Gold and Silver have caught a nice bounce from last weeks lows – up 7.8% and 14.9% respectively — but we’d suggest postponing the celebration until the rally has had a week or two to develop legs, assuming it does. Although our initial reaction was that the correction would be over quickly, there are some reasons to be very cautious nonetheless. For one, the U.S. dollar is showing signs of life, a development that could put pressure on bullion prices if it continues. And for two, because a misguided phalanx of amateurs evidently got trapped in Silver at its recent, fleeting summit, it could take a while for the metal to base for the next big rally. How misguided were they? Egregiously, it would appear. Volume in ETFs and call options spiked to record highs, no doubt driven by visions of Silver doubling or tripling in price. It is not the lofty expectations of these star-gazing speculators that we would quibble with, however, but rather their timing. And, bad as it was, long-term investors will simply have to be patient, however long it takes for confidence to return to the precious-metals market. In the meantime, more than a few of those who have ridden out the storm so far will undoubtedly be praying for a good rally so they can lighten up. In our experience, however, and unfortunately, no force is more powerful in driving stock and commodity prices lower than an effusion of prayer seeking the opposite.

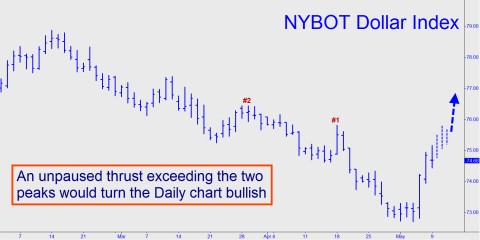

Regarding the Dollar Index (DXY), it has surged 3.4% since last week and need only rally a further 1.6% to turn the daily chart bullish via the creation of an “impulse leg.” This is shown in the chart above. DXY has generated two such signals in the last 18 months, and although both were later negated we continue to treat each new impulsive move as a prospective bull market a-borning. We’ll want to verify this each and every step of the way, however, especially since we can think of no good reason for a dollar bull market to emerge at this time. That doesn’t mean there are not some strong technical reasons for a strong bear rally to commence, as indeed there are. For one, dollar sentiment is about as negative as we can recall, implying that everyone is on the same side of the trade. And there is also the “euro factor” mentioned here yesterday. It’s one thing for Geithner, Bernanke and DaBoyz to gin up occasional rallies in the dollar by seizing on Europe’s financial troubles at regular intervals, but one of these days those troubles are going take a fatal turn for the worse when Spain flames out. If and when this occurs, it is not hard to imagine a short squeeze on the dollar that will recoup months’ worth of bear-market declines in mere days. To get the jump on that move will require close attention to subtle details on the intraday charts. We used them yesterday to project the top of June Gold’s $22 rally within a dime. If you’d like to learn how to do this trick yourself, joining hundreds of traders who have taken the Hidden Pivot Webinar, click here for further details. The next is scheduled for May 25-26, and seats are filling up fast.

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

Rick, two questions:

“…when Spain flames out. If and when this occurs…”

Is the “if” necessary here, is there any doubt?

“…a short squeeze on the dollar … To get the jump on that move will require close attention to subtle details on the intraday charts.”

For technical analysis to be possible, this event (flame out) would have to be known to some in the market, or the market would have no predictive value.

Is that always the case for stuff like that?

If so, why is that, because these are human issues, not non-anthropogenic things?

On that note, do real accidents/disasters ever have preceeding market information for a tech. analysis to work? One would think not–tsunami, Three Mile Island. Unlike 9/11 which undoubtedly did have market action in the days before