Chiding the inflationistas here yesterday, we elicited a torrent of informative responses, including the 5000th post to the Rick’s Picks forum (worth a free 30-day subscription to the lucky lady!). We’re going to stick with this provocative topic for now, since we think it’s crucial that readers understand why deflation will be with us for a ruinous while, notwithstanding The Guvvamint’s desperately extravagant but so far ineffectual attempts to resuscitate inflation in the housing sector. A popular misconception is that the Fed stands ready to do “whatever it takes” to beat deflation. In fact, the Fed has already shot trillions of dollars at the problem without producing even the tiniest blip in home prices. That’s because countervailing forces of deflation are drawing irresistible power from the deleveraging of a global financial edifice once valued at nearly a quadrillion dollars. Under the circumstances, Helicopter Ben & Co. might as well be attempting to raise the level of the seas using a garden hose. For our part, we have long expected home prices to fall by at least 70%, and nothing we’ve seen so far has changed our outlook. The implication is that home prices, even after having fallen for nearly three years at the steepest rate since the Great Depression, are no more than halfway to the bottom.

Concerning the inflation-vs-deflation debate, we’re going to try and kick the level of discussion up a notch or two with a couple of suggestions. First, because the pro and con arguments often bog down in pseudo-intellectual claptrap about what constitutes “money,” we are going to provide you with foolproof way to recognize deflation for what it is – namely, an increase in the real burden of debt. Some will say that this is just a symptom of inflation, but we would tell them that it is ultimately only the symptoms that matter. Trust us on this: You’re a deflationist, just like us, if you believe that paying off your mortgage, servicing the $200,000 debt your daughter racked up attending Vassar, and retiring at 65 will not get any easier within the foreseeable future. If, on the other hand, you believe that Helicopter Ben and his band of tooth fairies will come to the rescue, raising your real income very substantially and causing perpetual increases in the value of your home sufficient to allow you to borrow against it just like in the good old days, then you are an inflationist.

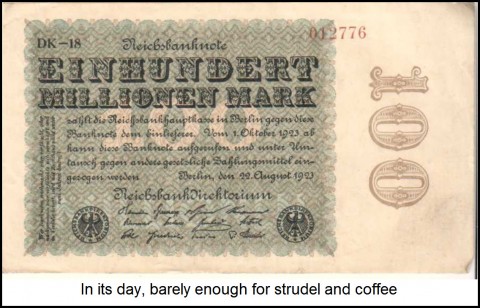

When Money Dies

Our second suggestion is that you beg, buy, steal or borrow a copy of Adam Fergusson’s book, When Money Dies: The Nightmare of the Weimar Hyper-inflation. Used original copies of this minutely detailed and fascinating work go for upwards of $800, but if you search the web for the title, you can turn up cheaper ways to access it. The book is essential for anyone who wants to understand why it would be impossible for the U.S. to trigger off a hyperinflation in the way the Germans did. The mechanisms simply don’t exist. Fergusson will save you the trouble of searching a million web pages to find out how all those D-marks actually got into the hands of German workers. Surely this question has occurred to you, right? Nearly all sources say the same thing – i.e., that the government revved up the printing presses, and… Bitteschön!… hyperinflation simply happened. In fact, putting a google of D-marks into circulation required a degree of collusion between the government and large employers that could not exist in the U.S. without major changes in the law.

It turns out that certain large German companies were allowed to print their own money in times of emergency. Because they did so most promiscuously when Germany’s official-currency printers were on strike, as occurred several times, the ironic result was that the most severe stretches of hyperinflation during the nearly three-year period occurred when sovereign notes were not even being printed. Another revelation from Fergusson is that some officials failed to see a hyperinflation threat even when money-creation was at full-bore. Would America’s political leaders be so stupid as to let hyperinflation occur inadvertently? And, was screwing the allies out of war reparations Germany’s motive for hyperinflating? In fact, maintaining a high level of employment was the primary goal, and it worked to the extent that Germany in 1921 had full employment while the war’s victors were wallowing in joblessness. This book is a great read, and the answers you’ve been looking for are all here.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Just wanted to point out that “CPI…rose 0.9% over the past year. ” & “…the near-term risks of it plunging all the way to zero or below have certainly receded.”

http://money.cnn.com/2010/08/13/news/economy/consumer_price_index/index.htm

This does point away from deflation & towards inflation. Not hyperinflation, but double digits can be a big problem too.