollars. RA