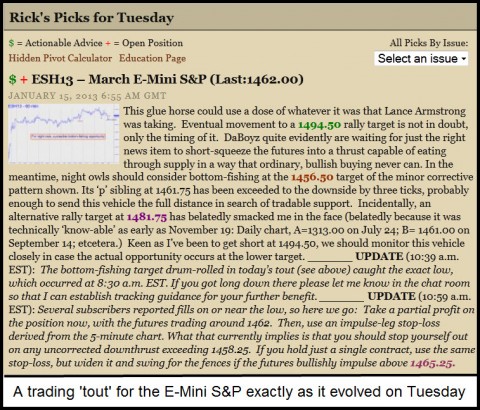

A trading “tout” disseminated to subscribers the night before caught the exact low in the E-Mini S&Ps Tuesday morning, allowing subscribers to climb aboard for a ride worth 12 points so far. That equates to a theoretical gain of $600 per contract. The graphic below (click on it to sharpen and enlarge the image) shows not only the original recommendation as it appeared on the home page late Monday night, but intraday updates that went out to subscribers as Tuesday’s session evolved. The purpose of the updates was to provide further guidance to subscribers who had reported doing the trade. Rick’s Picks shuns P&L claims, by the way, since they rarely seem to match the results subscribers achieve following the advice of some guru. Our policy is to provide “tracking guidance” for a recommended trade, but only if at least two subscribers report having filled the order. And if their prices differ, we use the worst price reported as our theoretical cost basis for the position.

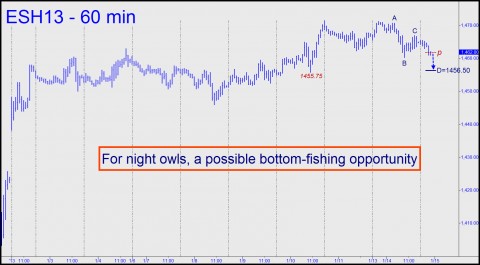

In the case of the E-Mini recommendation, several subscribers weighed in with fills shortly after the index futures touched 1456.50, the number highlighted above in brown. Technical jargon aside, and as you can see for yourself, the advice was pretty straightforward: Take a speculative stake if the futures fall to 1456.50. The likelihood that this would indeed occur was signaled the night before when the futures slightly exceeded the target’s midpoint “sibling,” labeled as a red “p” in the chart immediately below.

Typically, we advise taking a small partial profit early in a trade if the opportunity should arise. The relaxation this brings is the best tool we’ve found to help a trader manage the risk of a trade from that point forward. In the trade detailed above, based on the two guidance alerts sent out intraday, subscribers would have exited three quarters of the position by the time the futures reached the 1667.75 ‘D’ rally target shown in the chart below. Our theoretical gain on the position at that point would have been $1150. Imputing this sum to the single contract that remains has effectively lowered its cost basis to 1433.50. Thus, subscribers who followed our guidance exactly are now holding a single contract that they can manage as they please.

Incidentally, we use a trick that anyone can easily master to position stop-losses. It’s called the “impulse-leg rule,” and the way it works is that one exits a trade if it goes awry by exceeding two prior highs or lows in the “wrong” direction. These highs and lows can be tiny ones found on the lesser intraday charts, dictating delicate stops . But if you’re swinging for the fences, you can use highs and lows on charts of greater degree, such as the hourly or even daily, to produce wide, robust stops.

A Reason to Stay Bullish

One reason we were on the alert for a bullish entry opportunity is that we’ve been using a 1494.50 rally target for the E-Mini S&Ps for nearly two weeks. That is also the reason why we suggested that subscribers hold onto whatever piece remains of the position they initiated at yesterday’s low. For the record, and also for your possible interest, Rick’s Picks has forecast a potentially important bottom in Apple at exactly 447.55. If it gets there, the stock will have fallen 36% since peaking in late September at 705. If you want to see how precisely our Hidden Pivot System works, watch for a possible interim bottom at 461.64, a well-defined Hidden Pivot support that is not quite as important as the one at 447.55. For a free week of Rick’s Picks, including access to the chat room, click here.

Gary, you write:

“You stated in the last post that the poor have always been poor? What an absurd statement. Here is the real world answer to your ignorant post:”

LOL, LOL!

Absurd?

It’s called NATURE!

Can you please tell me what YOU, or for that matter, any human being is born with?

Absolutely nothing.

We enter this world poor.

Sometimes, SOME of us are lucky that we enter this world to parents, that happen to have something, but that is not OURS, its theirs.

Poor is the natural state of ALL human beings, you would like to deny this?

It is not being poor that is the aberration in human history.

In fact, of all the human beings that have ever lived (n no idea how many billions that would be, but I would guess >10 billion, seeing as about 6.3b are extant today), how many of these were not poor, vs. had little or nothing?

Yet you presuppose that it is the opposite, that having something, how ever much that is, is the baseline, from which those having little or nothing are the deviation.

UTTERLY and PROVABLY false thinking.

And your proof for it?

An arbitrary, government defined, RELATIVE measure.

Yet, very very many of those RELATIVELY defined as poor in this country, enjoy a standard of living that is unfathomable for close to a billion Indians, or Chinese, or favela dwellers in Rio, or just about all of black, sub-sahara Africa.

So, as you like RELATIVES, compared to these masses, our “poor” are nothing of the sort.

THis relative consideration is also true in a temporal sense:

Have you EVER visited a European castle or palace in the winter? Even the counts/dukes/kings of yore froze in their beds, had very limited food-choices much of the year, and so on.

QED