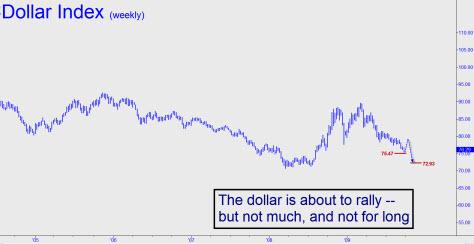

Here are two numbers to jot down if you’re interested in gold and the U.S. dollar: 75.47 and 72.93. Those are our current downside targets for the NYBOT Dollar Index, and we are quite confident that both will be reached in the fullness of time. The first lies just 1% below yesterday’s settlement price of 76.28; the second, 4.3% below it. Like you, we’ve heard many compelling arguments from dollar bulls and bears. Some think it is about to turn very strong, while others see a collapse. Our gut feeling is that the bulls will be right, and that the dollar will rise because of a deflationary short-squeeze on all who owe dollars. But when push comes to shove, we are perfectly willing to toss everyone’s best arguments out the window – including even our own – and to simply go with the charts. And the charts say, simply, that the dollar will continue lower after a corrective rally from just beneath current levels.

If so, the bearish targets given above would square nicely with our outlook for gold. We’ve been quite bullish on the stuff for a long, long time and have no disagreement with those who believe think bullion’s bull market is still in the warm-up stage. However, our immediate outlook calls for a potentially important top at $1074, basis the December Comex contract. That would imply a rally of about 5% from yesterday’s settlement price of $1020. If this scenario comes to pass, the high in gold would likely coincide with a temporary low in the Dollar Index at the 75.47 target given above.

A Buying Opportunity in Gold

And then? We won’t hazard a guess concerning how high the dollar will rally, but we would view it as corrective rather than impulsive. That means gold’s corresponding decline would be corrective as well, making it a buying opportunity for long-term bulls. Once gold’s correction has run its course, we would expect it to rally anew as the Dollar Index resumes its decline, presumably to the 72.93 target. Gold would probably be trading well above $1074 by that time – perhaps around $1300-$400 – but we’ll leave it to the swamis to tell you how exactly high.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

I meant the transition between night and day or inflation and deflation would be twilight like condition resembling stagflation. Of course bond yields don’t reflect that scenario yet, but rattle their cages and you’ ll see the vigilantes punish government debt with higher yields. This of course, will stop any gross attempts at reflation in its tracts and deflationary forces can bring on the forces of liquidation.

As far as the CPI goes, I’m sure you’ve seen the latest PPI surprise and CPI can’t befar behind. I’ll give you the fact it may be a statistical blip, but this “twilight market” may resemble both forces interwoven for a while, and therein lies the bewilderment experienced by the orthodoxy during THIS period, EJ is going to look like a genius.