The yellow flag is out for two popular trading vehicles that Rick’s Picks tracks closely – Comex Gold and the E-Mini S&Ps. Is a major top in the offing? We’d say the odds are against it for stocks, since there is little evidence that the promiscuous Fed easing that has pumped the stock market full of hot air is going to end, even if it is officially slated to do so in June. In any event, we’ve told subscribers to expect a peak of at least tradable significance in the June Mini-S&P contract at exactly 1371.00. We routinely identify such peaks, and provide detailed recommendations for getting short at each, although we don’t do so with the expectation of catching the exact high of the Mother of All Bear Rallies. You might just as well bet on a 30-to-1 horse that hasn’t finished in-the-money for two years. Because the stock market has been chugging relentlessly higher since March 2009, “picking the top” is never going to be an odds-on bet. That is not to say that picking “a top” is particularly difficult, as our subscribers would readily attest. In practice, we always advise taking a partial profit if the pullback we expect from a Hidden Pivot rally target is generous enough to allow it. Traders invariably make better decisions once they’ve taken some of the house’s money off the table, and that is why we try to take partial gains, however small, when a trade goes our way. This also allows us to widen the stop-loss on whatever position remains — and, in theory, to come out of the trade with a small profit even when we are wrong about the bigger picture.

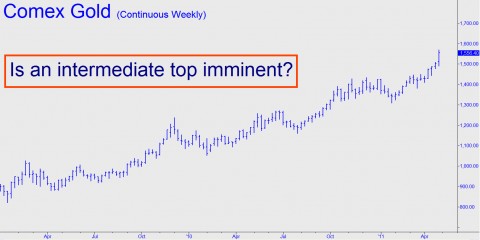

Concerning Gold, minor, technically-derived targets have kept us quite bullish the whole way up. But the most immediate such target is not a minor one. Rather, it is a major “Hidden Pivot” that has been nearly three months in coming, and it sits fully $200 above the “ideal” price where long-term bulls might have gotten long or augmented an existing stake. The target was disseminated a while back to subscribers, but if you don’t subscribe and would like to know exactly where the potential danger-spot lies, click here for a free trial subscription to Rick’s Picks. It will give you access not only to all of our forecasts and recommendations, but to a 24/7 chat room that draws veteran traders from all over the world. You’ll also be able to participate in the occasional virtual trading sessions that we offer online, wherein, using the Hidden Pivot Method and “camouflage” trading technique, we look for real trades in real time. Incidentally, we’ve also identified a rally target in Silver with the potential to slow down the metal’s rampage, if not reverse it. We never chisel these targets in stone, however, and if they are exceeded, we infer not that the target itself was “wrong,” but that the underlying trend is so powerful that it is likely to continue at least to the next, major Hidden Pivot target.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Just saw a Bloomberg headline for a story on Charlie Munger.

Berkshire holds 5 billion dollars worth of GS options.

All the wealth in higher, tighter, righter hands.