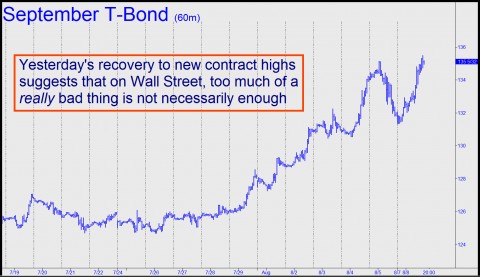

And how did Treasury paper do following Standard & Poor’s bombshell downgrade of U.S. debt? Why, T-Bonds, Bills and Notes came through unscathed, thank you. Actually, they did much better than that, rallying so sharply yesterday that one might have inferred the U.S. was the last citadel against the panic, confusion and fear that rein elsewhere in the world. Which is more or less true, relatively speaking. We hesitate to describe yesterday’s tidal surge in Treasurys as counterintuitive, however, since, officially, U.S. debt is still rated AA+. That’s a tad optimistic, if not to say delusional, given the fact that U.S. borrowing is eventually headed north of $20 trillion. How could debt not be about to go parabolic now that Congress has discovered that the debt ceiling can be raised without exacting a fiscal price, or even a political one? Even so, and as the mortgage boom/bust demonstrated, institutional investors base their allocations not on fundamentals or even reality, but on the official say-so of the ratings agencies. And although we all understand that the AA+ rating is conferred with a wink and a nod, it has always been in Wall Street’s best interests to pretend to take it seriously.

Keep in mind as well that neither Moody’s nor Fitch’s has gone along with the downgrade, at least not yet. This will suffice to allow those who have been mindlessly pouring cash into the Treasury of a nation edging toward bankruptcy to credibly claim down the road that, at the time, the U.S. was still officially the safest place on earth to park one’s cash. They’ll be correct about that, too, since U.S. Treasury paper has become the only sanctioned safe haven for the very biggest money. George Soros undoubtedly recognized this when he decided to shut down Quantum. These days, it’s hard enough to preserve one’s own capital, let alone make it grow. It takes genius just to eke out a “safe” 4% return, so why should a hedge fund manager who has nothing to prove and more wealth than he could ever spend obligate himself to a bunch of uber-wealthy investors who were spoiled by the anomalously high returns that obtained prior to the Great Financial Crash of 2008-09?

A Crowded Safe Haven

Over the years, we have asserted here many times that, during the deflationary bust that lay ahead, even financial wizards would find it challenging to hold onto a small fraction of their peak net worth. Although we lacked the imagination to envision bullion and Treasury paper as the last assets left standing, we always suspected that even the very smartest of the smart money would somehow get trapped. That is now clearly a possibility if you grant that the U.S. could default on its obligations. And yes, we know that, technically speaking, because Uncle Sam can gin up as much digital cash as it takes to pay the interest and principal on America’s debt, a true default cannot occur. But hyperinflation would have the same effect, wiping out those who now cling, via Treasury paper, to the branches of a tree sprouting from the sand of a small island that will soon be submerged. The rentiers (and pension funds, and hedgies, and many others) may be dry at the moment, but the tide of debt seems all but certain to inundate them. Under the circumstances, although Gold is officially execrated rather than sanctioned, we see no reason to worry about the health of its long-term uptrend. That said, we have turned cautious on gold for the near term because the December Comex contract yesterday came within $4 of the $1728 Hidden Pivot rally target we’d been using as a minimum upside objective. If that resistance is easily brushed aside within the next day or two, however, it would be telegraphing the next big push – to $2000, and presumably beyond. (Click here for a free trial subscription to Rick’s Picks.)

***

(If you’d like to have Rick’s Picks commentary delivered free each day to your e-mail box, click here.)

No, Joey. Those are not gains, even though the government will attempt to tax them at %28. The government is comprised of liars and thieves.

Those are exactly the same money you started with.

Everyone else lost in the mean time.